Bitcoin market dominance has trudged over the line, marking over 60% for the first time in over two years, as a continued rally past USD 12,000 is underway.

BitcoinNews.com had reported yesterday that dominance stood at exactly 60% (CoinMarketCap) but in the past 24 hours since, increasing US dollar valuations, coupled with a downward retracement for most of the major altcoins, have ensured that Bitcoin dominance comes into play once more.

These levels were last seen immediately after Bitcoin’s last parabolic run in late 2017 and early 2018. And, similarly, altcoins were the ones to pay for this dominance, with their value dropping far more spectacularly than Bitcoin throughout 2018.

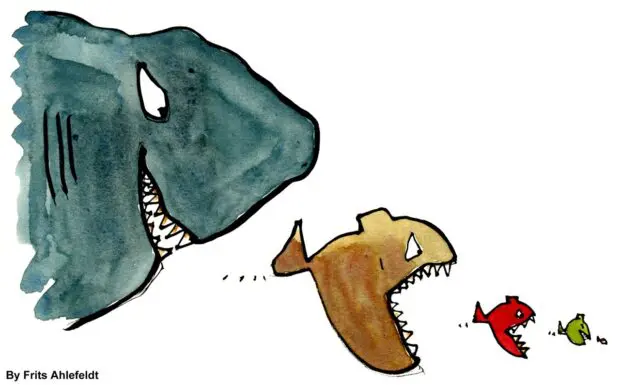

As Bitcoin price also now stands above 60% of its all-time high near USD 20,000, few altcoins have managed to show the same recovery. For example, despite hitting a 2019 high with USD 336, Ether (ETH) is still yet to recover to even 25% of its all-time high above USD 1,400. Others like Ripple (XRP), while enjoying green lines this year, is still at about USD 0.46, a pale 12% of its all-time high at USD 3.84.

Bitcoin market capitalization is now at USD 226 billion, with the total crypto cap at USD 365 billion.

Even with this totals, Bitcoin maximalists are reluctant to trust CoinMarketCap statistics too much, believing the actual number to be much higher. Some think it could be as much as 95%:

That opinion might hold some weight, if data manipulation is rife, although other data analytics sites such as CoinCodex and Cointrader also show the same dominance figures.

For those who have always believed that Bitcoin comes first, this can only spell more good news in the near time to come. Altcoin traders will hope this is only a temporary thing, however, with the much-anticipated alt spring yet to arrive.

Follow BitcoinNews.com on Twitter: @bitcoinnewscom

Telegram Alerts from BitcoinNews.com: https://t.me/bconews