Macroeconomist Abams Pascal explains the dynamics of money, credit, and bonds to illustrate how fiat currencies are collapsing and why bonds would make a better investment under a Bitcoin standard.

As J.P. Morgan stated in his testimony before Congress in 1912, “Gold is money. Everything else is credit.” Well, that was true until 2009 when Satoshi Nakamoto released the Bitcoin whitepaper. But still, while that quote by J.P Morgan is 100 years old, it still holds water because it begs the question:

What is money?

Fantastic authors such as Lyn Alden, Eric Yakes, and Safiedean Ammous have written extensively about what money is and have done well answering that question, so we don’t have to do the same in this piece.

Let’s stick instead with the de-facto definition of money as “the most salable good across time, space, and scales,” which can act as a store of value, medium of exchange, and unit of account and has key properties such as scarcity, durability, acceptability, portability, divisibility, and fungibility. Eric Yakes’s book The 7th Property gives an in-depth explanation of the items in this list and is a must-read for Bitcoiners.

Anyway, for the TLDR folks; Gold has been the best candidate (ticking most boxes, although not all) for money since its discovery, thousands of years ago, and it’s safe to assume that J. P. Morgan was aware of this dynamic.

What about credit?

As with every definition of something on the internet, there are hundreds of them. Without getting into the different school of thoughts about credit, here’s a simple definition I came up with after a 60-second Google search: Credit is the ability to borrow money or access goods or services with the understanding that you’ll pay later.

The interesting thing about credit is that it’s as old as humanity, having existed for years before the advent of money. But because credit has gotten to evolve over the years (and humans don’t live that long), people tend to think that credit started with the discovery of fiat currencies. Here’s an example of how credit would have probably existed in the early Stone Age, when fire was discovered: A group of hunters, living in the same geographical region, would take turns staying awake at night to ensure the safety of their food, which in this case would be animals. They are trying to preserve their labor by ensuring that outsiders don’t steal from them. Someone whose turn is to watch this night (hunter 1) but has his child to spend time with can tell his mate (hunter 2) “watch for me tonight, and I’ll watch for you tomorrow”. Hunter 1 also had the option of offering a bit of his share in the jointly-hunted animal (as money), but instead opted to pay back in service. In other words, hunter 1 got a service he didn’t pay for, and choose to pay it back by offering the same service–That’s credit 101. Hunter 2 took the risk of night-watching for hunter 1 without a guarantee that he’d do the same in return. But of course, they were from the same tribe, so hunter 1 had incentives to keep his word: his reputation was on the line or could be forced to give up a portion of the jointly-hunted animal, when push came to shove.

Even growing up as kids, you’d ask your sibling to help do the dishes the night of the champions league finals so you could see the football match, and you’d repay by doing them the next morning before school. That’s a form of credit. At this point, we wouldn’t be off to say that credit is part of human nature. We’ve all engaged in credit, one way or another, in our lifetime.

But there are different forms of credit, and the most popular is bonds. Which, again in simple terms, is a loan from an investor to a borrower such as a company or government. The borrower uses the money to fund its operations, and the investor receives interest on the investment.

A crash-course on bonds

Due to how credit has evolved over the years, we have stopped offering services-for-services or goods-for-goods (although my six-year-old nephew still engages in service-for-service type of credit all the time). Those are informal types of credit. Formal types entail the use of money. And as we’ve seen earlier, money could be anything that fits certain criteria, but for the sake of this piece and the fact that we aren’t in the pre-1971 era, let’s refer to “fiat currencies” as money– althought to Bitcoiners, fiat currencies aren’t money but “melting ice cubes” as Greg Foss put it.

To put into perspective; Bonds are issued by governments and corporations when they want to raise money. By buying a bond, you’re giving the issuer a loan, and they agree to pay you back the face value of the loan on a specific date, and to pay you periodic interest payments along the way, usually twice a year.

There are different types of bonds, including government, corporate, municipal, and agency bonds. They all have their pros and cons, but I won’t be going into all of that because you’d be better off contacting Greg Foss for a bond 101 class.

