El Salvador, the first country in the world to adopt bitcoin as legal tender, has reached a new high. The Central American country now has over 6,000 bitcoin (BTC) in its coffers, worth around $569 million, making it a global Bitcoin leader.

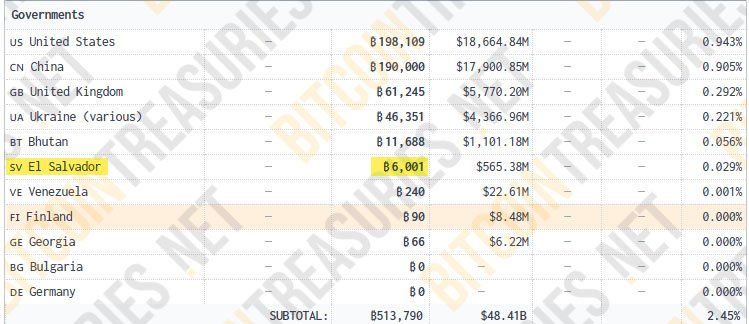

On December 29, 2024 El Salvador bought 1 more bitcoin, which propelled its treasury holdings past the 6,000 BTC mark. It’s now 6th in the world in terms of bitcoin holdings behind the US, China, UK, Ukraine and Bhutan.

According to the National Bitcoin Office’s portfolio tracker, the country gathered its treasury at an average price of $45,450 per coin, that’s a 108% gain since they started in September 2021. They bought their first 200 BTC just before making bitcoin legal tender.

President Nayib Bukele, the man behind El Salvador’s Bitcoin plan, is still a strong believer in the digital asset. In a recent post he said:

“Our country’s Bitcoin reserves are now worth 127% more than we paid for them — an increase of more than $344 million.”

Stacy Herbert, Director of the National Bitcoin Office, hinted they might buy more bitcoin faster.

El Salvador’s plan is simple: they buy 1 bitcoin every day, sometimes more. In December they bought 11 BTC in one transaction, just after they got a $1.4 billion loan from the International Monetary Fund (IMF).

Related: El Salvador To Scale Back Bitcoin Plans in $1.4B Loan Deal with IMF

The country’s Bitcoin experiment hasn’t been without challenges. The IMF approved the loan but asked El Salvador to slow down on the Bitcoin policies. The global financial institution is concerned about the risks of such approach for a developing country.

In response, El Salvador made bitcoin acceptance by businesses voluntary. But they are still committed to their strategy. “Bitcoin continues to be our main strategy,” said a spokesperson for the National Bitcoin Office.

They also announced they will phase out the official Chivo wallet, which was created to facilitate Bitcoin transactions. Private sector wallets will take over and more competition and innovation will be allowed in the digital currency space.

For El Salvador, bitcoin is more than just a treasury asset—it’s a symbol of financial freedom, according to Vice President Félix Ulloa Jr.

The country’s officials said that Bitcoin has brought financial inclusion to many Salvadorans who didn’t have access to traditional banking. Digital wallets are a lifeline for Salvadorans to send and receive money.

Other countries are taking notice. Analysts predict by 2025 more will add bitcoin to their reserves as a hedge against economic uncertainty and a step towards diversification. Texas and Pennsylvania are already looking into this in the US.

El Salvador is a case study for the power of Bitcoin in national economies. While the international organizations like the IMF are cautious, the Bukele administration is willing to take big risks for long term gains.

With bitcoin’s recent rise past $100,000 mark this year, El Salvador’s bet on the scarce digital asset is paying off. Whether other countries will follow is to be seen, but for now El Salvador is the world’s only nation state to adopt Bitcoin.

With 6,000+ BTC in reserves and a growing reputation as a financial innovator, the small Central American country is showing big wins can be achieved with small steps.