Bitcoin has continued to gain traction as a legitimate form of payment and investment. Its prominence has made it the preferred asset for many businesses and individuals worldwide.

This article explores the current state of Bitcoin adoption, highlighting its increasing acceptance and impact across various sectors.

Bitcoin in Retail and E-commerce

One of the most significant indicators of Bitcoin’s growing adoption is its acceptance by major retailers and e-commerce platforms.

Companies like Shopify and Newegg have long been proponents of Bitcoin, allowing customers to purchase a wide range of products, from furniture to electronics.

Bitcoin in Technology and Services

This acceptance is not limited to online platforms; select Burger King locations and Whole Foods stores have also embraced Bitcoin payments, reflecting a growing trend in the fast-food and grocery industries.

Tech giants such as Microsoft and AT&T have also integrated Bitcoin into their payment systems, allowing users to add funds to their accounts or pay bills using bitcoin.

This move by major technology companies underscores the increasing trust and legitimacy of Bitcoin as a viable payment option.

Bitcoin in Travel and Hospitality

The travel and hospitality industry has also seen significant Bitcoin adoption. Expedia, one of the world’s largest online travel agencies, accepts bitcoin for hotel bookings.

This feature provides a modern and convenient payment method for travelers who prefer using digital currency. The integration of Bitcoin into travel services offers a glimpse into the future of how digital payments can enhance the travel experience.

Another notable instance of bitcoin adoption in the hospitality scene is the Aurora Hotel in Hungary. The 4-star hotel recently announced that it accepts bitcoin payments for all its services, from rooms and drinks to pool and fitness center.

Related: Bitcoin Breaks Ground in Hungary’s Hospitality Scene

Bitcoin in Charitable Donations

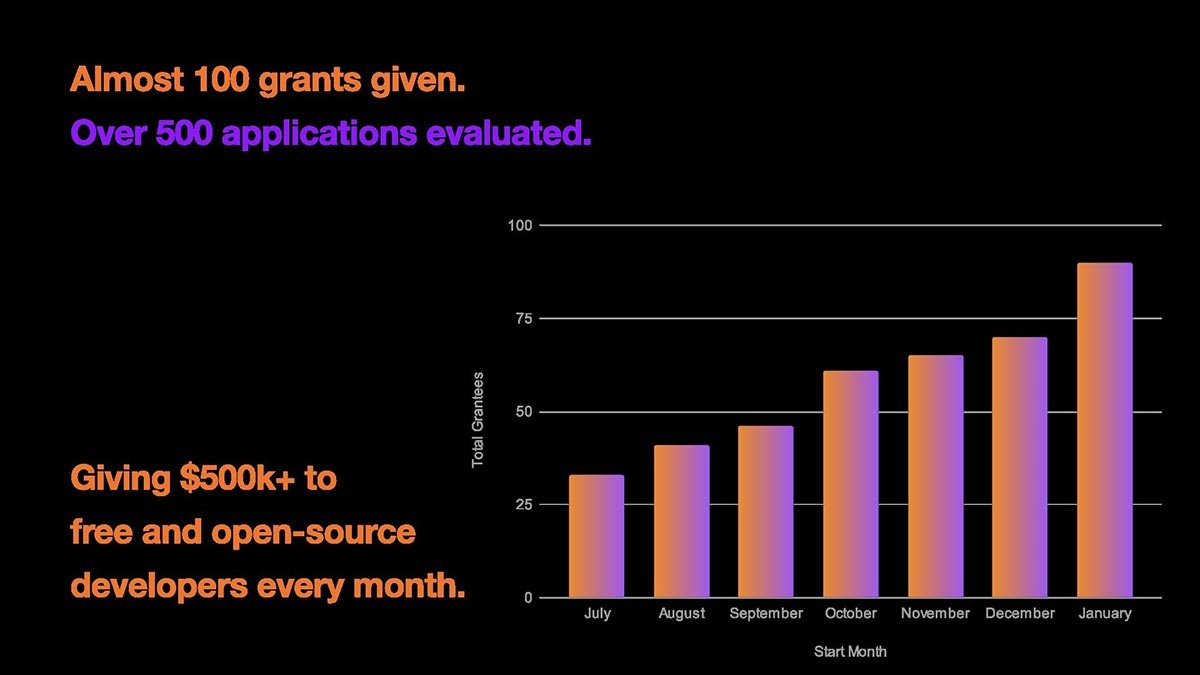

Grants and donations play a crucial role in driving Bitcoin adoption forward. OpenSats is a nonprofit organization dedicated to supporting the development of open-source projects within the Bitcoin ecosystem.

