The highly anticipated Bitcoin halving 2024 event finally went through, with the protocol effectively cutting issuance of new bitcoin rewarded to miners to 3.125 BTC per block.

According to mempool.space data, Bitcoin’s 4th halving event was successfully executed by the Bitcoin’s decentralized protocol on 19:09 CT on Friday evening. The first post-halving block was mined by ViaBTC pool, which carried a coinbase reward of 3.125 BTC and a staggering total transaction fee of 37.62 BTC. This precious block netted the miner a jaw dropping 40.75 BTC.

During having events, an intense competition usually forms between mining pools to mine the first block after halving. The winner would get the new coinbase reward, and gets to inscribe a message in this very special block. The block is eyed by miners also because many Bitcoiners want to have a transaction on this block, and are willing to pay hefty fees for it, as evident in the block #840,000. It technically is not different from other blocks after it, but it seems to hold a sentimental value to whoever mines it or has a transaction on it.

Understanding the Halving

The halving, an intrinsic feature of Bitcoin’s design, occurs approximately every 210,000 blocks, marking a reduction in the digital asset’s supply. The 4th halving, which happened on Friday, comes amidst global economic uncertainties and heightened interest in Bitcoin as a safe haven asset and a hedge against rampant inflation.

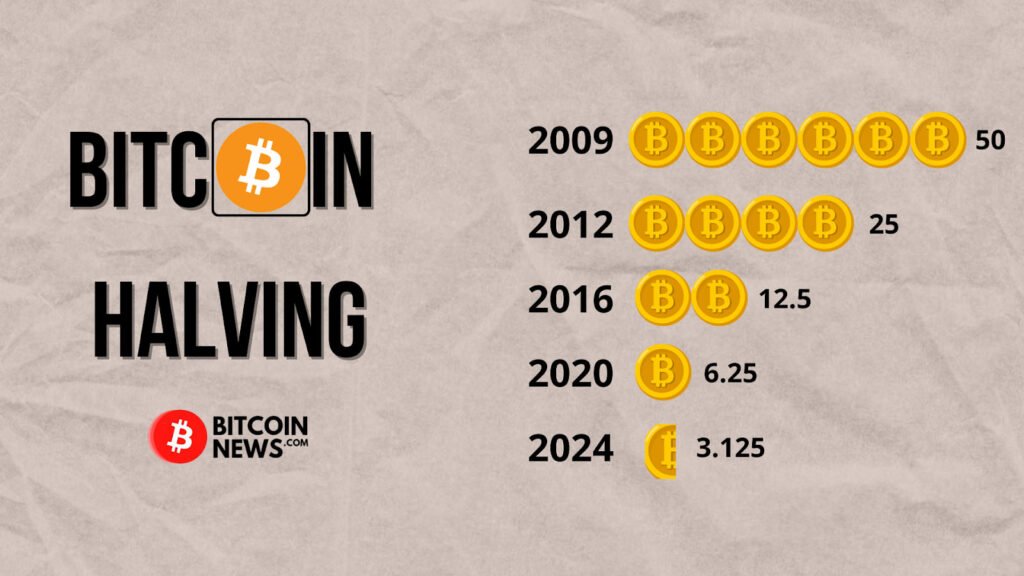

Bitcoin operates on a decentralized network where transactions are verified by a distributed network of computers, or miners. These miners are rewarded with new bitcoin for their validation efforts. With each halving, the reward is reduced by 50%, creating scarcity and potentially driving up the digital asset’s value.

Bitcoin first started with a 50 BTC reward per block, which was cut in half in the first halving in 2012 to 25 BTC. 3rd halving on 2016 reduced the reward to 12.5 BTC, and the next one further slowed down bitcoin production to 6.25 BTC in 2020.

Purpose of the Halving

A fundamental aspect of Bitcoin is its finite supply, capped at 21 million coins. The halving mechanism ensures that this limit is maintained, serving as a hedge against inflationary practices common in traditional financial systems. This fixed supply model is a key argument for Bitcoin’s long-term value preservation.

The halving is often associated with a surge in bitcoin’s price, as the reduction in new supply theoretically increases its scarcity. However, the extent of this price appreciation and its timing are subjects of debate among analysts. While some anticipate a post-halving rally, others argue that market expectations may already be priced in.

Bitcoin Halving 2024: Market Response and Future Outlook

Leading up to the halving, bitcoin’s price has exhibited volatility, influenced by factors such as geopolitical tensions and investor sentiment. Despite fluctuations, historical data suggests that previous halving events have preceded significant price increases, contributing to Bitcoin’s status as a speculative asset.

As the Bitcoin market evolves, factors beyond the halving, such as institutional adoption and regulatory developments, will continue to shape bitcoin’s trajectory. While the halving may serve as a catalyst for price appreciation, broader market dynamics and investor behavior will ultimately determine its long-term viability and acceptance.