Author Foreword

The following article is the first of a three-part series looking at the Nature of Bitcoin in the Isle of Man. After spending three months enjoying the pleasures of the Bitcoin ecosystem in El Salvador for my dissertation research, it is time to take some of what I’ve learned and apply it to the place I call home.

The Bitcoin Island: Introduction

The ever-increasing diffusion of Bitcoin and Lightning solutions, justified by U.S. Bitcoin ETF Rumblings and the expansion of favorable legislation in places like Switzerland, El Salvador, and Dubai to name a few, unfolds itself in a unique way within most economies.

Notably, Bitcoin’s utility is often found by applying the technology to solving problems unique to a particular economy. For instance, in places like Nigeria and El Salvador, Bitcoin, and Lightning’s utility often is claimed to lie in onboarding the unbanked to digital infrastructures and enabling cheaper remittances.

In others, the utility may lie in access to a permissionless network to transfer value, away from corrupt public officials or corporations. However, in larger economies, utility often takes a second role as the purchasers of bitcoin often flock to it as an investment, as opposed to a utility-based use case.

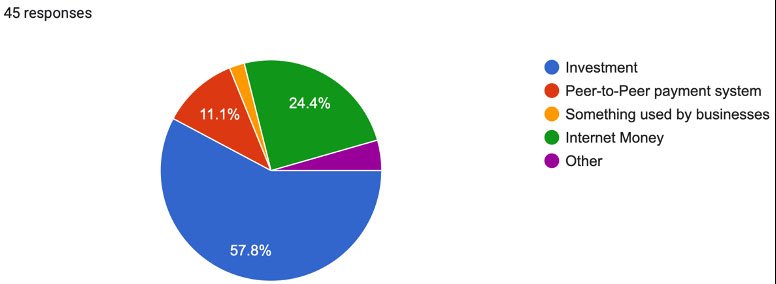

This article is in part backed up by an Isle of Man-based consumer survey, looking at attitudes towards Bitcoin. It revealed that 58% saw Bitcoin as an investment, 24% as internet money, and 11.1% as a peer-to-peer payment system.

What are your existing perceptions of bitcoin?

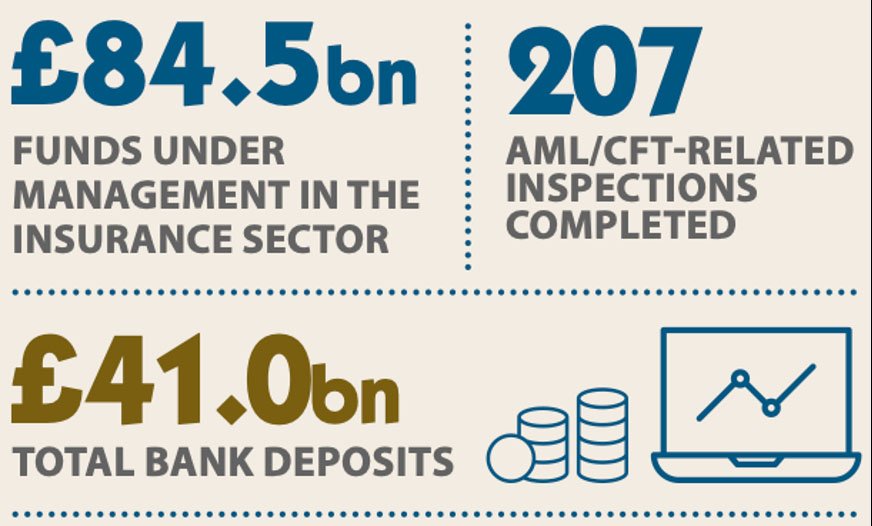

Sandwiched between Ireland and the UK and home to 84,000 residents, the Isle of Man is predominantly oriented as an offshore financial base, with:

-

- over 49% economically inactive (p.17).

-

- A total of £41bn in bank deposits.

