Bitcoin has captured the attention of investors worldwide, promising unprecedented returns and financial liberation.

However, the allure of rapid gains has also led many to engage in bitcoin day trading, a practice that involves buying and selling bitcoin within short time frames to profit from its price volatility. Despite the excitement surrounding this activity, bitcoin day trading often falls short of its promise.

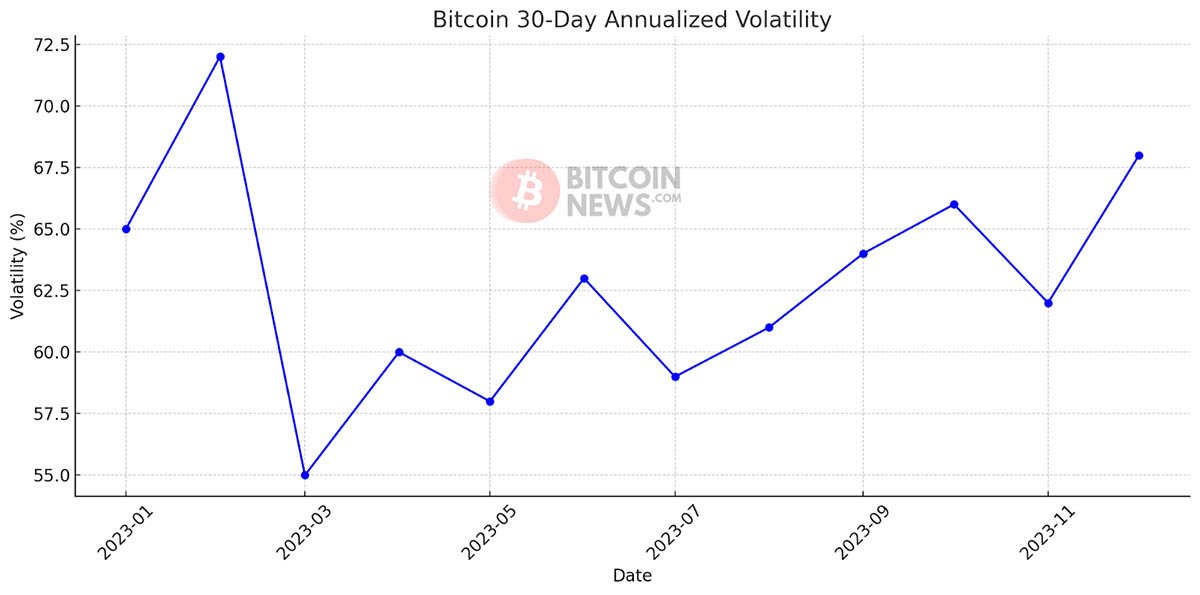

Bitcoin’s price is notoriously volatile. While this volatility creates opportunities for substantial gains, it also exposes traders to significant risks.

Prices can swing wildly within minutes, driven by market sentiment, news, regulatory changes, and even social media trends.

This unpredictability makes it very challenging for day traders to consistently guess market movements and profit from them.

For instance, a trader might buy bitcoin anticipating a price increase, only to see the market move sharply in the opposite direction due to an unexpected news event. Such sudden shifts can lead to substantial losses, wiping out gains accrued over several successful trades.

Day trading, by its nature, requires constant attention and quick decision-making. Traders must stay glued to their screens, monitoring price charts and market indicators, ready to execute trades at a moment’s notice.

This constant vigilance can lead to high levels of stress and emotional burnout.

The psychological toll of day trading should not be underestimated. The pressure to make fast decisions and the emotional rollercoaster of gains and losses can lead to anxiety and mental fatigue.

Over time, this stress can impair decision-making, causing traders to make irrational choices driven by fear or greed, further compounding their losses.

