In a groundbreaking development for the Bitcoin market, Bitcoin Exchange-Traded Funds (ETFs) have surged to an impressive $10 billion in assets under management (AUM) within an unprecedented timeframe. This achievement marks a significant milestone in the integration of digital assets into traditional financial systems.

Swift Growth of Bitcoin ETFs

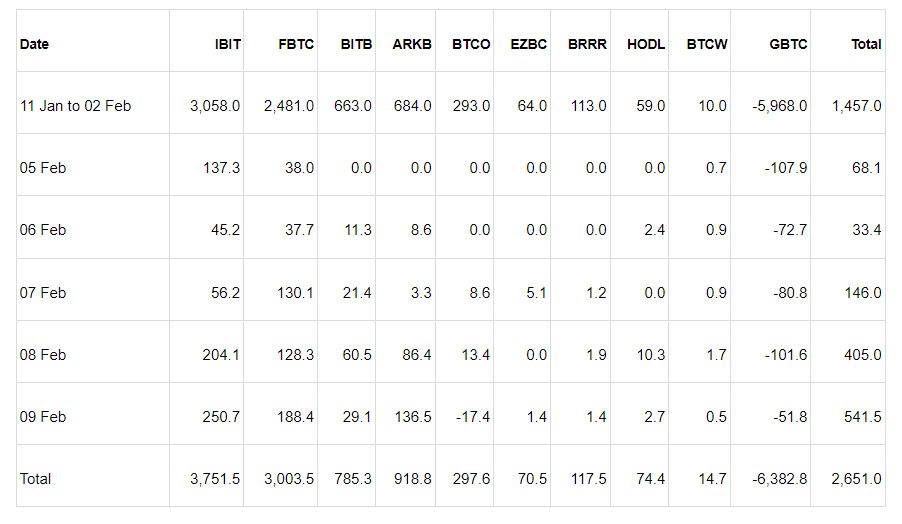

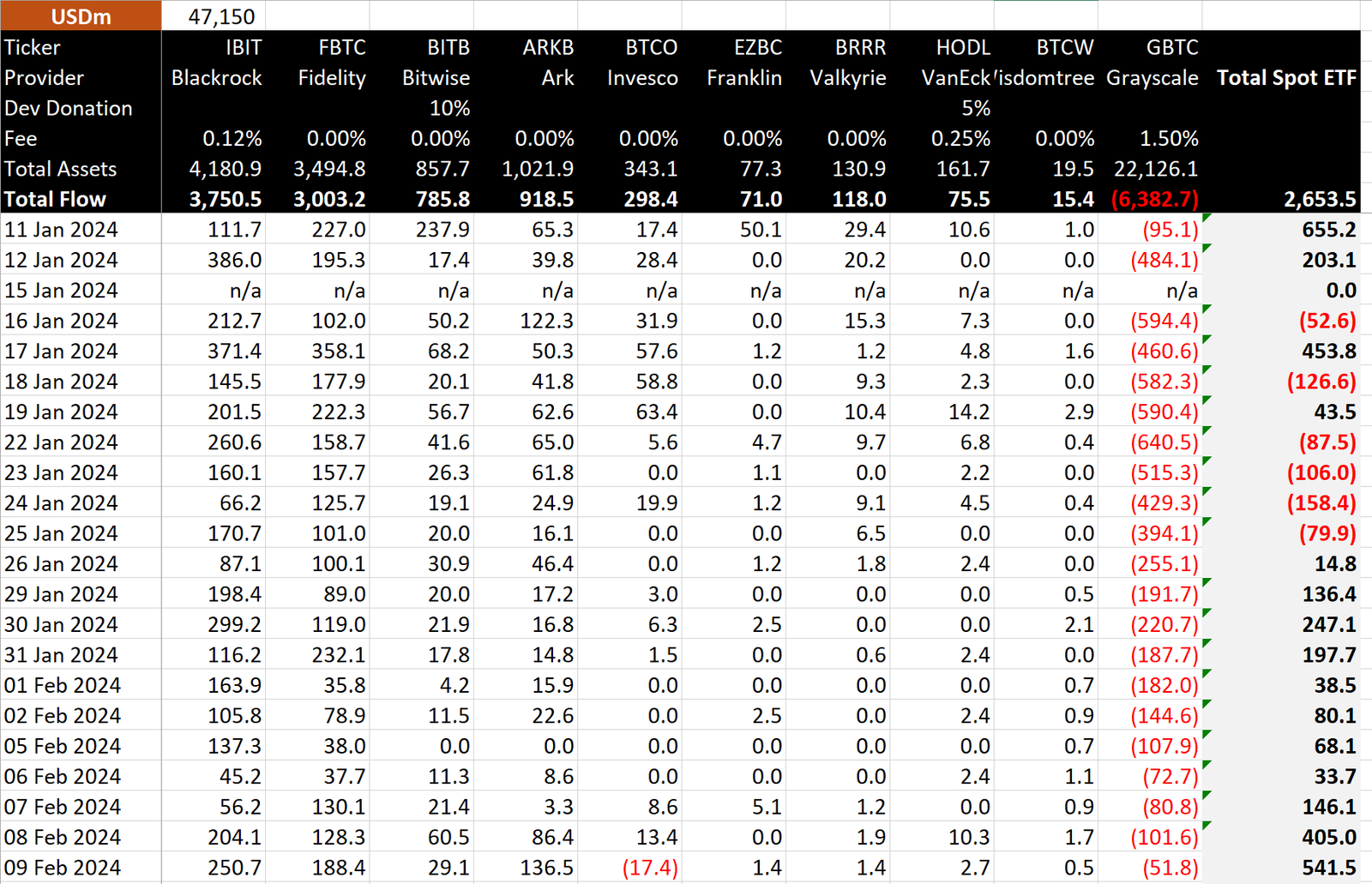

In a span of just one month after their approval, nine spot Bitcoin ETFs have collectively amassed over $10 billion in assets under management. According to Farside, net inflows to these ETFs on February 9 alone amounted to over $540 million. It’s worth noting that since January 11, these ETFs experienced an influx of $2.7 billion, even accounting for GBTC outflows, which amounts to over $6.3 billion.