-

- 10,000 unique foreign Politically Exposed People (PEPs) scattered amongst industries such as Life Assurance companies (62%), Banking (17.8%), and Fiduciary Services (14.5%) as of 2023 (p.25).

-

- £84.5bn funds under management in the insurance sector (p.14).

The Island has a large population of those aged 65 and over. Despite that, thanks to the push by CoinCorner, a promising homegrown exchange, over 50 merchants accept Bitcoin and Lightning through their solutions.

The number of merchants accepting Bitcoin and Lightning seems large relative to the small population size. This has been a product of the last few years. The narrative behind the Isle of Man being termed ‘Bitcoin Island’ was created as early as 2014/5.

Many articles aim to serve as a testament to the advances the digital currency has made in the Isle of Man. An example is found below this paragraph. However, as an Island native and local Bitcoin enthusiast, taking local market knowledge into account, the question remains to be answered and justified as to whether this is really the Bitcoin Island or not.

There are previous examples of the Bitcoin Island Narrative too:

-

- White, M. S. (2022) Bitcoin Island: The Isle of Man is turning Orange. City AM. Available from: https://www.cityam.com/bitcoin-island-the-isle-of-man-is-turning-orange/

-

- Kleinman, Z. (2015) Bitcoin Island: cleaning up the cryptocurrency. BBC. Available from: https://www.bbc.com/news/business-32394170#

-

- Kahn, J. (2015) Greetings from Bitcoin Island. Bloomberg. Available from: https://www.bloomberg.com/news/features/2015-09-07/isle-of-man-tax-haven-with-tailless-cats-becomes-bitcoin-hub

-

- Barrie, J. (2015) Here’s the Isle of Man’s plan to become a Bitcoin paradise. Business Insider. Available from: https://www.businessinsider.com/the-isle-of-mans-plan-become-bitcoin-fintech-paradise-2015-3

About the Isle of Man

Current Economic Direction and Situation

As previously mentioned, the Isle of Man’s economy is predominantly oriented as an offshore financial base. However, as per central government’s 10-15-year economic strategy, the Island’s future is shifting towards removing the dependency on the dominant E-Gaming and Insurance sectors.

This is in response to identified ‘global headwinds’ (p.18) that occupy the environment. Tynwald, the oldest running continuous parliament in the world, has now shifted its focus to new growth industries:

-

- Diversifying the finance sector

-

- Digital sector development

-

- Medical cannabis development

-

- Developing the tourism sector

Although Bitcoin and Lightning activities are not specifically mentioned in the report, Tynwald’s goal to diversify the finance sector and to develop the digital sector certainly alludes to the possibility that it could be in the future.

Start-Up Ecosystem

One of the most touted advantages the Isle of Man often boasts is the close contact businesses have with regulators and other public agencies. Several sources from the comment requests and beyond gave examples of the advantages phoning or walking into the Isle of Man Financial Services Authority (IOMFSA) brings to their business operations.

Further, the government consistently:

-

- Provides calls to industry.

-

- Provides Grants and funding support schemes.

-

- Urges potential applicants to make early contact with public agencies before formal applications.

-

- Establishes external knowledge challenges such as the yearly innovation challenge.

Drawing on industry experiences, Rick Landman of Infinex Partners shared his observations of the Isle of Man’s start-up ecosystem:

“…during the crypto bull run of late 2019 to 2021, I’ve observed a significant growth in the Fintech sector, particularly in the CVC Blockchain area. This period saw the rise of e-money banks, an influx of crypto on/off ramp solutions, and the emergence of play-to-earn games and metaverses.”

However, comments from Fintech, accounting, and a payments firms, highlighted that despite the consistent growth in finance sectors, there still exists significant barriers for innovation to occur and start-ups to flourish.