As the name suggests, government bonds are issued by the government. In the US, the tasks falls on the US Treasuries and hence it’s given the name treasuries. They issue bonds for various reasons and different schools of thought argue over what exactly those reasons are (you can watch the fight on Twitter), but the takeaway is that the government issues bonds to fund itself. Issuing bonds is a fancy way of saying borrowing money.

Here’s an oversimplified version of how bonds do work. But before going into that, let’s define some terms. Shall we?

- Face value (par value) is the value of a bond held until maturity. It’s basically what the bond will be worth when it matures.

- The coupon rate is the interest rate (expressed in percentage) paid by the bond issuer on the face value to the bondholder.

- Coupon dates are the dates the bond issuer pays out the interest rate (to the bondholder) on the face value of the bond. The standard is semiannual payments, although it can happen at any interval.

- The maturity date is when the said bond expires and the issuer pays the holder the face value of the bond.

- The issue price is the price at which the bond was originally issued by the issuer. In most cases, it is issued at par.

If you bought a 10-year bond today at a face value of $1,000 with a coupon rate of 5%, you’d receive 5% × $1,000 face value = $50 every year. For the next 10 years.

Bonds are one of the safest ways to save/invest money (bearing low inflation). And they can come in different ways, depending on the investor’s risk appetite.

Bonds are issued in different time intervals: 3 months, 6 months, 10 years, 30 years (the highest in the US), and even 100 years (in the case of Australia).

If you’re getting a yield of 5% on your bond holdings, while inflation (denoted by CPI) is at 8.3%, you’re getting a negative real yield of -3.3%. Going by that, bonds are a surefire way to lose money during inflationary periods.

Bond prices are inversely correlated to interest rates (bond yields)–When yields go up, bond prices fall to have the effect of equalizing the interest rate on the bond with prevailing rates, and vice versa.

A much easier lens to view this through is to find out the price of our bond, assuming the yields changed, rather than using an interest rate change. For example, a bond with a $1,000 face value, yielding 10% ($100 per year), would yield 12.5% if the price fell to $800. This happens, so you get the same guaranteed $100 on an asset that is now worth $800 ($100/$800). The same bond would yield 8.33% if the bond price rose to $1,200 ($100/$1,200).

So even though you get paid back the face value of your bond upon maturity, it buys you less due to the ever-depreciating nature of fiat currencies. Fiat currencies are programmed to lose value into perpetuity.

