Investments in spot Bitcoin exchange-traded funds (ETFs) are surging, with over 900 professional firms entering the market.

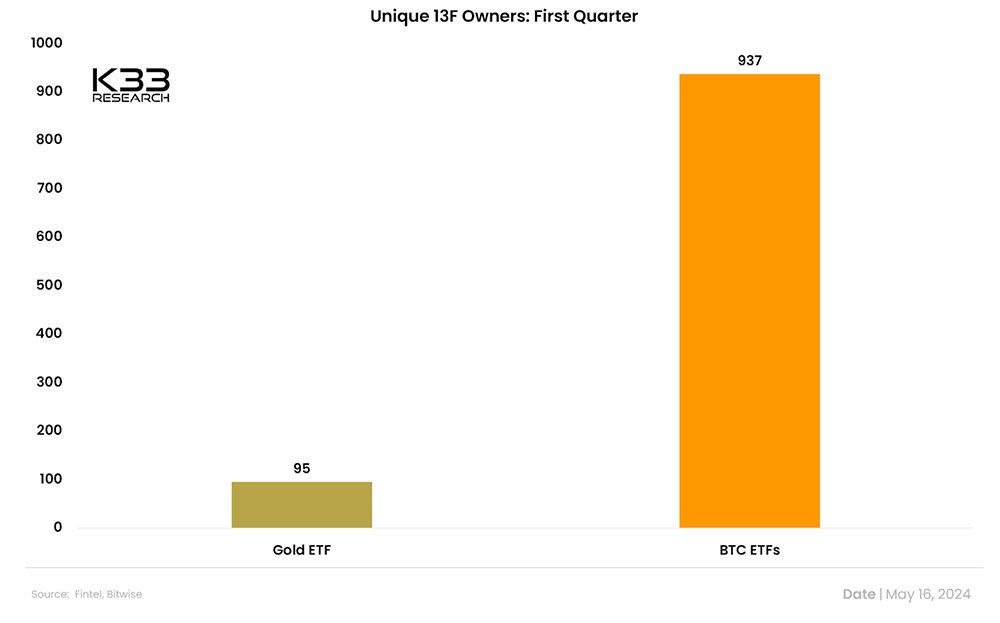

Vetle Lunde, a senior analyst with digital asset intelligence platform K33 Research, pointed out that during the first quarter of ’24, the number of financial entities investing in spot Bitcoin ETFs in the first quarter of 2024 rapidly outpaced those investing in gold ETFs.

In a recent post on social media platform X, he stated:

“According to 13F reporting, 937 professional firms were invested in US spot ETFs as of March 31. In comparison, gold ETFs had 95 professional firms invested in their first quarter.”

Lunde also pointed out the dominance of retail investors holding a significant majority of these ETFs, investing $47.96 billion as of the end of Q1 2024.

This represents 81.3% of the total assets under management (AUM) in bitcoin spot ETFs. On the other hand, professional investors held $11.06 billion, making up 18.7% of the bitcoin spot ETFs AUM.