Explanations for this range from red tape to an uneducated regulatory system. Bitcoin and Lightning-based companies pursuing a quick-to-market strategy, find regulations behind the scope of what they are trying to regulate. Several jurisdictions such as Dubai, El Salvador, and Estonia have now paved the way to develop and join innovative new regulatory approaches and open standards such as the EU’s MiCA.

Expressing further comment, Rick Landman shares his perspective on the recent move towards open standards and how it may affect the Isle of Man’s start-up ecosystem:

“A key issue is the evolving local licensing regimes, as developments like the EU’s MiCA and similar regulations in the UK and globally have eroded any first-mover advantage. Web3 companies may now opt for European licensing under MiCA, though the Isle of Man retains opportunities for those not targeting Europe or the US”

Who are Digital Isle of Man and What Are Their Activities?

Digital Isle of Man is one of the seven public agencies created under the Isle of Man’s Department for Enterprise. Its primary focus is to provide support for the technology sector to develop the industry. Furthermore, as a public-private partnership enabling the government to support growth and spur innovation, it reflects the interests of both actors.

Overall, the agency is a little behind its three hundred job creation objective for the digital sector, sitting at 240 despite hitting their numbers consecutively the years prior.

However, this touches on a greater narrative at play regarding the Isle of Man’s future economic growth. This pertains to the current skills shortage and lack of talent to fill jobs, with more on this to be discussed in the following sections.

Furthermore, analyzing the agenda for Digital Isle of Man among other public agencies, it is the author’s opinion that little attention is shown toward the potential economic benefits of Bitcoin and Lightning solutions.

This and more will be discussed in the third article focused on recommendations, where comments from a face-to-face meeting with a senior executive at Digital Isle of Man will be released about this subjective claim.

However, whilst attending this year’s Digital Isle of Man conference in November 2023, it is evident that the agency’s focus is shifting towards:

-

- Creating a data foundation structure for high-value and impact personal data under a new data stewardship plan.

-

- Delivering a £397m increase in GDP (7.5%) by 2030 through the plan to become a world-leading AI biosphere nation.

To support this, there have already been over fifty meetings with stakeholders in Singapore, discussing manners of things such as raising capital to realize the economic gains AI may provide.

AI may be leveraged to increase GDP. An example would be Large Language Models (LLM) like Chat GPT, biased towards improving Environmental, Social, and Governance (ESG) activities and practices on the Isle of Man.

Other key focus areas for the Digital Isle of Man agenda are Fintech, Blockchain, E-Gaming, Video Games, and E-Sports. Supporting the implementation of these key outlined areas is an infrastructure plan.

Bitcoin and the Isle of Man

Overview of Trends and Bitcoin Environment

Overall, the trends within the Isle of Man’s Bitcoin, Lightning, and Fintech sector are reflective of the overall trends globally. This is a slowdown of investment that is instead being funneled towards AI start-ups.

Despite eighty new Fintech jobs in 2023 so far, and ten new designated business registrations necessary for CVC activity, only four new IOMFSA licenses have been granted. This is perhaps reflected within Lyle Wrexall’s opening speech at the Digital Isle of Man conference.

“We had some really big opportunities in our pipeline which didn’t end up working”

– Lyle Wrexall, Chief Executive Digital Isle of Man at this year’s Digital Isle of Man conference

Focusing more on Bitcoin and Lightning specifically, the environment in the Isle of Man saw renewed enthusiasm in 2023, with a three-day education-orientated event being organized by local Bitcoiner Mark Chapman and the increase in the number of merchants accepting Bitcoin and Lightning payment options.

During the author’s experience of individually speaking to one hundred businesses in 2022, discussing topics such as the Bitcoin environment in the Isle of Man, one of the main conclusions drawn was that often consumers hold the bargaining power in demanding payment options.

This is perhaps why most businesses that accept bitcoin and Lightning in the Isle of Man reported a low volume of usage by consumers. By extension, it is not unlikely to assume that the real kick-starter to increased usage on the Island will be when bitcoin hits all-time highs, as with most other jurisdictions.

