After a year of internal infighting over spam, Bitcoiners now appear united against a massive external FUD campaign aimed at weakening Bitcoin while prices are down: the threat of quantum computing.

The biggest news events this week include:

Bhutan builds a meditation city (using Bitcoin).

A Samourai developer reports to prison.

Michael Saylor reveals ongoing talks with the world’s largest banks.

Latest News

Adoption

Bhutan plans to allocate 10,000 Bitcoin from their mining operations as collateral to finance construction of Gelephu Mindfulness City, using lending and yield strategies to fund infrastructure without selling.

Lightning Network capacity hits 5,637 BTC, a new ATH and its highest level since 2023, meanwhile the USD value of that liquidity has 5.6x’d since the last ATH, jumping from $88M to $494M.

Nic Carter ignites a heated debate in the Bitcoin community with a new article arguing that Bitcoin developers are sleepwalking toward collapse by ignoring the threat of quantum computing.

Regulation

Samourai dev, Keonne Rodriguez, officially reports to prison to serve his 5-year sentence for creating Bitcoin privacy software.

UK targets full digital asset regulation by October 2027, placing exchanges, stablecoins, and wallets under FCA and BOE oversight, with holding limits, interest restrictions, and clearer tax rules.

CNN reports on the growing use of bitcoin ATMs in scams targeting elderly victims, increasing pressure for tighter oversight and stronger consumer protections for cash-to-bitcoin on-ramps.

Markets

David Sacks, Trump’s Crypto Czar, says the US economy will boom in 2026, citing falling interest rates, easing inflation, and new tax cuts that could boost disposable income and liquidity across the system.

BitGo integrates the Lightning Network into its qualified custody platform, giving institutions access to fast, low-cost bitcoin payments without running nodes, managing liquidity, or handling private keys.

Fourteen of the top twenty-five banks in the US are building bitcoin products for their customers, a quiet but meaningful shift as legacy finance moves from resistance to integration.

Treasury

Michael Saylor posts a photo from Morgan Stanley HQ after adding more than 21,000 BTC in two weeks, exceeding the total holdings of the world’s seventh-largest bitcoin treasury company.

NAKA risks Nasdaq delisting after shares stayed below the $1 minimum and now has 180 days to regain compliance by closing above $1 for 10 consecutive days.

Norway’s sovereign wealth fund, Norges Bank, voted in favor of all five of Metaplanet’s shareholder resolutions, endorsing the Bitcoin treasury firm’s capital restructuring and preferred share issuance.

Mining

MicroBT unveils a 1.35 PH/s WhatsMiner at Bitcoin MENA 2025, pushing mining into the petahash era as revenues tighten near $35 per PH/s and efficiency becomes critical amid rising competition.

Pool-level data show Bitcoin’s hashrate dip was largely due to US cold weather curtailments, with the network at only about 20 EH/s, indicating a temporary disruption rather than a major China shutdown.

Hut 8 shares jump ~20% after announcing a 15 year, $7B AI data center lease with Fluidstack, highlighting miners’ shift toward AI and high-performance computing amid volatile bitcoin economics.

Politics

Cynthia Lummis, America’s most pro-Bitcoin Senator, has decided not to run for reelection and will retire at the end of her term in 2026.

The BoJ raises rates 25 bps to 0.75%, the highest since 1995, while approving an 18.3T yen debt-funded stimulus, underscoring tensions between tighter monetary policy and aggressive fiscal spending.

Taiwan’s Ministry of Justice says the government now holds 210.45 bitcoin in seized assets, adding Taiwan to the growing list of nation states holding bitcoin.

Bitcoin Trivia

Bam’s 2 Sats

Protecting Your Wealth

Along the journey to becoming a Bitcoiner, people are often told to become their own bank. It’s framed as a feature, not a bug, with self responsibility as the core principle. Sometimes this escalates into extreme takes like, “If he lost his bitcoin, he didn’t deserve it in the first place”.

The truth is that becoming your own bank is easier said than done. It is not that people reject responsibility, but moving from a “nerfed” world where banks appear to protect you, to full responsibility for your own wealth, should not be taken lightly.

When it is this easy to lose your life savings with a single click, something arguably impossible even under a gold standard, education becomes critical to making this transition safely.

