In a surprising turn of events, the U.S. Senate has been inundated with over 2,200 letters within a span of just 48 hours, all advocating for Senator Cynthia Lummis’s newly introduced Bitcoin Reserve Bill.

This legislation aims to establish a strategic bitcoin reserve, positioning the United States as a leader in Bitcoin adoption and financial innovation.

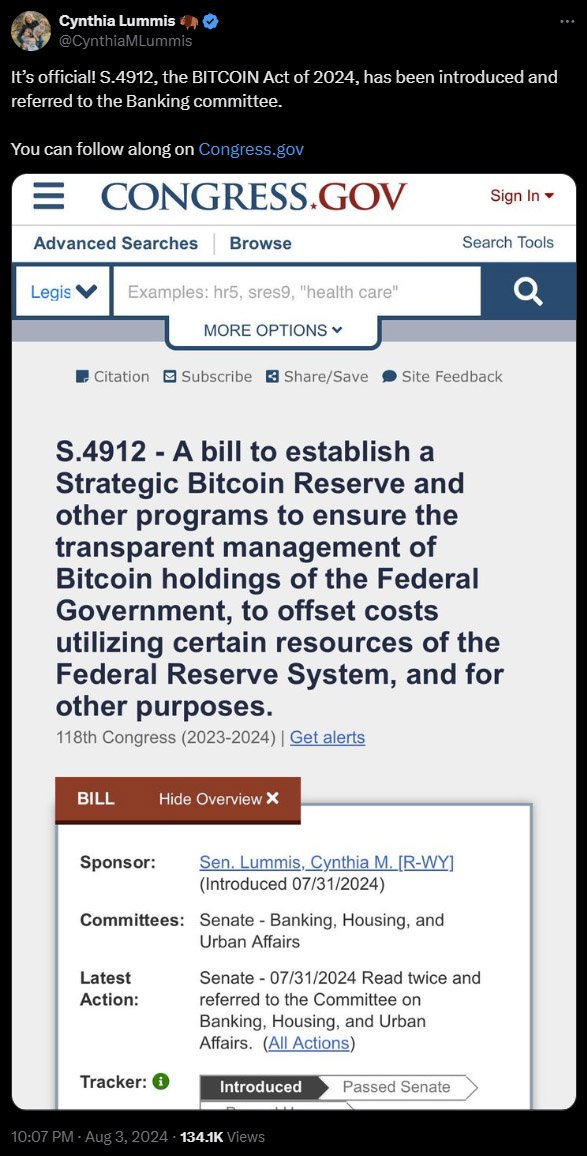

In the latest developments, the bill is now referred to the Senate Banking Committee. Senator Lummis celebrated the progress, stating, “It’s official! S.4912, the BITCOIN Act of 2024, has been introduced and referred to the Banking committee.”

Senator Cynthia Lummis, a known advocate for the Bitcoin industry, introduced the Bitcoin Reserve Bill at the end of July 2024.

The bill proposes that the U.S. government create a reserve of bitcoin, managed by the U.S. Treasury. The goal is to accumulate up to 1 million BTC, which is about 5% of the total bitcoin supply, using existing Treasury funds.

This ambitious plan mirrors the Treasury’s current strategy for gold reserves.

She believes that bitcoin’s value and scarcity could provide a stable financial asset that strengthens the U.S. economy. Creating a strategic reserve of bitcoin would assist future generations in managing increasing inflation rates.

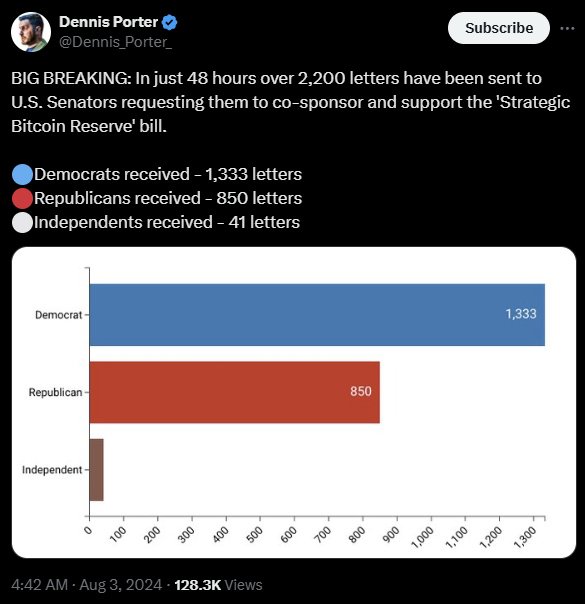

The response from the public has been overwhelmingly positive. In just two days, over 2,200 letters were sent to U.S. senators, urging them to support and co-sponsor the bill. This grassroots initiative highlights a growing bipartisan interest in Bitcoin, transcending traditional political boundaries.

