In a surprising turn of events, renowned Pershing Square Capital Management founder and CEO Bill Ackman has stepped into the limelight with a speculative scenario about Bitcoin’s potential impact on the economy.

Ackman’s X post sets off a humorous debate within the Bitcoin community, prompting responses from industry heavyweights and even an invitation for a one-on-one discussion.

‘Bitcoin Goes to Infinity’: Bill Ackman

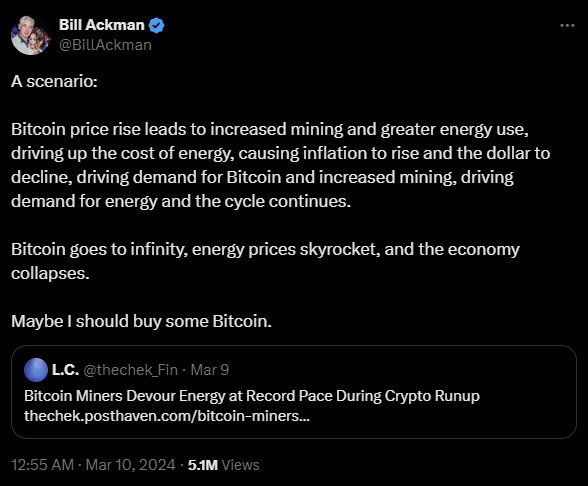

The discussion sparked when Ackman directly replied to a user’s post, emphasizing the substantial energy consumption due to the recent surge in BTC prices.

As per Ackman’s post, the surge in BTC price leads to increased mining activity, causing a spike in energy costs. He believes that this causes a domino effect, with rising energy prices triggering inflation, devaluing the US dollar, and ultimately leading to an economic collapse.

In his own words, “Bitcoin goes to infinity, energy prices skyrocket, and the economy collapses. Maybe I should buy some Bitcoin.”

The community responded swiftly, challenging Ackman’s analogies and explaining concerns about Bitcoin’s energy consumption. Some argued that traditional banking systems use more energy than digital assets, aiming to counter Ackman’s narrative.

Invitation to Orange-Pill

In the midst of the banter, renowned bitcoin advocate and MicroStrategy co-founder Michael Saylor chimed in with a different perspective. Saylor explained:

“You should buy some bitcoin, but not for the reasons cited above. Most bitcoin miners are driving the cost of electricity down for other consumers, not up.”

Saylor’s positive take on Bitcoin’s impact on energy costs challenged Ackman’s scenario, opening the door for a potential debate between the two figures.

Adding to this, VP of Research at Riot Platforms, Pierre Rochard, also invited the renowned thinker for a discussion on mining economics. He stated:

“There’s a lot of feedback loops, Bitcoin purchasing power can’t go straight up due to wealth effect spending / rebalancing of holders.”

What’s Next?

Ackman’s recent participation in the Bitcoin discussion signals a potential shift in his stance on digital assets. Previously recognized as a short seller, Ackman admitted to being a small investor in digital asset projects and venture funds in 2022, adopting a more casual and hobbyist approach to the emerging technology.

Notably, Ackman’s contemplation about buying bitcoin comes at a time when the United States Securities and Exchange Commission (SEC) recently approved Bitcoin spot ETFs. The historic launch has drawn massive attention from traditional investors.

The bitcoin community now speculates whether Ackman’s unconventional scenario could pave the way for him to explore the possibility of investing in bitcoin. With major players extending invitations for discussions, the industry awaits whether Ackman’s perspective on bitcoin will undergo a transformation similar to that of other high-profile figures who shifted their stance upon closer exploration.

Meanwhile, Bitcoin was nearing the coveted $70,000 level, trading at $69,800. According to the data from TradingView, this marks a 2% daily and over 12% weekly increase.