MicroStrategy, the business intelligence company turned Bitcoin pioneer, is at it again with another $2 billion capital raise, this time through perpetual preferred stock offering.

The funds will be used to buy more bitcoin and cement the company’s position as the largest corporate holder of the scarce digital asset.

This is part of MicroStrategy’s “21/21 Plan” to raise $42 billion over three years—$21 billion in equity and $21 billion in fixed income. The funds will be used to strengthen the balance sheet and grow the bitcoin in the company’s coffers.

Michael Saylor, MicroStrategy’s co-founder and chairman, has been a long time Bitcoin bull. He sees bitcoin as a long term financial investment, not just a digital currency.

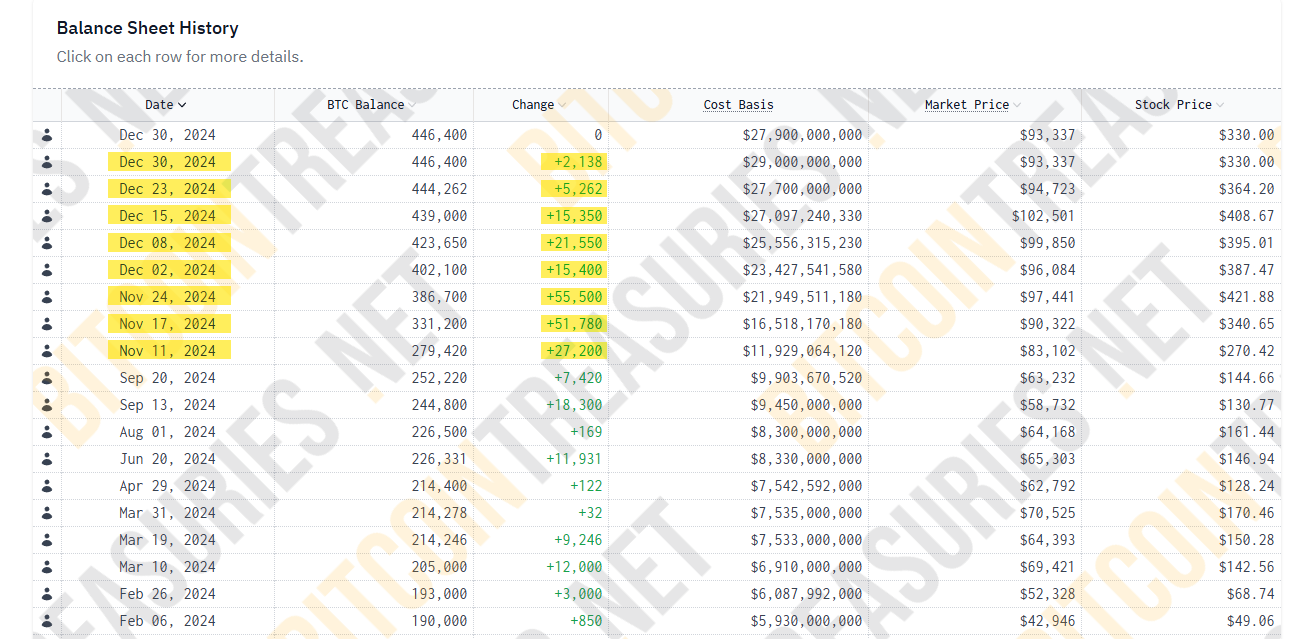

MicroStrategy has been all in on Bitcoin. As of January 2025 the company holds 446,400 BTC worth approximately $43.7 billion. These holdings have generated significant unrealized gains which will only add to investor confidence.

The $2 billion stock offering, expected in 1st quarter of 2025, will be for preferred stock with some unique features, including being convertible into common stock, cash dividends and other redemption options. But the details and timing are still subject to market and investor demand.

MicroStrategy may not proceed with the offering if conditions are not right. A filing with the U.S. Securities and Exchange Commission (SEC) is still expected and the company will seek shareholder approval to increase the authorized stock.

This includes increasing the common stock from 330 million to 10.3 billion and the preferred stock from 5 million to 1 billion.

Related: MicroStrategy Calls for Shareholder Meeting to Accelerate 21/21 Plan

Since MicroStrategy started buying bitcoin as its primary reserve asset in 2020, the company has been buying more and more. The purchases have been funded through debt instruments like convertible notes and preferred stock offerings, with no end in sight.

Since the announcement of the “21/21 Plan” on October 30, 2024, the company has bought 194,180 BTC, which is almost half of its three-year target.

Despite the volatility risks of bitcoin, MicroStrategy is confident in its plan. The firm’s aggressive buying shows how sure it is about bitcoin’s impact on traditional finance.

MicroStrategy’s big moves have been met with both praise and criticism. While the stock (MSTR) rose 417% in 2024, it has also been very volatile.

MSTR shares recently fell below $300, a 46% drop from the November high, due to the company’s heavy use of debt and equity to fund its bitcoin purchases. But it has shown signs of strength in the recent days, rebounding to over $330.

MicroStrategy’s move is part of a larger trend of institutions getting into bitcoin. Bitcoin’s growing adoption and dominance in the financial markets has made it an attractive asset for companies looking for high returns and diversification.

In 2024 Bitcoin was one of the top performing assets globally, and investors are confident. Analysts say it will continue to go up as adoption and support grows from big names including US politicians.

As MicroStrategy gets ready to proceed with the $2 billion offering, the company will be doubling down on its biggest financial bet yet. Nevertheless, it will have to navigate the market, regulatory and shareholder issues.