Bitcoin ATM installations around the globe have experienced a decline of around 11% from the start of 2023 to January 1, 2024. This significant departure from the previous decade’s trend of consistent annual growth, raises questions about the factors influencing this shift.

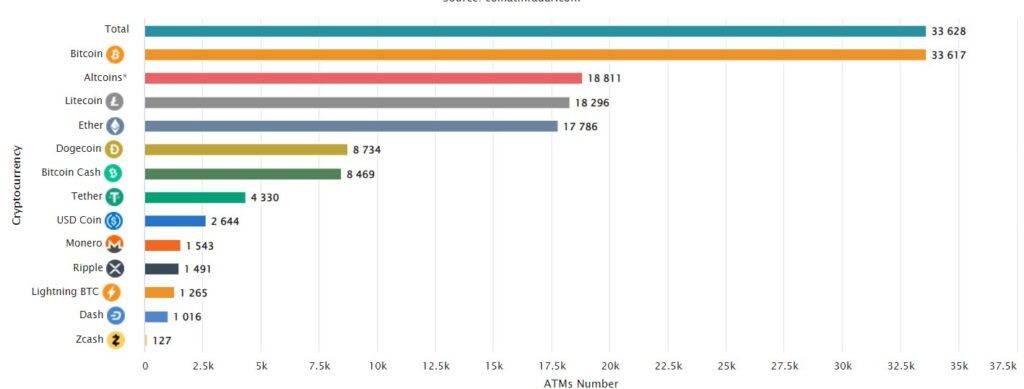

Coin ATM Radar, a reputable source for tracking digital asset ATMs worldwide, reveals that the number of digital asset ATMs as of the start of 2024 is 33,628, down from 37,827 recorded on January 1, 2023.

Bitcoin ATMs: Global Trends and Historical Perspective

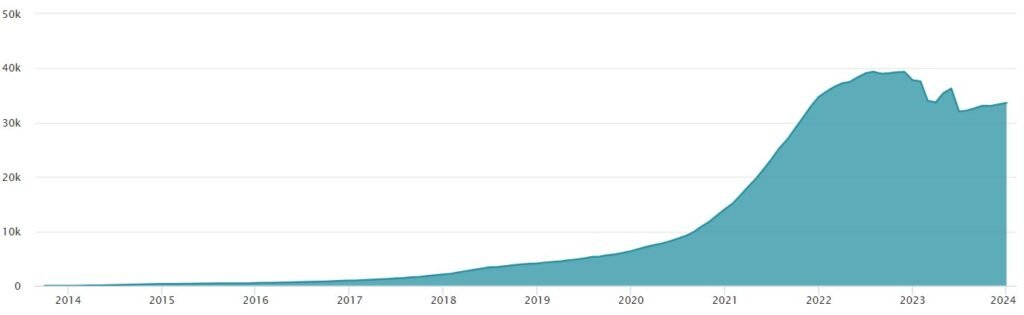

The decline in Bitcoin ATMs marks a departure from the historical pattern of continuous monthly increases since Coin ATM Radar began tracking digital asset ATMs in October 2013. The numbers reached an all-time high of 39,376 in August 2022. However, the trend reversed in 2023, reflecting a mixed pattern of growth and decline throughout the year.

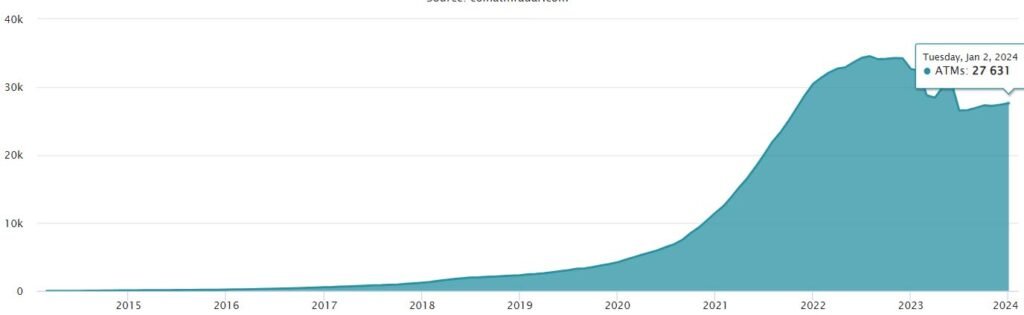

Notably, the United States witnessed the most significant drop in digital asset ATMs during 2023, with a 15.4% decrease from 32,672 to 27,631.

Despite this reduction, the U.S. remains a dominant force, hosting 82% of all bitcoin ATMs worldwide.

Contributing Factors to the Global Decline

Several factors contributed to the decline in Bitcoin ATMs globally. The substantial decrease in the United States played a crucial role, but other countries, such as Australia, Canada, Spain, and Poland, experienced steady growth in their bitcoin ATM installations during the same period.

Related reading: Athena Bitcoin to Bring Lightning Network to ATMs in El Salvador

Additionally, Coin ATM Radar data suggests that the digital asset ATM manufacturer BitAccess may have influenced the decline, with its net installations falling by 26%. Notably, while the company installed 9,160 units in August 2022, it shows a drop to 6,774 units on January 1, 2024.

In contrast, manufacturers General Bytes and Genesis Coin continued to increase the number of Bitcoin ATMs throughout the year.

The overall landscape reveals a total of 498 digital asset ATM operators across 71 countries, as per Coin ATM Radar’s data. It is interesting to note that bitcoin remains the dominant digital asset supported by ATMs, with additional support for tokens such as Bitcoin Cash (BCH), Ether (ETH), and Litecoin (LTC).

Bitcoin Depot’s Resilience

Amidst the decline in global Bitcoin ATM installations, Bitcoin Depot emerges as a standout player in the bitcoin ATM space. The company achieved a significant milestone by becoming a publicly listed entity on the Nasdaq on July 3.

Furthermore, Bitcoin Depot expanded its operations to encompass its 28th state in the U.S. The company reported revenue of $179.5 million in Q3 2023, showcasing a 3% year-on-year increase. The strategic moves by Bitcoin Depot amid industry challenges demonstrate its leadership in the evolving landscape. Brandon Mintz, CEO and Founder of Bitcoin Depot, had commented on his company’s resilience by stating:

“Our results this quarter continue to demonstrate the strength of our business model and how we’re able to deliver strong results irrespective of the market environment or price of Bitcoin.”

The future trajectory of Bitcoin ATMs remains a subject of keen observation, with Bitcoin Depot exemplifying adaptability and growth in the face of industry challenges.