Interestingly, it has been disclosed that a Bitcoin community was established in 2014 but has since become a more closed affair. It suggests that the optimism resulting from steady Bitcoin prices increases over the last few months, may cause a more formal and open Bitcoin community being formalized in due course on the Island.

Several replies to the comment requests suggested that participants do see a formal Bitcoin community, similar to Bitcoin Beach and My First Bitcoin in El Salvador, working on the Isle of Man.

Trends in the Bitcoin and CVC Payments and Attitudes

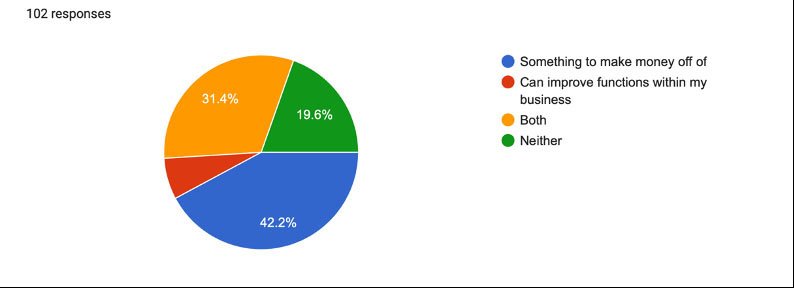

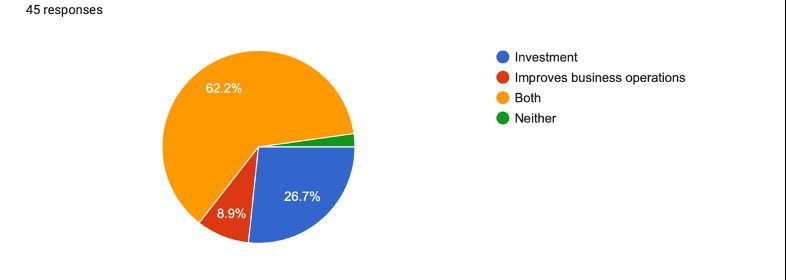

Comparing the results of a self-collected 2022 survey involving over 100 consumers in the Isle of Man to a 2023 self-collected consumer survey suggests that within the last year, there has been a change in attitudes, but still similar levels of ownership exist.

Despite the relative difference in sample size, it seems more people in the Isle of Man are aware of the utility beyond profit motivations provided by Bitcoin and other digital assets a year on (see figures below).

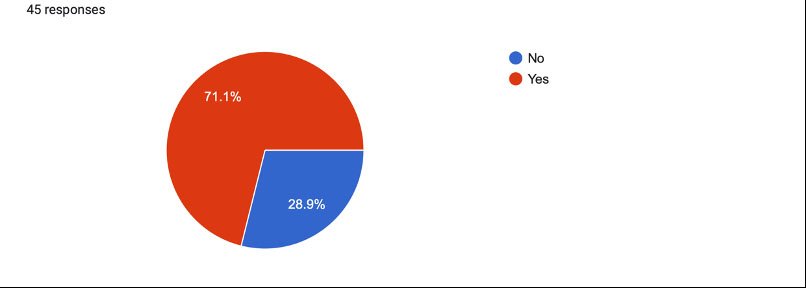

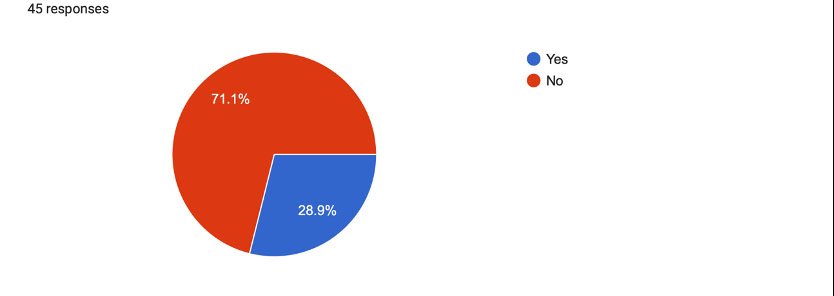

This comes as only 28.9% of respondents were aware of what the Lightning Network is in the 2023 survey, falling in line with the consistently highlighted trend by many retailers, regarding low volume in payments.