Fiat currencies are collapsing everywhere

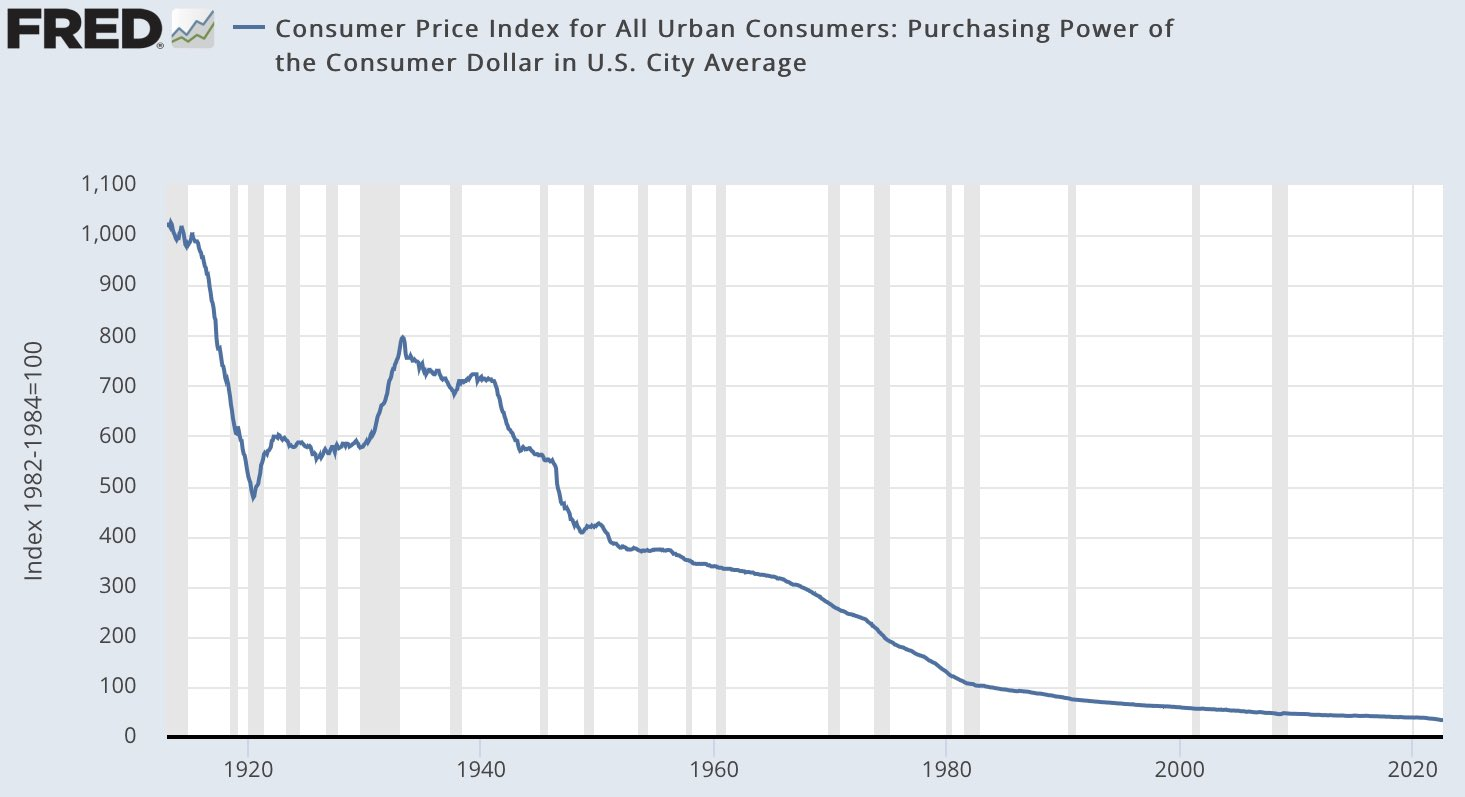

Below is a graphical representation of how the US dollar has lost over 90% of its value in the past 100 years:

Assuming the US Treasuries issued a 100-year bond in 1920, that bond upon maturity (today) would be worth less. The primary reason fiat currencies lose their value is due to money printing. When writing articles like this, I try as much as I can not fall into the trap of unending arguments: Does the Fed print money? Is money printing bad? What’s the cause of inflation? While I can’t give a definitive answer to these questions, what I can say with confidence is the dollar has lost over 90% of its value in the last 100 years. And if you bought a 100-year bond (assuming it existed), or saved it in fact, you lost all your money as of today.

The dollar is probably the cleanest dirty shirt in the laundry, yet it is down 90%. Other fiat currencies by default are down 95%. And in the Weimar Republic, the German Papiermark hyperinflated, losing 100% of its value. The same pattern can be seen today in countries like Zimbabwe and Venezuela which are experiencing hyperinflation, while other parts of the world including Turkey and Germany experience double-digit inflation.

