El Salvador has agreed with the International Monetary Fund (IMF) for a $1.4 billion loan in exchange for toning down its Bitcoin plans.

This 40 month deal is to “stabilize the economy” and implement financial reforms. But it comes with big changes to the Bitcoin experiment that has been a bold move and a global controversy.

Under the deal, bitcoin acceptance will be voluntary for businesses in El Salvador. Previously, the 2021 Bitcoin Law required businesses to accept bitcoin alongside the US dollar, the official currency.

But that was mandatory, and according to the IMF, raised economic risks and low usage among the population.

IMF said the new measures will “significantly diminish the risks” of Bitcoin. “Legal reforms will make acceptance of bitcoin by the private sector voluntary,” the IMF said.

El Salvador will also phase out its involvement in the state owned Chivo wallet that was launched to facilitate Bitcoin transactions. Despite the initial hype and a $30 bitcoin bonus, the wallet has had technical issues and low long-term usage.

Taxes in El Salvador will still be paid in US dollars only, further reducing Bitcoin’s role in public sector transactions. The government will also limit its involvement in Bitcoin activities, something the IMF sees as key to financial stability.

Related: El Salvador Announces Bitcoin Certification Program for 80,000 Civil Servants

The deal includes a broader package of economic reforms to “improve” El Salvador’s fiscal health. One of the targets is to reduce the debt to GDP ratio that reached 85% in 2024. The reforms aim to improve the primary fiscal balance by 3.5% of GDP over 3 years.

The IMF deal will unlock an additional $3.5 billion in financing from the World Bank and other regional development banks to support the country’s recovery.

El Salvador was the first country in the world to adopt bitcoin as legal tender in 2021, a move championed by President Nayib Bukele as a way to achieve financial independence.

The government also bought a lot of bitcoin. It currently has around 6,000 BTC worth around $600 million.

Despite that, Bitcoin adoption has not been as high as expected.

A recent survey showed that 92% of Salvadorans don’t use Bitcoin for transactions, up from 88% the previous year. Critics say the policy put unnecessary risks to the economy while supporters see it as a long term investment.

The IMF has been critical of El Salvador’s Bitcoin plan for years, citing volatility and macroeconomic risks. In response to those concerns, the IMF suggested scaling back Bitcoin’s legal tender status and not issuing bitcoin backed bonds.

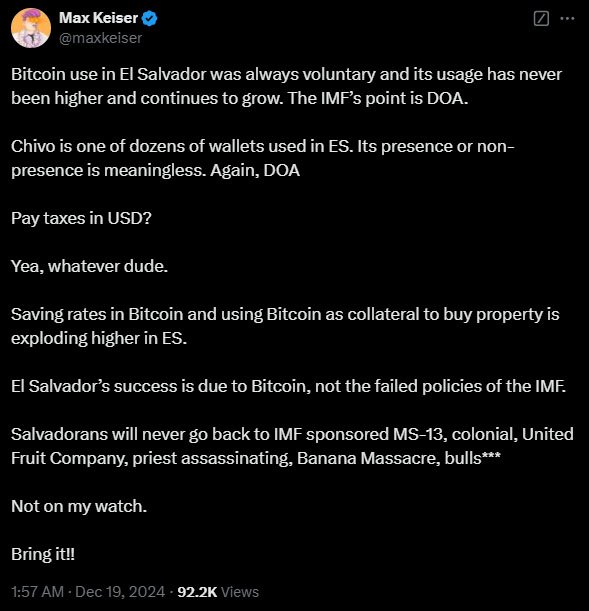

The recent agreement is a compromise and has been met with mixed reactions. Max Keiser, Bitcoin adviser to President Bukele, called the IMF’s stance “bureaucratic nonsense” and said Bitcoin use in El Salvador is voluntary and growing.

The IMF deal is a new chapter in El Salvador’s Bitcoin journey, where the government’s innovation meets stability. Critics are not happy, and see it as a retreat from the bold vision that put El Salvador at the forefront of the bitcoin revolution.

For supporters it’s a way to have stability without giving up on Bitcoin. As the IMF Executive Board is about to approve the deal, El Salvador has to align its internal goals with international expectations.

President Bukele is popular among Salvadorans and will have to walk this tightrope as his government continues to figure out the role of Bitcoin in the country’s future.

El Salvador’s economy is strong and resilient during these changes, with remittances, tourism and security improving. For now, the country’s Bitcoin experiment is ongoing – just smaller and more gradual.