Do you think of digital assets as simply a way to make money or something that can be used to improve business functions? (2022)

Do you think of digital asset as simply a way to make money or something that can be used to improve business functions? (2023)

Brief Overview of the Regulatory Environment Towards Bitcoin in the Isle of Man

Like all companies in the Isle of Man, Bitcoin and Lightning-focused businesses can benefit from 0% corporation tax and 0% capital gains tax. However, to not lose the precious approval of the Financial Action Task Force, strong AML and CFT requirements remain in place.

These requirements are needed before registering as a designated business and undertaking any activities, as per the Designated Business Act (Registration and Oversight) of 2015. This and more can be found in the Isle of Man Digital Business Act 2021, which will be discussed in greater detail through the second article focused on regulation.

More specifically, Bitcoin falls under the definitions of Convertible Virtual Currencies (CVCs) as shown in the quote below. However, in terms of bitcoin itself, it is not deemed a security, instead it’s more akin to property.

Instead of requiring a financial services license, CVC firms must maintain strict adherence to the aforementioned Designated Business Act 2015 AML/CFT requirements.

For merchants in the Isle of Man that accept or receive bitcoin and Lightning payments, no separate registration for a designated business or any special license is needed.

“may be converted into a fiat currency, either directly, or through an exchange. For a CVC to be convertible, there does not need to be set value or rate, nor an established benchmark, merely that the ownership rights can be transferred from one person to another, whether or not they are exchanged for money, another token or something else entirely.”

– IOMFSA definition of CVCs (Source)

Digital Asset Exchanges in the Isle of Man

Bittylicious

Incorporated in 2020, Bittylicious is a cryptocurrency exchange business in the Isle of Man. An old favorite amongst several Britcoiners, it offers services similar to an earlier UK business, which is now dormant. What the website lacks in comparison to other more developed user interfaces of the likes of Coinbase, it makes up for in simplicity and ease of use.

CoinCorner

CoinCorner was founded in 2014 to deliver simple access bitcoin to services in a safe and friendly manner for consumers and merchants in the UK. Unlike many FinTechs, CoinCorner has stayed away from the lure of institutional money, enabling them to retain the image of a promising homegrown Isle of Man company.

Looking at some of the firm’s global operations, on Oct 12, 2022, El Salvador residents were also granted access to Coin Corner’s products and services, in a step by the company to leverage their specialties in the only economy where bitcoin is legal tender.

However, expansion has not stopped there. Already operating in 45 countries, CoinCorner has also expanded out into the emerging Fintech hotbed of Dubai, through a joint venture partnership with the Royal Family.

On the What Bitcoin Did Today podcast episode in December 2022, CEO and Founder Daniel Scott suggested that their focus in part may be directed towards the high number of remittances flowing outward, due to the high concentration of migrant workers in the UAE.

Consumer Use and Attitudes Towards Bitcoin and Lightning

Exploring the results from a consumer survey spanning from mid-November till mid-December, 93.3% of the 45 respondents were between 18-26 years old.

-

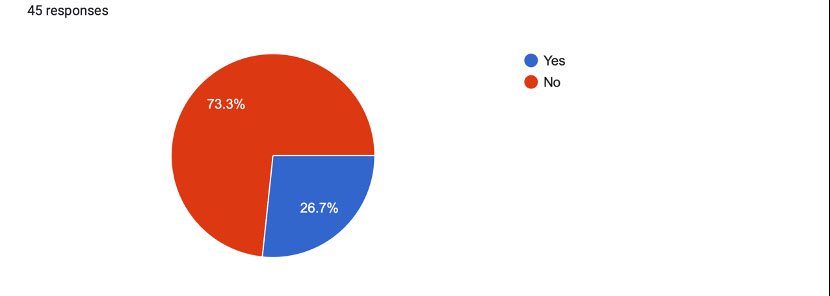

- 26.7% of those surveyed owned bitcoin.

