Table of Contents

Introduction: The Dawn of a New Accounting Era

In a decisive move shaping the future of digital finance, the Financial Accounting Standards Board (FASB) has rewritten the rules of the game for Bitcoin and other digital assets.

The new FASB bitcoin rule isn’t just a minor tweak in the accounting world; it’s a seismic shift that promises to change how corporations view and report their cryptocurrency holdings. For both the uninitiated and the seasoned, this development is a window into a rapidly evolving financial landscape.

Demystifying the FASB Bitcoin Rule: A Simplified Breakdown

Imagine a world where the value of your assets fluctuates wildly, but your ledger (or net worth) shows only a fraction of this story. This has been the reality for companies holding bitcoin. The FASB rule changes this narrative. Previously, Bitcoin was like a shadow in the financial statements, visible only when its value dipped. Now, under the new rules effective from December 2024, Bitcoin will be reported at its fair market value, reflecting both rises and falls in real-time. It’s like finally being able to see the full spectrum of colors in a previously black-and-white financial picture.

The Ripple Effect: Beyond Bitcoin

While Bitcoin undoubtedly takes the spotlight, the ripple effect of this rule extends well beyond. It reshapes the financial portrayal of digital assets on corporate balance sheets, touching a spectrum of businesses that venture into the digital asset realm. Notably, Bitcoin stands as the primary digital asset of choice for corporate holdings, with 38 publicly traded companies investing in it, compared to a mere two for others.

This pivotal change transcends the boundaries of tech giants and blockchain startups, signaling a clarion call to all sectors to reassess their treasury strategies. In the face of mounting inflation and expansive monetary policies anticipated in 2024, companies are not just allowed but obligated to protect shareholder interests. This environment sets the stage for an increased corporate pivot towards Bitcoin, positioning it as a potential hedge and a strategic asset in the broader corporate financial playbook.

Transforming Bitcoin, Stocks, and ETF Prospects

This accounting shift could revolutionize Bitcoin’s role in corporate finance. Companies can now acknowledge the actual worth of their bitcoin holdings, making it a more attractive asset on balance sheets. For the stock market, this brings a new layer of transparency, potentially smoothing out some of Bitcoin’s notorious volatility in financial reports. And for the much-anticipated Bitcoin ETFs, this could be a beacon of legitimacy, signaling a matured and financially recognized asset class.

Winners: Companies in Focus

The upcoming changes in accounting rules herald significant benefits for companies like MicroStrategy, Marathon Digital Holdings, Tesla, Coinbase, Block, and Riot, all of which hold substantial bitcoin investments. This accounting makeover will more accurately reflect their digital assets’ market worth, potentially leading to a considerable uplift in their financial health and stock valuations. It’s as if these companies are set to showcase a new, digitally savvy financial identity.

Seizing the Opportunity: Investor Strategies in the New FASB Era

For investors, the new FASB rules offer a fresh perspective for evaluating company value. Firms like MicroStrategy might witness their stock prices align more closely with the real-world value of their bitcoin holdings. Keeping tabs on firms with substantial digital assets is now more crucial than ever, as these rules may reveal previously hidden values in their stocks, presenting unique investment opportunities.

MicroStrategy

Let’s break this down with a few of these companies so we can really see what the potential return is here.

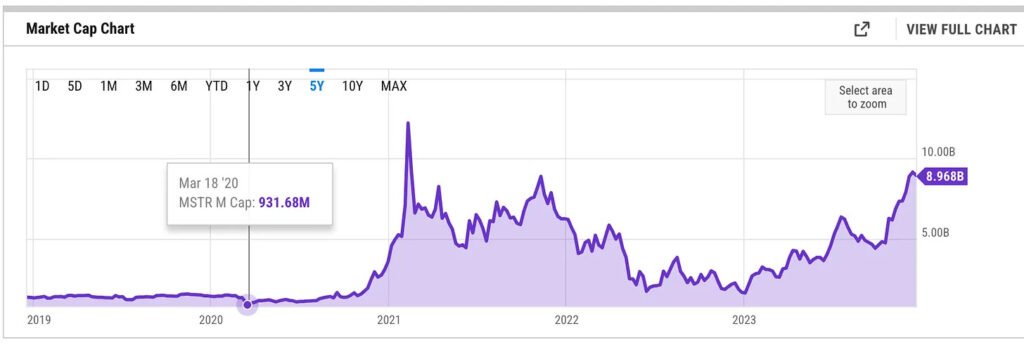

We’ll start with MicroStrategy (MSTR): a data analytics firm founded by Michael Saylor and the company with the largest bitcoin holding of any public company (by a margin of over ten times the next closest company). MSTR began purchasing bitcoin in 2020 and as of November 30, 2023 they hold 174,530 bitcoin.

