Bitcoin-focused investment firm Twenty One Capital has made headlines after buying 4,812 BTC worth $458.7 million, making it the third-largest corporate holder of the scarce digital asset.

The move is a big and public one towards becoming the “ultimate Bitcoin investment vehicle” according to its leadership, and is turning heads in both bitcoin and tradfi world.

Tether, the issuer of the world’s largest stablecoin, bought the bitcoin on behalf of Twenty One Capital.

According to a filing with the U.S. Securities and Exchange Commission (SEC) on May 13, Tether acquired the bitcoin on May 9 at an average price of $95,319 per coin.

Twenty One Capital was launched in April 2025 through a SPAC merger with Cantor Equity Partners, a Cayman Islands-based firm affiliated with Wall Street giant Cantor Fitzgerald. The company is backed by Tether, Bitfinex exchange and Japanese investment giant SoftBank.

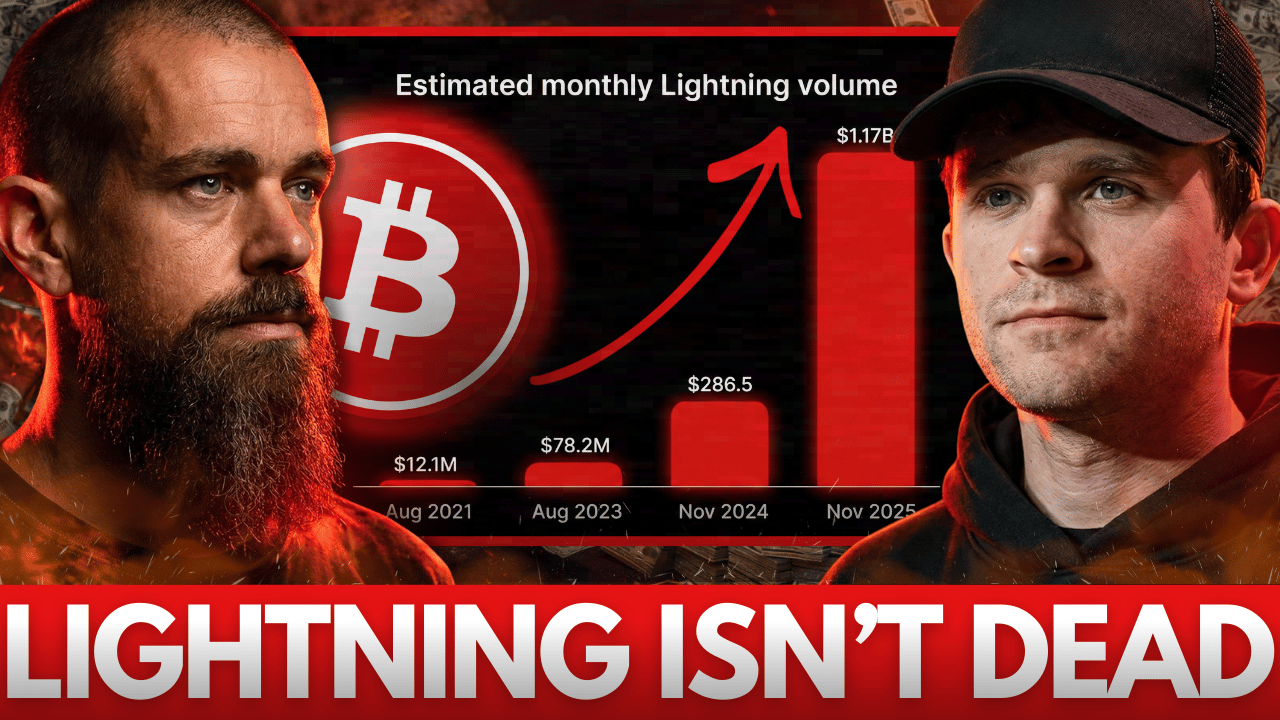

The firm is led by Jack Mallers, founder of the bitcoin payments app Strike, who has been vocal about bitcoin business models.

“We want to be the ultimate vehicle for the capital markets to participate in Bitcoin… building on top of Bitcoin,” said Mallers in an interview. “So we are a Bitcoin business at our core.”

At launch, Twenty One Capital had 31,500 bitcoin on the balance sheet with plans to get to at least 42,000 BTC.

The breakdown of that initial allocation was 23,950 BTC from Tether, 10,500 BTC from SoftBank and about 7,000 BTC from Bitfinex—all to be converted into equity at $10 per share.

The company is openly modeling its strategy after what Bitcoiners call “Saylorization”—a term coined after Michael Saylor, executive chairman of Strategy, who started large-scale bitcoin accumulation by corporations in 2020.

“Twenty One Capital isn’t just stacking sats,” said Bitcoin advocate Max Keiser, “It’s leading a generational shift in corporate capital allocation … Jack Mallers is taking the Saylor playbook and turning it into an arms race.”

The strategy is simple: use bitcoin per share as a metric instead of earnings per share, prioritize bitcoin accumulation over short-term profits, and use the capital markets to fund purchases. Mallers said:

“We do intend to raise as much capital as we possibly can to acquire bitcoin. We will never have bitcoin per share negative… Our intent is to make sure when you are a shareholder of Twenty One that you are getting wealthier in Bitcoin terms.”

The bitcoin purchase was made at a time of growing market momentum.

On May 14, bitcoin hit $105,000 briefly before settling at around $104,000—a 7.5% gain in the past week. Retail buying has also picked up, with purchases under $10,000 up 3.4% over two weeks, suggesting continued bullishness.