-

- When asked about perceptions of Bitcoin:

-

- 58% used Bitcoin as an investment.

-

- 24% believed it’s Internet Money.

-

- 11.1% believed it’s a peer-to-peer payment system.

-

- When asked about perceptions of Bitcoin:

-

- 77.8% had no idea of the Isle of Man’s legal stance on Bitcoin.

-

- 71.1% said they don’t know what the Lightning Network is.

-

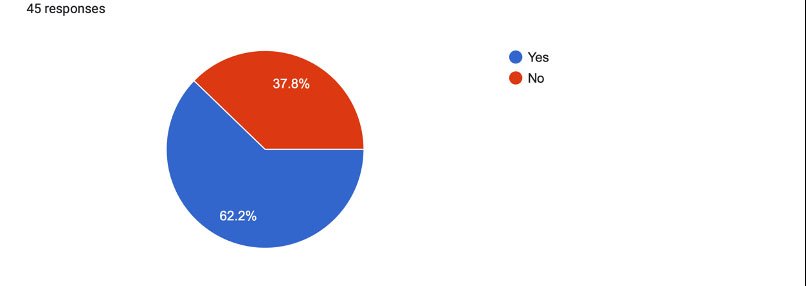

- 55.6% said they would pay in bitcoin if more businesses allowed them to.

-

- 71.1% said they would want bitcoin to be legal tender in the Isle of Man.

-

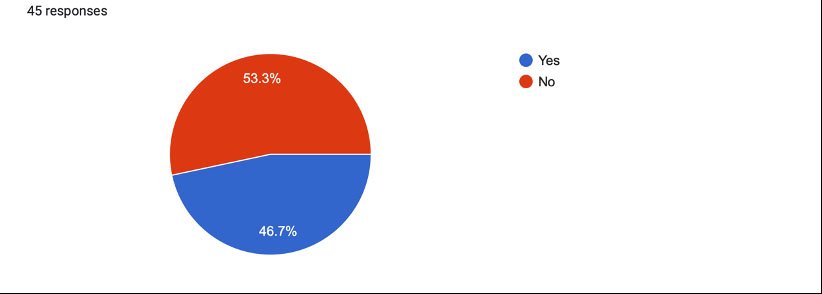

- 53.3% saw no benefit to paying in bitcoin.

The results present some interesting facts. For instance, a comparison to the UK data for ownership shows the Isle of Man’s figures are 6% higher (26.7%) than the 20% average.

Would you want Bitcoin to be legal tender in the Isle of Man?

Would you want your bank to start offering digital asset services?

Do you think there are any benefits to you personally paying with bitcoin?

Do you currently own any bitcoin?

Do you know what the Lightning Network is?

Furthermore, evidence is found for the point made at the start of the article about how bitcoin use cases reflect the unique problems faced by individual economies.

With 58% seeing bitcoin as an investment in the survey and 53.3% seeing no advantage to paying in bitcoin, it may reflect in part the excess disposable incomes Isle of Man residents have, compared to other parts of the world.

Boasting a Gross Domestic Product Per Capita of $79,530 as of 2020, it can be suggested that due to the key digital infrastructure and systems already in place in the Isle of Man, consumers flock to it as an investment opportunity more so than a utility-based use case.

As for what this means overall for Bitcoin, it serves to highlight its multi-dimensionality and multi-functionality.

Purchasing bitcoin in the hopes of profit suggests it is more akin to a new asset class, however, sending payment across the Lightning Network inspires notions of an international payment network.

However, to do this, accounts or wallets are needed, highlighting its ability to affect financial incumbents such as banks. Bitcoin arguably facilitates all these functions simultaneously and more.