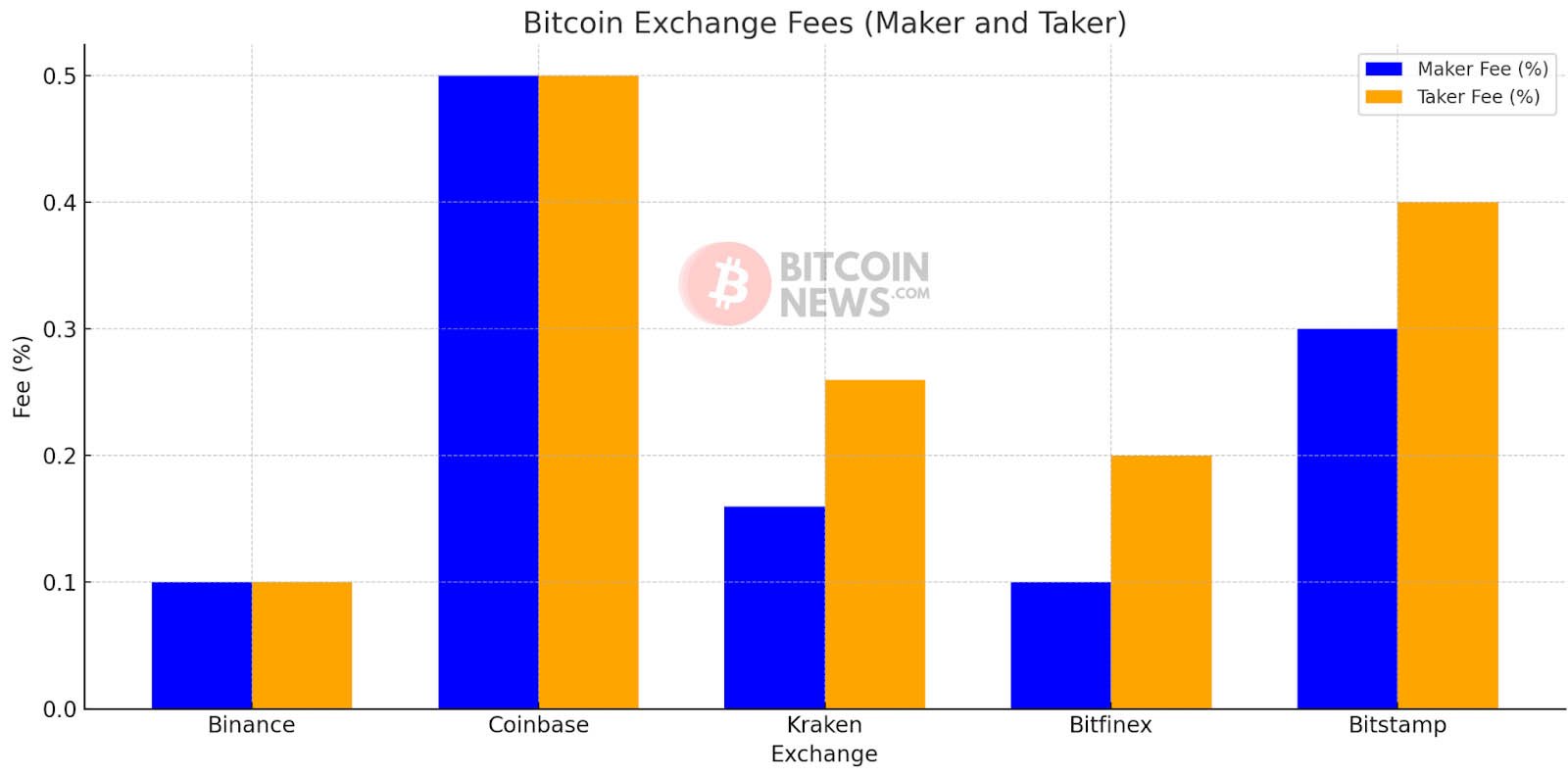

It’s also worth mentioning that every time a trader buys or sells bitcoin, they incur transaction costs. These costs include trading fees charged by exchanges, as well as the spread between the buy and sell prices.

For day traders who execute numerous trades daily, these costs can add up quickly, eroding potential profits.

Additionally, frequent trading can trigger higher tax liabilities in many jurisdictions. Capital gains from short-term trades are often taxed at a higher rate than long-term investments, reducing the net returns for day traders.

When these costs are factored in, the seemingly lucrative gains from day trading can shrink considerably.

Bitcoin markets are less regulated than traditional financial markets, making them susceptible to manipulation. Large players, known as “whales,” can influence prices by executing substantial buy or sell orders, creating artificial price movements that can trap day traders.

For example, a whale might pump the price of bitcoin by making large purchases, attracting retail traders who jump in hoping to profit from the rise.

Once the price peaks, the whale sells off their holdings, causing the price to plummet and leaving day traders with losses. These manipulative practices make it difficult for individual traders to navigate the market effectively.

The opportunity cost of day trading is high. By focusing on short-term gains, traders may miss out on the potential long-term appreciation of bitcoin.

Historically, bitcoin has demonstrated significant growth over longer time horizons. Investors who adopt a buy-and-hold strategy often realize greater returns with less stress and effort compared to those who engage in day trading.

For those interested in Bitcoin, there are more sustainable and less stressful investment approaches than day trading.

One popular method is the dollar-cost averaging (DCA) strategy, where investors regularly purchase a fixed dollar-amount of bitcoin regardless of its price. This strategy mitigates the impact of volatility and reduces the emotional stress associated with market timing.

Long-term holding is another viable approach. By buying bitcoin and holding it for an extended period, investors can benefit from its potential long-term appreciation without the need to constantly monitor the market or make frequent trades.

Interestingly, Jack Dorsey, founder of Block, Inc., plans to invest 10% of the company’s monthly profit from bitcoin products into bitcoin. This strategy involves regular, systematic purchases, aligning with the DCA approach to build up bitcoin holdings steadily and minimize market timing risks.

While bitcoin day trading can be exciting and potentially lucrative, it is fraught with challenges that make it unsuitable for most investors.

Extreme volatility, emotional stress, high transaction costs, lack of market insight, and the risk of manipulation all contribute to the pitfalls of day trading.

Instead of chasing quick gains, investors should consider more stable and sustainable strategies that align with their financial goals and risk tolerance.

By adopting a long-term perspective, investors can better navigate the complexities of the Bitcoin market and enhance their chances of achieving meaningful returns.