Dennis Porter, CEO and co-founder of the Satoshi Act Fund, played a significant role in mobilizing this support. He stated:

“Over 2,200 letters have been sent to U.S. senators within 48 hours, urging them to co-sponsor and support Lummis’s BTC strategic reserve bill.”

The breakdown of the letters reflects a diverse coalition: Democratic senators received 1,333 letters, Republican senators received 850, and Independent senators received 41.

This widespread support underscores the growing recognition of Bitcoin’s potential strategic value across the political spectrum. Senator Lummis’s proposal has garnered significant bipartisan support, including endorsements from notable figures.

Former President Donald Trump, speaking at the Bitcoin 2024 conference in Nashville, said that he strongly advocates for the U.S. government to hold at least 5% of the world’s bitcoin supply for a minimum of 20 years.

This endorsement aligns with Lummis’s vision of using bitcoin to pay down the national debt and bolster the U.S. dollar.

Independent presidential candidate Robert F. Kennedy Jr. has also expressed support for the initiative, adding to the bill’s bipartisan appeal.

Vice President Kamala Harris, the presumptive Democratic nominee, has also garnered support from leaders in the digital assets sector, a demographic President Joe Biden struggled with.

Related: Could Trump Become a Bitcoin Maximalist?

Lummis drew a historical parallel to emphasize the transformative potential of the bill, stating:

“This is our Louisiana Purchase moment that will help us reach the next financial frontier.”

The proposed legislation aims to bolster the country’s financial reserves with a decentralized, scarce asset. By creating a network of secure bitcoin vaults managed by the U.S. Treasury, the bill ensures strict cybersecurity and physical security measures to safeguard the assets from theft.

This approach not only aims to enhance the country’s economic security but also to solidify Bitcoin’s role as a credible asset class.

Senator Lummis highlighted the urgency of establishing a strategic bitcoin reserve to boost the nation’s financial security.

She underscored the nation’s precarious fiscal situation, noting that the U.S. is now $35 trillion in debt, with a debt-to-GDP ratio approaching 120%. “We can’t go on blindly just printing money 24/7 that has nothing to back it,” she warned.

The potential impact of this bill extends beyond national borders. By adopting bitcoin as a reserve asset, the United States could set a precedent for other nations, encouraging them to consider similar strategies and further legitimizing Bitcoin on the global stage.

Pierre Rochard, VP of Research at Bitcoin miner Riot Platform, noted that a strategic bitcoin reserve could be instrumental in managing national debt.

While the bill has received substantial support, it is not without its challenges. The current regulatory environment for Bitcoin in the U.S. is often criticized for its lack of clarity and its punitive approach.

Senator Lummis emphasized the importance of clear and supportive regulation to foster innovation and ensure consumer protection.

“People want to comply with the law, but if you don’t know what the law is, you’re stabbing in the dark at trying to hit the compliance target,” she explained.

Lummis anticipates significant changes in regulatory agencies under a Trump administration, which she believes would foster an environment conducive to innovation.

The Bitcoin Reserve Bill is now with the Senate Banking Committee for further deliberation. As discussions progress, the bill’s potential to reshape U.S. financial policy and the global Bitcoin landscape becomes increasingly evident.

Senator Lummis remains optimistic about the bill’s prospects. “Bitcoin is transforming not only our country but the world,” she said. “Becoming the first developed nation to use Bitcoin as a savings technology secures our position as a global leader in financial innovation.”

The increasing political and public support for the bill suggests that the conversation around Bitcoin’s role in national economic strategies is far from over.

As the 2024 presidential election approaches, Bitcoin is set to remain a key talking point, with significant implications for the future of U.S. financial policy.