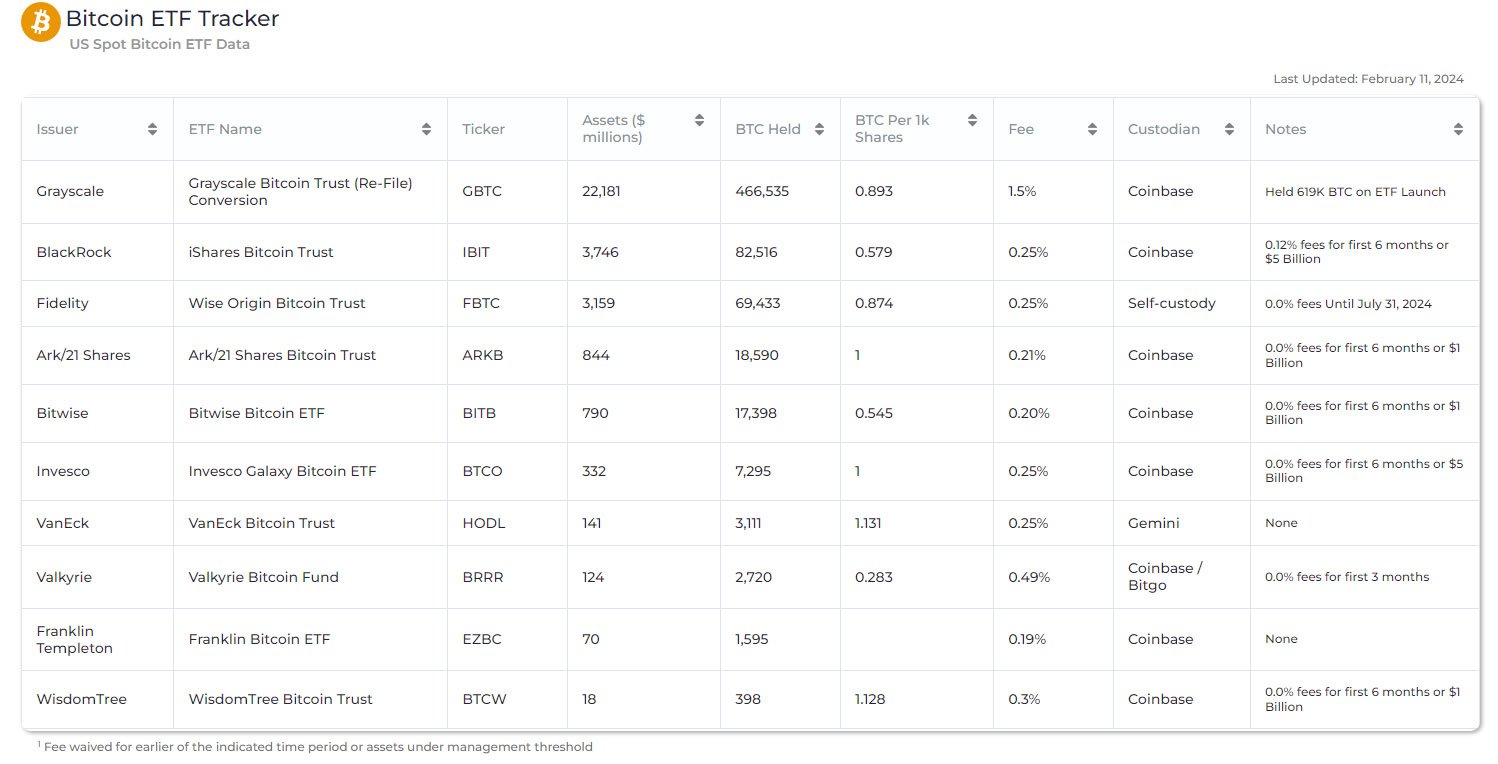

Data from BitMEX Research showcases strong investor interest in this emerging asset class. Leading the charge is BlackRock’s IBIT fund, boasting a massive $4.1 billion in bitcoin holdings, closely trailed by Fidelity’s FBTC with over $3.5 billion under management. According to the data, all 9 Bitcoin ETFs now hold an impressive $10.2 billion in AUM.

The data also shows that Grayscale outflows have slowed down quite significantly. GBTC recorded daily outflows of about $500 million a day on the early days of the Bitcoin ETF launch, but in the recent days, the daily outflows have been reduced to less than $100 million.

Key Players and Milestones

Among the notable players in this landscape is ARK 21Shares, whose Bitcoin ETF has also crossed the billion-dollar threshold, now holding more than $1 billion worth of bitcoin in its portfolio. However, amidst this remarkable growth, Grayscale’s GBTC faced significant outflows totaling $6.3 billion over the past month, underscoring shifting investor preferences in the bitcoin market.

Data from Apollo indicates that the 9 Bitcoin ETFs now hold more than 203,000 bitcoin in their coffers. It also shows that Grayscale’s bitcoin holdings have taken quite a hit. From its high of 619,000 BTC at the ETFs launch, the asset manager now holds 466,000 BTC.

Bloomberg analyst Eric Balchunas expressed optimism about the strength of bitcoin ETFs, noting:

“I thought the Nine would get a bit weaker as GBTC outflows subsided but they’re getting stronger.”

Market Analysts’ Outlook