At the time of this writing one bitcoin is worth roughly $43,500 which comes to roughly $7.59B. At the time of this writing, MSTR’s market cap (stock price x total shares outstanding) is around $7.8B. Now keep in mind, the new FASB rule is not in effect, so MSTR has had to mark down their bitcoin when the price decreases, but has not been able to mark it up when the price goes up.

MSTR’s lowest market cap over the last five years was $931.68 million in March 2020 (before they began purchasing bitcoin). If we assume the company has never improved or grown that leaves approximately $500M of value that the stock will need to increase (conservatively). And that is just if the price of bitcoin does not move from here. That translates to a 6.05% increase in stock price if MSTR does nothing other than hold bitcoin and the price of bitcoin does not move.

Showing my work (this is the formula used for all calculations): old market cap + increase in value of bitcoin (new bitcoin value – old bitcoin value) / old market cap = % increase.

At $50k/bitcoin, MSTR’s holdings will be worth over $8.7B, and there would be a minimum $900M increase in the stock, just for their bitcoin holding. Add another $931M to the market cap for the value of the company (they still are a data analytics firm with clients who pay for services) unadjusted from March 2020 and you would have a minimum 23% increase in stock price.

That is without bitcoin making a new all-time high. You see where I’m going with this…no ok, let’s do another example.

Marathon Digital Holding

Marathon Digital Holdings (MARA) is the largest publicly traded Bitcoin mining company based on market cap, bitcoin holdings, or hash rate. The cherry on top is unlike many of their counterparts, MARA has geographically diversified the locations of their mining centers to avoid any potential blowback from any nations regulatory efforts (or one in particular).

MARA currently holds 14,025 bitcoin and has a market cap of $4.91B as of the time of this writing. At a price of $43,500/bitcoin, their stack is worth $610M. While this is a fraction of their market cap (12.4% of current market cap), as a mining company they will continue to to add to this stack through the blocks they mine and the fees they collect.

Now there are a lot of accounting tricks used by public companies, but it is important to remember the FASB rules in place now say a company can only mark down the value of their bitcoin, and not up. Based on MARA’s most recent earnings report, fair value of their holdings was approximately $370 million at quarter-end. This would mean that their bitcoin holdings only accounts for 7.5% of their current market cap.

With the new FASB rule and with a price of $43,500/bitcoin, MARA’s stock would increase by 4.88% overnight. Should the price of bitcoin jump to $80,000 during the next bull run, their stack (if all else remains constant) would be worth over $1.12B; or a 15.27% increase in stock price. While not numbers to retire on, still a positive move in one’s portfolio.

P.S. I did not track down MSTR’s fair value of their holdings so you can assume those percent increases are conservative.

Tesla

One more for good luck: Tesla (TSLA). Surprising to some, TSLA has the third largest bitcoin holding of any publicly trade company, despite news that TSLA sold their bitcoin. Their 10,725 bitcoin holdings remained valued at $184 million (roughly $17,156/bitcoin – oh how I wish I could buy for that price). At $774B, TSLA’s market cap is significantly higher than any other company holding bitcoin so the impact of the FASB rule will have limited impact on the price of bitcoin.

Just an adjustment to a bitcoin price of $43,500, TSLA would see a 0.036% increase in stock price. But for arguments sake, let’s say the Bitcoin-maxis are right and bitcoin will be worth $500,000 in 2025. Assuming everything else remains constant (which with Elon Musk we know is practically impossible but still let me cook), TSLA would have a 0.6% stock increase strictly from its bitcoin holdings.

Takeaways

This analysis shows that the impact of the new FASB rules varies depending on the size of the company and the extent of its bitcoin holdings. While significant for companies like MSTR and MARA, the effect is less pronounced for giants like Tesla. Nevertheless, this is a pivotal moment in mainstream finance for Bitcoin, marking its recognition and potential revaluation in the corporate world.

While it is an exciting proposition, it is important to set expectations appropriately. No one knows where the price of bitcoin will be in the future, if I had that answer I’d be living it up in Vegas.

Conclusion: A Financial Landscape Transformed

The FASB’s new rules are more than an accounting change; they are a testament to Bitcoin’s burgeoning clout in mainstream finance. As we witness this evolution, it’s a reminder of the dynamic nature of financial markets and the need to stay abreast of these changes. For companies, investors, and enthusiasts alike, this is a pivotal moment – a chance to be part of a defining shift in how digital assets are perceived and valued in the world of finance.