A new proposal from Amazon shareholders is making waves. A group of investors are asking the company to diversify its cash reserves by putting at least 5% of its $88 billion in liquid assets into Bitcoin (BTC).

They say it will protect shareholder value, hedge against inflation and profit from bitcoin’s growth.

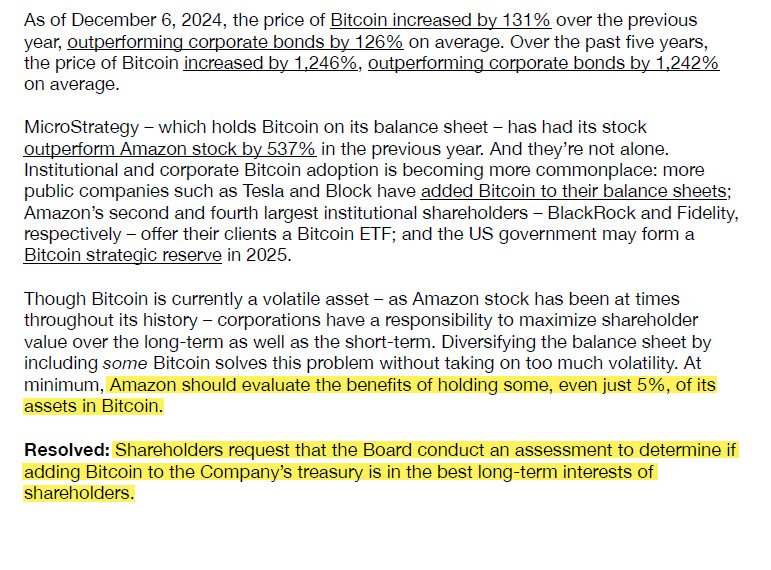

The proposal from the National Center for Public Policy Research (NCPPR) points out the benefits of putting bitcoin in the treasury. The request highlights that bitcoin has outperformed bonds, gold and even Amazon’s own stock over the last few years.

Amazon has $88 billion in cash, cash equivalents and marketable securities including government and corporate bonds. But shareholders say this asset mix doesn’t protect against inflation.

“Amazon isn’t adequately protecting billions of dollars of shareholder value simply by holding these assets,” the proposal says, adding:

“At minimum, Amazon should evaluate the benefits of holding some, even just 5%, of its assets in Bitcoin.”

Bitcoin’s performance this year makes the case stronger. The top digital asset has risen over 150% in 2024 and recently broke $100,000. Over the last five years bitcoin has gone up over 1,200%—way more than traditional assets.

The NCPPR notes that inflation, often underreported by the official Consumer Price Index (CPI), is eating away at cash reserves. With bond yields not keeping up with inflation, bitcoin is a more robust alternative, the shareholders say.

Related: Unmasking Inflation | The Reality of a Debased Currency

The proposal cites companies like MicroStrategy and Tesla as examples of companies that have successfully adopted Bitcoin.

MicroStrategy which has made Bitcoin a key part of its financial strategy, has seen its stock rise over 500% in the last year—way more than Amazon’s 49% over the same period. Tesla and Block (formerly Square) have also gone Bitcoin, putting it in their balance sheet and business model.

Amazon has a duty to consider investments in assets that have outperformed bonds, the proposal says.

Former Binance CEO Changpeng “CZ” Zhao has gone further and suggested Amazon should accept bitcoin as a form of payment.

In response to the proposal he posted on X: “Simple. Accept Bitcoin payments?” He said this would allow Amazon to get hands on experience with the digital asset and test its value against other currencies.

Shareholders think a 5% allocation to bitcoin would be the right balance of risk and reward. The proposal says: “Diversifying the balance sheet by including some Bitcoin solves this problem without taking on too much volatility.”

Amazon is not alone in being pressured to adopt Bitcoin. NCPPR has also submitted similar proposals to other tech companies like Microsoft. In fact, Microsoft shareholders will be voting on a Bitcoin proposal today.

NCPPR thinks this could be the start of a bigger trend among companies as speculation grows about the US government creating a bitcoin reserve by 2025.

If Amazon approves the proposal, it will be a big deal for the Bitcoin space. Adding bitcoin to their reserves will further legitimize the asset as a financial instrument and accelerate global adoption.

Shareholders hope Amazon will see the long term potential of this strategy and not just the short term volatility. As the proposal says:

“Maximizing shareholder value is a central responsibility. Bitcoin offers a unique opportunity to achieve this goal.”

Amazon’s board has not commented publicly yet, but the corporate Bitcoin trend is building. With bitcoin price rising and institutional interest growing, Amazon may find this suggestion hard to ignore.

For now, it’s up to Amazon’s leaders, but the shareholder pressure could be a game changer for their financial strategy.