Latest Articles

April 25, 2:18 pm

Traditional Firms Allocate Millions to FBTC Amid ETF Rebound

April 25, 2:07 pm

Tesla Holds on to Its Bitcoin, Maintains 9,720 BTC Investment

April 25, 1:58 pm

Could Mt. Gox’s $9B Bitcoin Repayments Shake The Market?

April 25, 1:49 pm

Bitcoin Poised to Surge Beyond $80,000, Analysis Suggests

April 24, 12:23 pm

Hashlabs Mining to Fight the Cold Finnish Winter With Bitcoin Mining

April 24, 12:22 pm

PayPal to Promote Low-Carbon Energy in Bitcoin Mining

April 24, 12:21 pm

“Buy Bitcoin” Sign from Janet Yellen Testimony Fetches $166,000 in Auction

April 24, 12:17 pm

Bitfinex Predicts Bitcoin Demand to Outstrip Supply by 5x

April 24, 12:15 pm

Bitcoin For Kids: Educational Resources

April 23, 12:29 pm

Exclusive: Swiss Bitcoiners Push for National Bank’s Bitcoin Reserves

April 23, 12:28 pm

Lightning Network Can Enable Frictionless API Monetization

April 23, 12:26 pm

Mt. Gox Exchange Repayment Updates: Market Impacts

April 23, 12:25 pm

Bitcoin Transaction Fees Plummet After Record High: What Happened?

April 23, 12:22 pm

Bitcoin Bounces Back: Halving Effects To Manifest in 100 Days

April 23, 12:21 pm

Bitrefill and Use of Bitcoin For Everyday Purchases

April 22, 1:13 pm

Mitigating Risk Through Bitcoin Self Custody

April 22, 12:16 pm

IRS Reveals Draft Form for Digital Assets Tax in 2025

April 22, 12:14 pm

Grayscale Reveals Bitcoin Mini Trust Fees, Analyst Calls it ‘Hypothetical’

April 22, 12:12 pm

FTX Investors Seek Settlement with SBF for Info on Celebrity Promoters

April 22, 12:11 pm

Bitcoin Investment on the Rise: Wealth Managers Expected to Join

Traditional Firms Allocate Millions to FBTC Amid ETF Rebound

Tesla Holds on to Its Bitcoin, Maintains 9,720 BTC Investment

Traditional Firms Allocate Millions to FBTC Amid ETF Rebound

- Editor’s Picks

Bitcoin Miner Manufacturer Auradine Secures $80M Funding

Marathon CEO Believes Halving is Already Priced In

Grayscale CEO Optimistic: Bitcoin ETF Outflows Approach Equilibrium

Hopes of Rate Cut Wane as Inflation Persists: Comparing Narratives

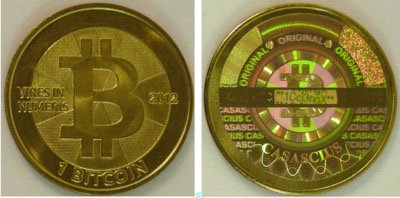

The First Bitcoin Physical Coin: Creation, History, And Evolution

Bitcoin Only

Newsletter

Weekly news roundups direct to your inbox!

Bitcoin Only

Newsletter

Weekly news roundups direct to your inbox!

Media Partners

We’re a Bitcoin-focused media outlet reporting on breaking news and updates. Our mission is to promote education and awareness by sharing and honest and accurate market news to help accelerate adoption.

We’re a Bitcoin-focused media outlet reporting on breaking news and updates. Our mission is to promote education and awareness by sharing and honest and accurate market news to help accelerate adoption.