Latest Articles

April 24, 12:23 pm

Hashlabs Mining to Fight the Cold Finnish Winter With Bitcoin Mining

April 24, 12:22 pm

PayPal to Promote Low-Carbon Energy in Bitcoin Mining

April 24, 12:21 pm

“Buy Bitcoin” Sign from Janet Yellen Testimony Fetches $166,000 in Auction

April 24, 12:17 pm

Bitfinex Predicts Bitcoin Demand to Outstrip Supply by 5x

April 24, 12:15 pm

Bitcoin For Kids: Educational Resources

April 23, 12:29 pm

Exclusive: Swiss Bitcoiners Push for National Bank’s Bitcoin Reserves

April 23, 12:28 pm

Lightning Network Can Enable Frictionless API Monetization

April 23, 12:26 pm

Mt. Gox Exchange Repayment Updates: Market Impacts

April 23, 12:25 pm

Bitcoin Transaction Fees Plummet After Record High: What Happened?

April 23, 12:22 pm

Bitcoin Bounces Back: Halving Effects To Manifest in 100 Days

April 23, 12:21 pm

Bitrefill and Use of Bitcoin For Everyday Purchases

April 22, 1:13 pm

Mitigating Risk Through Bitcoin Self Custody

April 22, 12:16 pm

IRS Reveals Draft Form for Digital Assets Tax in 2025

April 22, 12:14 pm

Grayscale Reveals Bitcoin Mini Trust Fees, Analyst Calls it ‘Hypothetical’

April 22, 12:12 pm

FTX Investors Seek Settlement with SBF for Info on Celebrity Promoters

April 22, 12:11 pm

Bitcoin Investment on the Rise: Wealth Managers Expected to Join

April 22, 12:08 pm

What is Bitcoin Mining? A Comprehensive Guide

April 21, 12:25 pm

Human Rights Foundation Launches “Finney Freedom Prize”

April 21, 12:24 pm

Bitcoin Halving Complete: What Comes Next?

April 21, 12:23 pm

Bitwise CIO Expects Substantial Price Rally for Bitcoin Post-Halving

Hashlabs Mining to Fight the Cold Finnish Winter With Bitcoin Mining

PayPal to Promote Low-Carbon Energy in Bitcoin Mining

Hashlabs Mining to Fight the Cold Finnish Winter With Bitcoin Mining

“Buy Bitcoin” Sign from Janet Yellen Testimony Fetches $166,000 in Auction

- Editor’s Picks

Bitcoin Miner Manufacturer Auradine Secures $80M Funding

Marathon CEO Believes Halving is Already Priced In

Grayscale CEO Optimistic: Bitcoin ETF Outflows Approach Equilibrium

Hopes of Rate Cut Wane as Inflation Persists: Comparing Narratives

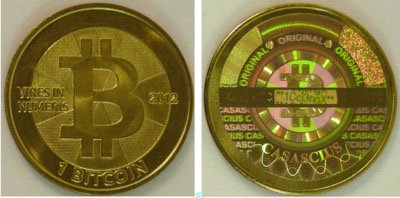

The First Bitcoin Physical Coin: Creation, History, And Evolution

Bitcoin Only

Newsletter

Weekly news roundups direct to your inbox!

Bitcoin Only

Newsletter

Weekly news roundups direct to your inbox!

Media Partners

We’re a Bitcoin-focused media outlet reporting on breaking news and updates. Our mission is to promote education and awareness by sharing and honest and accurate market news to help accelerate adoption.

We’re a Bitcoin-focused media outlet reporting on breaking news and updates. Our mission is to promote education and awareness by sharing and honest and accurate market news to help accelerate adoption.