Digital assets analytics firm Arkham has publicly disclosed the wallet address for bitcoin holdings of Elon Musk’s corporate entities, Tesla and SpaceX. The on-chain analysis conducted by Arkham brings to light Tesla bitcoin holdings, showcasing that Tesla possesses 11,509 BTC, equivalent to $780 million, spread across 68 addresses.

Simultaneously, Spacex is identified as holding 8,285 BTC, valued at $560 million, and distributed across 28 addresses. Arkham states:

“Arkham has identified the BTC holdings of Tesla and SpaceX. We are the first to publicly identify these holdings on chain.”

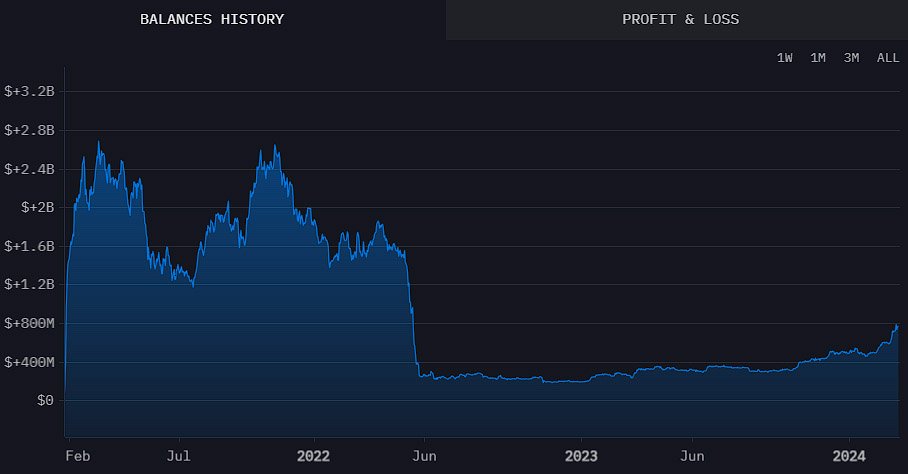

SpaceX, Tesla Bitcoin Holdings: On-Chain Fund Flows

Arkham’s analysis emphasizes the meticulous correlation between on-chain fund flows and the official financial statements of Tesla and Spacex. The firm asserts that their identification of bitcoin holdings accurately aligns with the companies’ financial disclosures.

It clarifies:

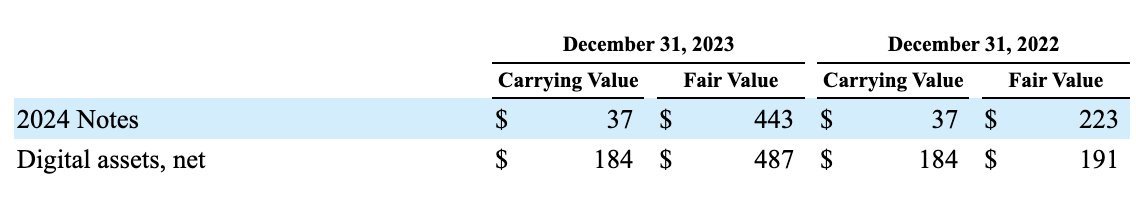

“There is a widespread erroneous belief that Tesla has held 9720 BTC since their most recent BTC sale in Q2 2022. This seems to come from a mistake in reading the quarterly reports – calculating the number of BTC by the Carrying Value rather than Fair Market Value.”

Backing their assertion, Arkham references Tesla’s latest Securities and Exchange Commission (SEC) filings, where the fair market value of the holdings aligns seamlessly with Arkham’s findings of 11.5k BTC holdings by Tesla.

Notably, Tesla’s foray into the digital asset market involved a $1.5 billion bitcoin purchase in January 2021, with subsequent sales in Q1 2021 and Q2 2022, totaling $1.2 billion. Transactional data further validates that the electric car company accepted bitcoin as payment for vehicle purchases between March 24 and May 12, 2021. Arkham stated:

“Our Tesla Intel Exchange Bounty revealed a Tesla car purchase linked to this larger cluster of Tesla holdings.”

Tesla’s Bitcoin Sales and Holdings Stability

Tesla’s bitcoin divestiture occurred in two phases, with a Q1 2021 sale amounting to $272 million and an additional sale of $936 million in Q2 2022. Despite these transactions, Arkham’s analysis reveals that Tesla’s digital asset holdings remained stable at $184 million in Q4 2023, a consistent figure since the fourth quarter of 2022.

The primary composition of Tesla’s digital holdings comprises bitcoin, with negligible exposure to the altcoin DOGE, accepted only for specific merchandise.

Arkham’s disclosure extends to Spacex’s bitcoin holdings, with a detailed breakdown available for scrutiny. Elon Musk had previously acknowledged SpaceX’s ownership of “a bunch of bitcoin” in January.

This revelation serves as a confirmation of Musk’s assertion and provides the digital asset community with valuable insights into the bitcoin reserves of yet another Musk-led enterprise.

Elon Musk’s Stance

While Elon Musk has acknowledged personal ownership of bitcoin, he expressed a limited focus on digital assets in December 2023. In November, Musk stated that none of his companies, including Tesla and SpaceX, would venture into creating a digital asset token. This stance aligns with his commitment to avoid such endeavors within his corporate entities.

Arkham’s revelation provides valuable insights into the evolving portfolios of Elon Musk’s companies, adding more confidence to the ongoing adoption of digital assets in the corporate world.