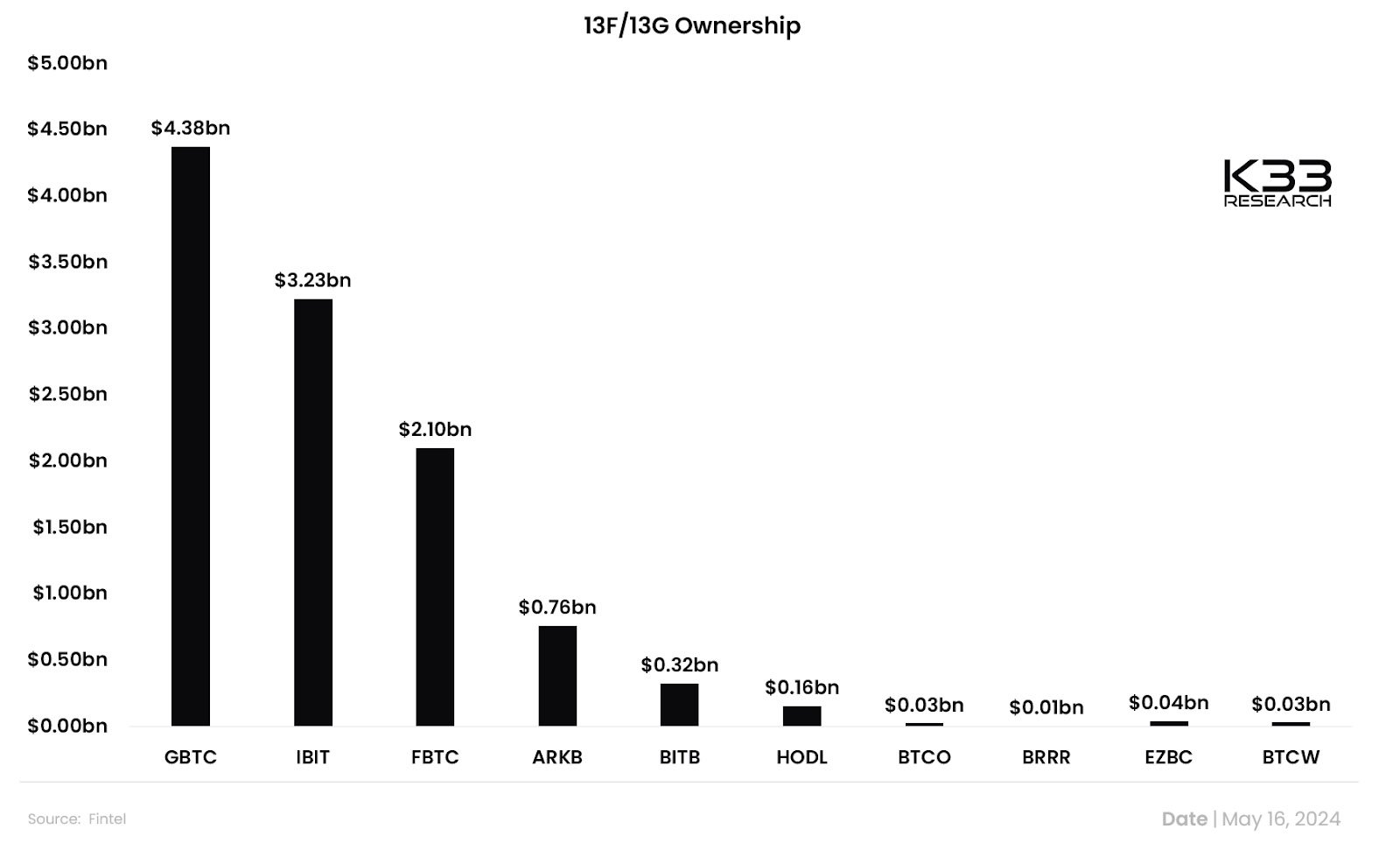

According to the data collected by Laude based on 13F filings, the biggest ETFs, Grayscale’s GBTC, BlackRock’s IBIT, and Fidelity’s FBTC, experienced a flow of $4.38 billion, $3.23 billion, and $2.10 billion from these firms, respectively.

Notably, the 13F filings are quarterly reports submitted to the U.S. Securities and Exchange Commission (SEC) by institutional investment managers with over $100 million in assets under management.

They provide a clear view of the increasing institutional interest in different investment vehicles, as they recently did with Bitcoin ETFs. According to this data, several financial giants have been significantly increasing their holdings in Bitcoin ETF shares.

For instance, Morgan Stanley has purchased 4.27 million shares of the GBTC, amounting to $269.8 million. The State of Wisconsin Investment Board also holds nearly $163 million worth of Bitcoin ETF holdings with IBIT and GBTC.

SkyBridge Capital founder Anthony Scaramucci recently predicted that more pension funds will follow the State of Wisconsin’s lead and add bitcoin to their investment portfolios. In an interview on CNBC’s Squawk Box, Scaramucci stated:

“I think institutional adoption is happening now. The State of Wisconsin announced. We expect other pension funds to announce. And of course, Bitcoin now has regulatory approval. And I think that was the rate limiting step for a lot of these large-scale institutions.”

Scaramucci emphasized that Bitcoin remains in the early stages of adoption, suggesting that there is significant potential for growth as more institutions recognize the benefits of investing in the digital asset.

“Sometimes when you’re early, you get a lot of bumps and scrapes. But I think it pays to be early in Bitcoin and I think we’re still early in Bitcoin,” he remarked.