In a groundbreaking move, the Central Bank of Argentina (Banco Central de la República Argentina, BCRA) has launched a live exhibition featuring Bitcoin mining equipment.

Titled “Art, Artificial Intelligence, and the Future of the Economy,” this exhibit has garnered widespread attention as it represents the first time a central bank has openly showcased bitcoin mining technology.

The exhibition, which officially opened on October 31 at the BCRA’s Historical Museum in Buenos Aires, signifies a noteworthy shift in the BCRA’s stance towards digital assets, highlighting Argentina’s growing interest in Bitcoin.

This unique display not only offers an inside look into the technical workings of Bitcoin mining but also introduces the public to the potential impact of digital currencies on the financial system.

By hosting this exhibit, the BCRA is promoting dialogue about the future of money, the growing presence of Bitcoin, and its possible integration into traditional banking frameworks.

The exhibition is designed to educate the public about digital currencies and blockchain technology, blending art with finance to make these complex concepts accessible to a broader audience.

Central to this initiative is Argentine artist Alberto Echegaray, whose installations emphasize the transformative power of Bitcoin.

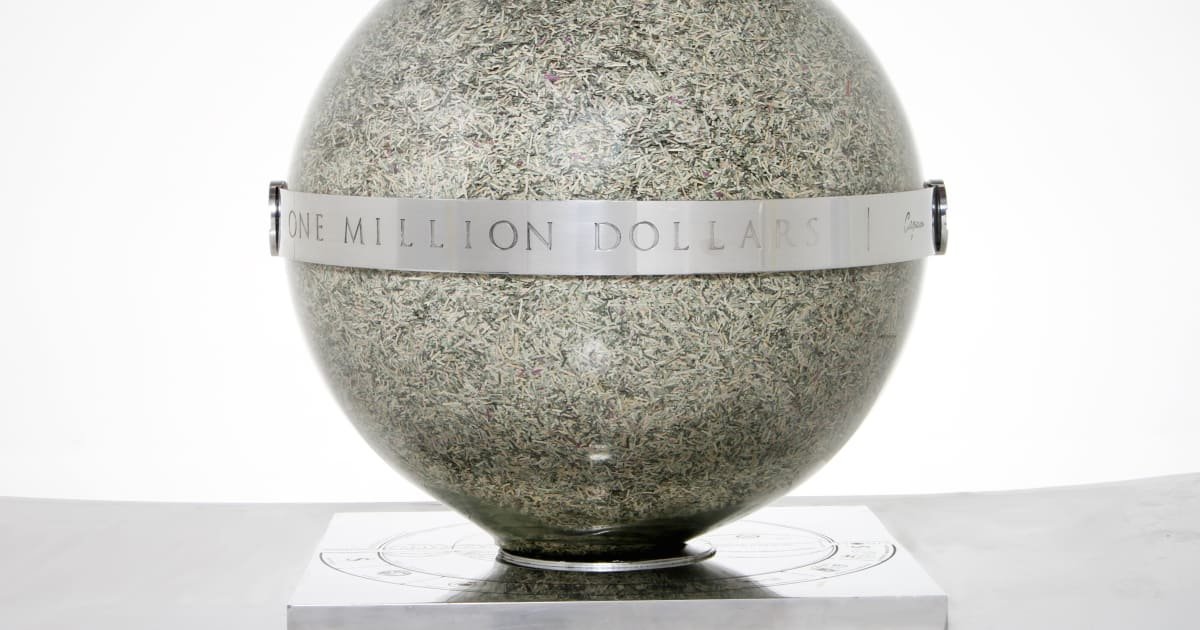

His works are symbolic representations of the ongoing shift from traditional cash to digital assets, with one of his pieces, the “Moneyball,” featuring a sphere filled with shredded currency to demonstrate “the instability of traditional currencies and the increasing role of cryptocurrencies in our everyday lives.”

Echegaray Guevara told the international Argentine online newspaper Infobae:

“We have developed the exhibition together with the Central Bank. It tries to show different types of currencies. I have gone to more than 17 central banks in the last twelve years, where I have destroyed money. The message has to do with the disappearance of paper money and the new financial systems, which are more linked to technology.”

Echegaray, a pioneer in digital currencies art, describes his work as a bridge between art and financial technology.

His says his goal is to “initiate a discussion about the transformation of the global financial system and show how technology is changing our perception of money and value.”

And now, alongside his “Moneyball” artworks, the exhibition features bitcoin mining rigs, offering visitors an up-close view of the machinery responsible for creating new digital currency.

What sets this display apart from other similar ones, is that the displayed bitcoin mining rigs are live and running.

This exhibition marks an unprecedented move for a central bank. Typically, Bitcoin mining is a private-sector activity and is rarely, if ever, associated with government institutions.

The BCRA’s decision to display operational Bitcoin mining rigs reflects a potential shift in the way digital assets are viewed in Argentina.

This decision to showcase mining equipment is seen by many as a step toward greater transparency and public engagement with Bitcoin.

The live mining rigs in the exhibit not only serve as an educational tool but also highlight the intricacies of the mining process. Visitors gain insight into how Bitcoin is created, the technology involved, and the energy-intensive nature of mining operations.

A BCRA spokesperson explained, “With this presentation, we want to give people an insight into how cryptocurrencies work and the technology behind them, without judging or promoting them. It’s about spreading knowledge and stimulating discourse.”

As the first central bank in the world to host a live Bitcoin mining exhibit, the BCRA’s move signals a shift in how digital assets are perceived within government institutions.

While central banks globally have traditionally approached digital assets with caution, Argentina’s proactive stance could pave the way for other nations to explore and discuss the role of digital currencies in their financial ecosystems.

The timing of this exhibit is significant. Argentina has experienced an increase in bitcoin adoption, particularly as its citizens seek alternatives to the national currency, the peso, which has faced high inflation and devaluation.

The adoption of digital currencies has provided many Argentinians with a way to preserve the value of their assets. Additionally, Argentina ranks high in digital asset transaction volumes across the region, underscoring its active role in the digital currency market.

Echegaray’s installations are key in this mission. Beyond the mining rigs, he includes “Moneyballs”—spheres crafted from shredded banknotes—that illustrate the gradual shift from physical currency to digital assets.

One notable piece is a 50 cm-diameter sphere containing $1 million worth of shredded $100 bills, donated by the U.S. Treasury. These spheres also connect virtual assets to real-time valuation data, allowing visitors to consider the evolving concept of money.

Echegaray believes that exhibitions like this serve as a platform for discussing the future of currency. He added:

“No central bank has ever handled operational mining equipment, and it’s good for both art enthusiasts and those interested in economic and digital systems to see it.”

His artwork encourages reflection on the future of money, imagining a time when cash may only be seen in museums.

Argentina’s enthusiasm for digital currencies has been noted for years, with government and financial bodies now taking a closer look at how Bitcoin might play a role in the country’s economy.

Recently, the National Securities Commission (CNV) has begun working on regulatory frameworks for Virtual Asset Service Providers (VASPs) to ensure that digital currency transactions are secure and transparent.

Related: Argentina Looks to El Salvador for Bitcoin Adoption Insights

Anthony Pompliano, the Founder and CEO of Professional Capital Management, shared his thoughts on X:

Patrick Lowry, the CEO of Samara AG, also highlighted the event, stating:

Through exhibitions like this one and regulatory efforts, Argentina is positioning itself as a potential leader in Bitcoin adoption.

The BCRA’s exhibit is more than just a display; it’s an invitation for the public to think critically about digital transformation and to engage with the ongoing evolution of money.