Key Takeaways

Strategy’s bitcoin holdings are slightly underwater, but the company continues buying and sees no liquidation risk.

Debt pressures are limited, with no bitcoin collateral, and repayments not due until 2027.

Fundraising may slow as the stock trades below bitcoin value, despite strong cash reserves.

Why Strategy Isn’t Panicking Despite Bitcoin Slipping Below Cost

Strategy, the company led by Bitcoin supporter Michael Saylor, is back in the spotlight. Bitcoin’s price recently fell below what the company paid on average for its coins. This means Strategy is now “underwater” on paper.

Still, experts say this is not an emergency. Saylor agrees, as he bought another batch yesterday, shrugging off the price drops.

He announced on Monday morning that the company had bought another batch of bitcoin, adding 855 BTC to its holdings at a price of $87,974 per bitcoin.

Over the weekend, bitcoin dropped into the mid-$70,000 range. At one point, it traded near $75,500. Strategy’s average purchase price is about $76,037 per bitcoin. This was the first time in months that the company’s bitcoin position turned slightly negative.

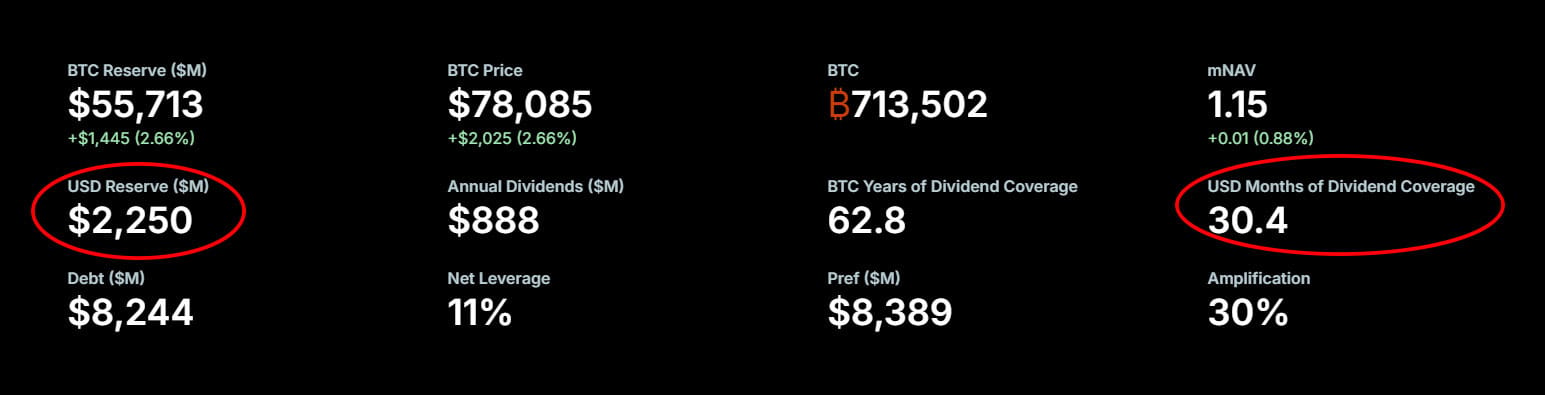

Strategy owns a massive amount of bitcoin, now grown to 713,502 coins. That makes it the largest corporate holder of bitcoin in the world. Because of the size of that position, even small price changes get a lot of attention, and even more scrutiny when prices fall 40% from all-time highs.

While the situation may sound worrying, analysts say there is no immediate danger. One key reason is that none of Strategy’s bitcoin is used as collateral. That means the company cannot be forced to sell its bitcoin just because prices fall.

Shah on X

Some investors worry about Strategy’s $8.2 billion in convertible debt. However, this debt is not tied to bitcoin’s daily price movements. The first repayment option does not come until 2027, giving the company plenty of time to manage it.

Strategy also has flexibility. It can extend its debt, convert it into shares, or use other tools like preferred stock. These options reduce the risk of financial stress, even during a market downturn.

Michael Saylor has pushed back strongly against fears of liquidation. In past comments, he said Strategy would not be forced to sell bitcoin even if prices collapsed. He famously said that even if bitcoin fell to $1, the company would keep buying.

That statement is not a price prediction. Instead, it shows Strategy’s mindset. The company treats bitcoin as a long-term asset, not something to trade in and out of based on short-term price moves.

The real challenge for Strategy is not survival, it’s fundraising. In the past, the company bought more bitcoin by selling new shares into the market. This worked best when the stock traded above the value of its bitcoin holdings.

Now, that situation has changed. As bitcoin fell, Strategy’s stock began trading at a discount to the value of its bitcoin. Selling new shares at these levels would dilute existing shareholders, making fundraising less attractive.

This has happened before. In 2022, when Strategy’s stock traded below the value of its bitcoin for most of the year, the company added only about 10,000 bitcoin. If prices stay low, bitcoin purchases may slow again.

Despite market pressure, Strategy has shown confidence in its finances. The company recently raised the dividend on its Stretch (STRC) preferred stock to 11.25%. This was the sixth increase since the stock launched in 2025.

Strategy describes Stretch as a “short-duration, high-yield savings account.” The company has also set aside $2.25 billion in cash to cover these dividend payments.

Strategy has enough USD to cover dividends pay for 30 months

With this much saved in its USD accounts, Strategy says it can easily cover dividends pay until mid 2028 without any changes. This move signals strong cash management and a commitment to investors, even during market weakness.