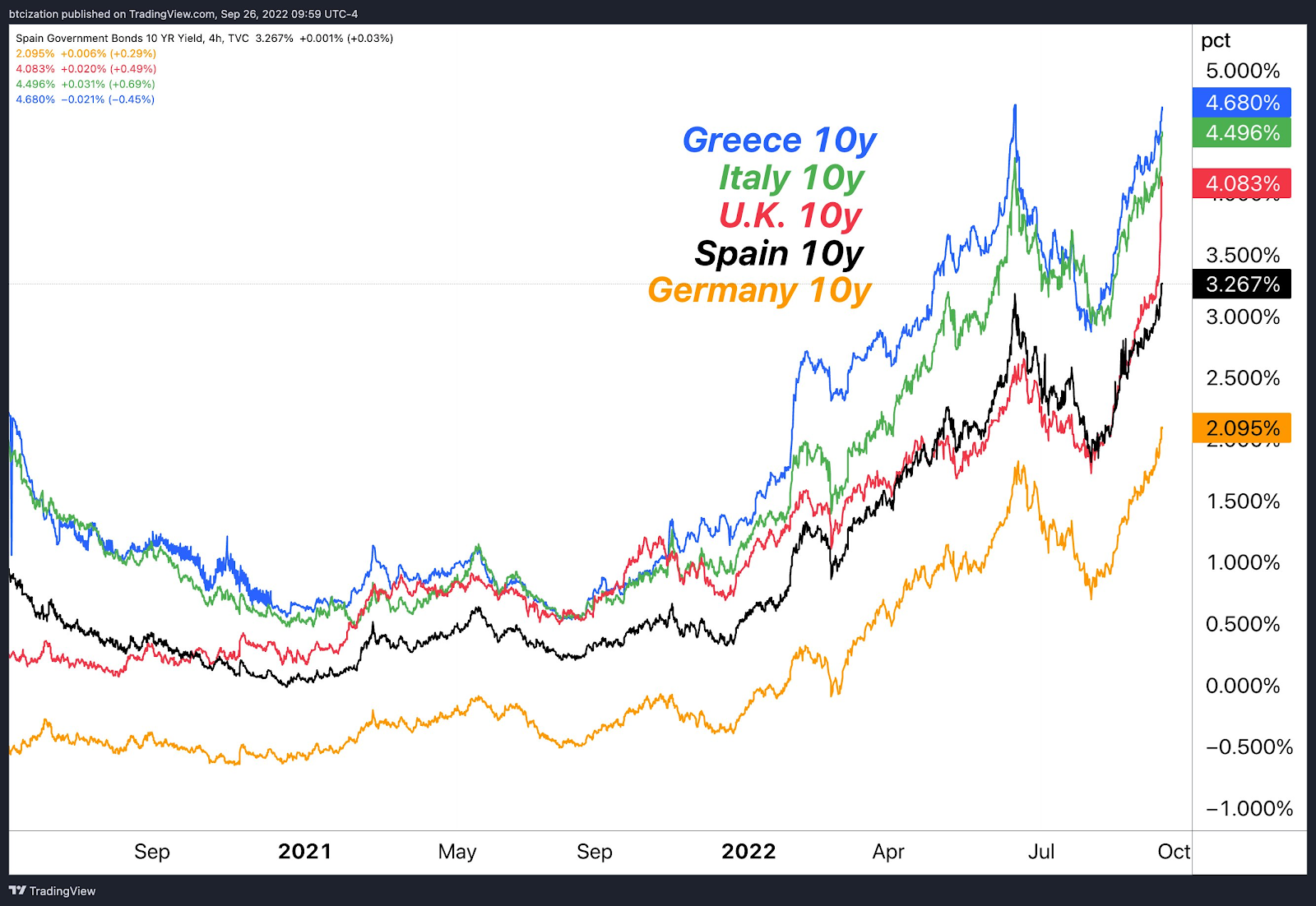

Due to high inflation in Europe, we’ve seen bonds of countries in the Eurozone sell off aggressively since late Q4.

In the US, shares of Core U.S Aggregated Bond ETF are down by 20% since its peak in Q3 of 2020, now at levels not seen since 2008. While US02Y is up from 0.105% to 4.3%, that’s the greatest rate of change in its history.

Bonds are selling off this hard due to rising interest rates caused by inflation which is a by-product of fiat currencies losing their value. This makes bonds appear as bad investments, but they are just a victim of their denominator: the US dollar.

Bonds would be a better investment under a Bitcoin standard because they’d be denominated in a currency that has a known finite supply, can’t be printed for whatsoever reason, and is also expected to accrue value in the long run due to its scarce nature.