A costly lesson in permissionless money

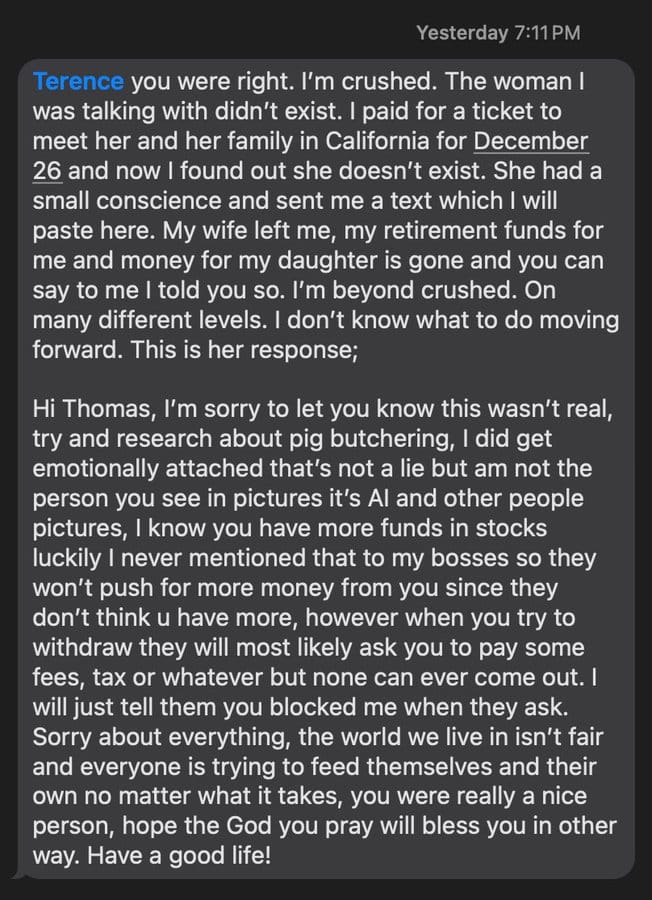

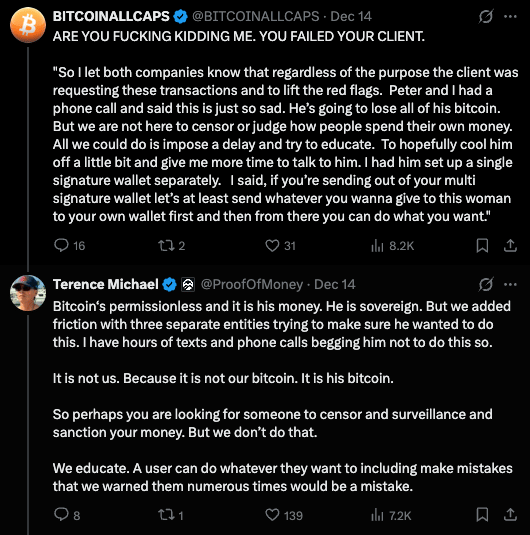

This week, a deeply sad story circulated on X about a Bitcoiner who fell victim to a pig butchering scam. His Bitcoin advisor enabled him to send his entire bitcoin balance, held in a multisig setup with BTC Adviser and Unchained, to a scammer, a woman he believed he loved, in the hope that she would help him double his money.

This would likely not have happened in the traditional fiat system. A bank would not have allowed such a transfer if it suspected the funds were being sent to a scam.

But is the advisor really at fault here?

Some Bitcoiners argue the advisor failed by letting the client walk into the slaughter. Others note the advisor warned him and tried to educate him. But the client was emotionally blinded, and it was ultimately his money. He exercised his sovereignty and used it as he saw fit.

That is both the power and the danger.

Sovereignty is a feature, and a responsibility

This is a painful story, but it highlights the knowledge gap and real risks of becoming our own banks.

Bitcoin’s fixed supply makes it a powerful store of value, but its permissionless design matters just as much. Misunderstood or ignored, it can allow someone to lose everything with terrifying ease.

I personally value both aspects deeply. But I also recognize that not everyone who becomes “a Bitcoiner” is willing, or able, to put in the same time and effort to fully understand the risks that come with sovereignty.

Still, I believe everyone should strive to use bitcoin in a sovereign way, not just gain exposure through third parties. At the same time, we should do a better job explaining what sovereignty really means, its benefits, and its risks, instead of focusing almost entirely on the number go up narrative, which is undeniably seductive.

Bitcoin offers full sovereignty, but sovereignty is not free. It requires education, discipline, and emotional restraint. Price appreciation gets people in the door, but understanding is what keeps them alive once inside.

Stay safe and keep on stacking!

-Bam

This Week on Bitcoin News [Live]

Just how real is the threat to quantum computing for Bitcoin?

Join us live today as Rob Wallace is joined by Bitcoin educator Kal Kassa to dive deeper.