Their mission is to foster innovation and sustainability by providing financial grants and resources to developers, researchers, and educators working on free and open-source software related to Bitcoin.

OpenSats operates with a commitment to transparency and community-driven funding, aiming to advance the infrastructure and adoption of Bitcoin technology.

Another notable instance of Bitcoin being used for donations is the generous contribution from an unknown entity to Julian Assange.

The WikiLeaks founder recently reached an agreement with U.S. officials, resulting in his release. However, his return to Australia on a chartered private jet was very expensive, as he was not permitted to use commercial airlines due to security reasons.

A crowdfunding campaign was launched to cover the $520,000 cost of his return home. In a single transaction, an unknown donor contributed 8 BTC to the cause. This transaction cost only a few cents and was completed instantly.

Using traditional financial institutions, such a transaction would have taken days to process, encountered numerous obstacles, and incurred thousands of dollars in fees.

Bitcoin Adoption by Financial Institutions

In the context of Bitcoin adoption, Bitcoin Exchange-Traded Funds (ETFs) should also be mentioned. These ETFs are investment funds that track the price of bitcoin and are traded on traditional stock exchanges.

They enable investors to gain exposure to bitcoin without directly owning it, providing a regulated and convenient way to invest in the digital asset.

ETFs offer liquidity, simplify the process of including bitcoin in investment portfolios, and enhance market accessibility.

These financial instruments are designed to follow the price movements of bitcoin, offering a more traditional investment vehicle for both individual and institutional investors.

Bitcoin Adoption by Nation-States

In a significant development, some nation-states are also considering adding bitcoin to their treasuries.

Montenegro is exploring innovative financial instruments such as Bitcoin hydro bonds, which would integrate Bitcoin into the nation’s economic framework.

Meanwhile, Dubai continues to position itself as a Bitcoin-friendly destination, with initiatives like the Bitcoin Oasis 2024 aiming to enhance its status as a hub for Bitcoin adoption.

Above these is El Salvador. The south-American nation adopted bitcoin as legal tender in 2021, and has since been actively building a bitcoin reserve. The country is following an initiative to add 1 BTC per day to its balance sheet.

Another notable example is Bhutan. The small Himalayan country has been accumulating bitcoin and is now actively engaged in mining the scarce digital asset.

These moves by nation-states underscore the growing acceptance of Bitcoin at the highest levels of governance and finance.

