Key Takeaways

Bitcoin’s 17-year history and repeated recoveries weaken tulip-bubble comparisons.

Balchunas noted that true bubbles don’t survive multiple crashes and still reach new highs.

Growing institutional adoption suggests Bitcoin is increasingly viewed as a long-term asset.

Tulip Comparison No Longer Fits Bitcoin

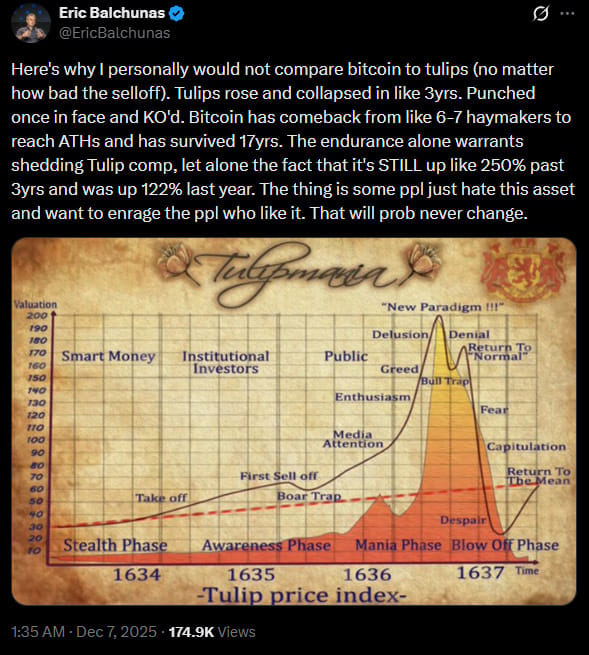

Bitcoin has often been compared to the famous tulip bubble from the 1600s, a time when tulip prices soared and then crashed suddenly. But according to Bloomberg ETF analyst Eric Balchunas, this comparison no longer makes sense. He says Bitcoin has proven itself by surviving for 17 years and recovering many times, something tulips never did.

Balchunas explained that tulip mania rose and collapsed in just about three years. After the crash, prices never recovered. In a post on X, he said:

“Tulips rose and collapsed in like 3yrs. Punched once in face and KO'd. Bitcoin has comeback from like 6-7 haymakers to reach ATHs and has survived 17yrs.”

He believes Bitcoin’s long life alone is enough reason to stop comparing it to tulips, since bitcoin is “still up like 250% past 3yrs and was up 122% last year.”

The Dutch tulip bubble happened between 1634 and 1637. Tulip bulbs became extremely valuable, and rare ones sold for more than houses. But the boom quickly turned into a crash, and prices fell by more than 90%. After that, tulip prices never went back up again. It was a short-lived bubble that disappeared as fast as it came.

Bitcoin, on the other hand, has gone through many ups and downs but continues to return. Over the years, it has survived big crashes, regulatory pressure, exchange failures, and global market fears.

Despite all of this, it still reaches new all-time highs. As analyst Garry Krug, Head of BTC Strategy at Aifinyo AG, noted, “Bubbles don’t survive multiple cycles, regulatory battles, geopolitical stress, halvings, exchange failures and still return to new highs.”

Some critics argue Bitcoin is like tulips because it does not produce anything. But Balchunas responded that many valuable assets are also non-productive. He said:

“Yes, Bitcoin and tulips are both non-productive assets. But so is gold, so is a Picasso painting, rare stamps - would you compare those to tulips? Not all assets have to ‘be productive’ to be valuable.”

He added that he thinks Bitcoin is “a different animal.”

Many people disagree with the claim that Bitcoin is non-productive. They argue that it introduces something previously unavailable: a trustless, permissionless, and uncensorable way to transfer value globally, and it does so much faster than traditional banking.

This debate is not new. Some well-known figures continue to dismiss Bitcoin. Investors like “The Big Short” Michael Burry once called it “the tulip bulb of our time,” and JPMorgan CEO Jamie Dimon said it was “worse than tulip bulbs” back in 2017. But Bitcoin’s growth and long-term survival make that criticism harder to support today.

Balchunas also commented on bitcoin’s price movements. He believes that the recent price drops are not a sign of collapse, but simply a normal market correction, “If you think about bitcoin's year, all that really happened (at least up to this point) is it gave up the extreme excess of last year,” he wrote.

He explained that bitcoin went up 122% last year, so a pullback is natural. In his words, “Assets are allowed to cool off once in a while, even stocks. People overanalyzing it IMO.”

Even with volatility, bitcoin is still up over 250% in the last three years. In Balchunas’ opinion, this kind of performance is unusual for something critics call a bubble. True bubbles burst once, they don’t recover repeatedly over nearly two decades.

Balchunas thinks Bitcoin’s history could also change how institutions view it. As more financial companies invest in bitcoin and bitcoin ETFs, it is becoming more accepted as a long-term asset. Many experts now see Bitcoin as a growing part of the global financial system rather than a speculative craze.