Renowned author, entrepreneur, and fervent Bitcoin supporter, Robert Kiyosaki, recently took to X to convey a compelling reason for acquiring Bitcoin. The author of best-selling financial self-education, “Rich Dad, Poor Dad,” underscored the urgency of Bitcoin ownership in the face of escalating U.S. national debt.

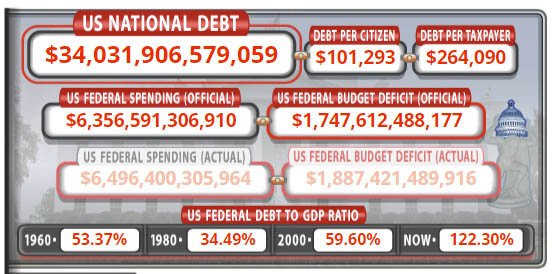

Kiyosaki revealed that over the past five months, the U.S. national debt has soared by an astounding $1 trillion. Expressing his concern, he urged individuals to diversify their portfolios by investing in precious metals like gold and silver, along with Bitcoin. He stated:

“Since the start of the latest NFL football season the national debt has gone up another $ trillion. WTF. Please buy more gold, silver, and bitcoin.”

Kiyosaki attributed the financial challenges to what he perceives as the incompetence and corruption of leaders within the Federal Reserve and U.S. Treasury.

Kiyosaki: Hyperinflation Fears and Economic Outlook

The author went on to express his fear about the possibility of hyperinflation plaguing the U.S. dollar, predicting a grim scenario for the nation’s economy.

This ideology aligns with the sentiments of many economists and financiers who raised alarms last year when the U.S. government removed the national debt ceiling, allowing it to surge beyond $31.4 trillion. The national debt currently stands at a staggering $34 trillion, prompting Kiyosaki to sound the alarm bells for investors.

Bitcoin Acquisition Amid ETF Approval

In a related note, Kiyosaki recently revealed that he has acquired an additional five bitcoin, expanding his digital asset portfolio. This decision coincided with the approval of Spot Bitcoin Exchange-Traded Funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) on January 10. Notable financial entities such as BlackRock, Ark Invest, and Grayscale were among the dozen Wall Street companies whose applications received the green light.

Interestingly, Kiyosaki expresses a bullish stance on the digital asset, predicting its price to reach $150,000 soon. He stated:

“BITCOIN ETF. Yay. Glad I bought it years ago. Bitcoin to $150k soon […] It’s all good news except for losers who save fake fiat US dollars. I will be buying more gold, silver, & Bitcoin with fake dollars.”

Market Dynamics

The initial day of Bitcoin ETF trading witnessed a total investment of $400 million, a modest figure in comparison to expectations. Subsequently, the bitcoin price experienced a pullback, dropping from around $49,000 to $41,590 before a partial recovery to $43,043.

Bloomberg analyst James Seyffart advised investors to focus on the long-term impact this approval will have. He stated:

“Anything talking about this being flop or terrible is either click bait or just had “god candle” expectations that were out of touch with reality.”

Analysts attribute this market movement to profit-taking by traders and the need for liquidity to invest in the newly launched spot-based Bitcoin ETFs.

As investors navigate through economic uncertainties, particularly in the face of a ballooning U.S. national debt, Kiyosaki’s call to action serves as a reminder of the growing importance of alternative assets like Bitcoin in safeguarding wealth and financial well-being.