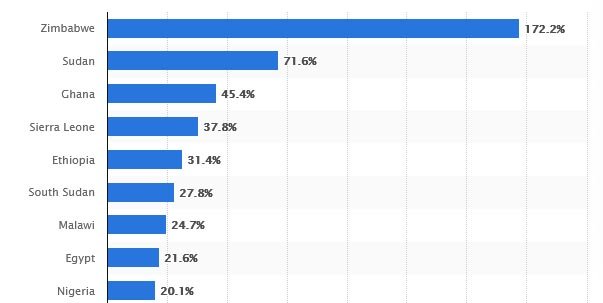

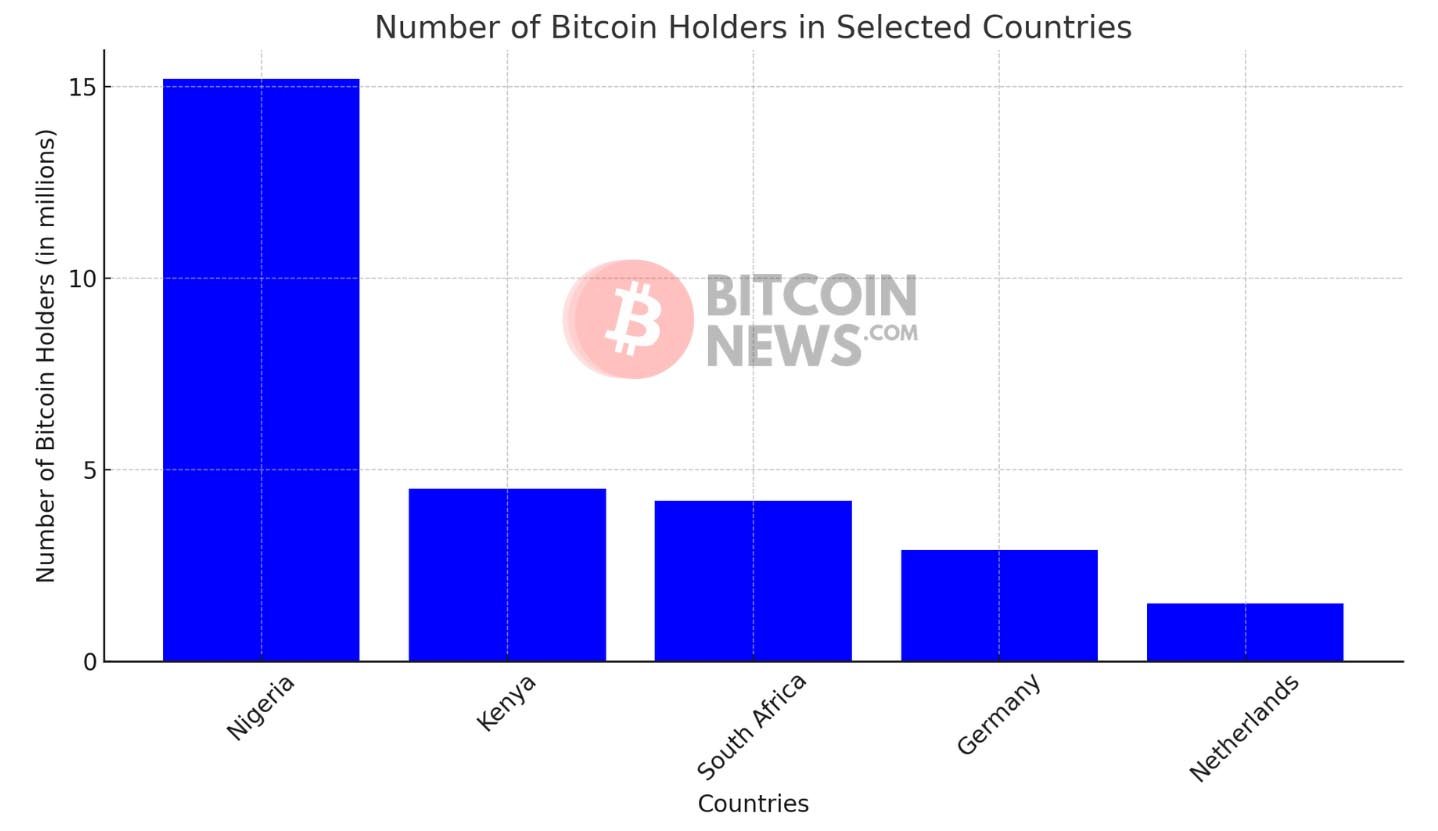

Bitcoin Adoption in Emerging Markets

- Africa: Bitcoin’s popularity is rising in Nigeria, Kenya, and South Africa, promoting the digital asset for financial inclusion and as a hedge against currency instability.

- Europe: Bitcoin adoption is growing in Germany, Switzerland, and the Netherlands due to regulatory support, innovation, and widespread acceptance by businesses.

These regions are leveraging Bitcoin for financial solutions, inclusion, and economic stability.

The Future of Bitcoin Adoption

The adoption of Bitcoin is poised to continue its upward trajectory as more businesses and individuals recognize its benefits.

From providing a decentralized and secure method of payment to offering an alternative investment vehicle, Bitcoin’s influence is growing across various sectors. As regulatory frameworks evolve and technology advances, the integration of Bitcoin into everyday life is becoming more seamless.