Market analysts anticipate continued growth in Bitcoin ETF flows as trading firms conduct thorough due diligence on these investment vehicles. Bitcoin’s price performance has been resilient, consolidating above key technical support levels, including its 200-day moving average. ARK Invest highlights Bitcoin’s potential as a risk-off asset, replacing gold in investment portfolios, a trend expected to persist in the financial markets.

Based on a recent assessment conducted by ARK Invest:

“Bitcoin’s price relative to that of gold has increased twenty-fold in the last 7 years. In January 2024, Bitcoin could buy ~20 troy oz of gold, compared to 1 troy oz in April 2017, we believe this trend should continue as Bitcoin increases its role in financial markets.”

Given the broader economic landscape, the asset manager forecasts that as inflation cools and real rates rise, bitcoin should remain antifragile as banks continue to lose deposits.

Bitcoin ETFs Taking Financial Markets By Storm

The approval of Bitcoin ETF applications by the U.S. Securities and Exchange Commission (SEC) marks a significant milestone in the Bitcoin space. This approval comes more than a decade after the initial application by Cameron and Tyler Winklevoss in 2013. Various leading financial institutions, including ARK 21Shares, Invesco Galaxy, VanEck, WisdomTree, Fidelity, Valkyrie, BlackRock, and Grayscale, have received the green light to launch their respective Bitcoin ETFs on January 10, 2024.

The rapid growth of Bitcoin ETFs to a $10 billion milestone within such a short timeframe underscores the increasing institutional interest and confidence in bitcoin investments. With the integration of digital assets into traditional finance gaining momentum, Bitcoin continues to assert its position as a significant player in the global financial landscape. As market dynamics evolve and regulatory frameworks adapt, the future of Bitcoin ETFs holds promise for both investors and the broader digital asset market.