Challenges to More Consumer Use

A disenchanting cycle can often be found within the Isle of Man Bitcoin environment. Despite not being a factor unique to the Isle of Man, merchants forget to charge their Bitcoin/Lightning-enabled POS devices due to the low volume of bitcoin transactions, creating a cycle.

For instance, if consumers walk into merchants’ store and willingly want to spend their sats, consumer behavior then becomes discouraged by the negative reinforcement received by out-of-charge machines and cashiers who aren’t equipped to create a Lightning invoice.

However, it is also important not to forget that this is not only a one-way street. The cause of merchant’s out-of-charge machines often is the result of a low volume of inbound lightning payments. This systemic issue is addressed in article three, which will be released in the coming weeks.

Merchant Use and Attitudes Towards Bitcoin and Lightning

As mentioned in the introduction, there are over 50 merchants that accept Bitcoin and Lightning in the Isle of Man, with almost all of these using CoinCorner’s payment solutions.

Speaking with three merchants who accept Lightning and Bitcoin in the Isle of Man, they revealed they receive around 1-7 payments per month in bitcoin.

This justifies in part the previous comments surrounding the low volume of Lightning payments characterizing the Isle of Man’s environment. Reflecting on this, it is evident that the push for bitcoin and Lightning diffusion is predominantly being driven by merchants and private enterprises.

Linking this to the remarks made previously, the fact that Bitcoin, amongst its largest core user base in the Isle of Man, is viewed as an investment (58%), may somewhat explain why this has occurred.

Challenges to More Merchant Use

One could often proclaim apprehension towards accepting Bitcoin and Lightning, tying it to bitcoin’s volatility. As the observation at the start suggests, Bitcoin’s utility often lies in its application as a solution to unique problems in an economy. Merchant practices towards handling bitcoin’s volatility can reflect unique factors making up an economy.

In a recent recorded interview with a local food merchant, the debate touched on how they mitigate the issue of volatility. It turns out that the deciding factor is the difference in how people view their acquired bitcoin. A merchant told the author that they simply keep all bitcoin purchases in bitcoin, therefore, riding the volatility, with the assumption that bitcoin price will continue to increase.

However, in places like El Salvador, the situation has been different. Research by the National Bureau of Economic Research shows that in El Salvador, out of the around 20% of businesses that accept bitcoin, 88% of these reported that they convert it instantly to USD to mitigate volatility.

Further studies on bitcoin adoption in the Isle of Man market landscape, highlight the biggest challenges faced when trying to onboard merchants to Lightning and bitcoin payment options: The cliché narrative that ‘only criminals use bitcoin’ remains the main obstacle, along with competitive worries for the Lightning Network, and existing poor wallet user interfaces.

Martin Aram CEO of MXT, an Isle of Man Blockchain company, had this to say on the matter:

“The general UI/UX of all wallets to make a payment is still very poor, compared to traditional forms of payment, but this is an issue of the Web3/crypto industry, not the Isle of Man. Lack of education to the general public, press articles about criminals using bitcoin, the barriers of getting bitcoin, the even bigger barrier of keeping your bitcoin safe and securing your keys/phrases”

Adding to the discussion on this, Rick Landman retained a similar position when asked about challenges that still exist in the widespread adoption of the Lightning Network:

“The technical complexities and the need for managing channel balances in the Lightning Network present significant obstacles. Additionally, the network grapples with capacity and routing issues. Security concerns such as funds locking, channel management, and routing attacks also pose risks. Moreover, the development ecosystem for alternative networks is larger and growing faster than that of the Lightning Network, raising concerns about potential network abandonment or a lack of skilled developers for its future development and maintenance.”

Long-Term Prospects and Predictions for Lightning and Bitcoin in the Isle of Man

Throughout the articles, outbound comment requests contained a section dedicated to asking respondents to highlight the benefits businesses can take advantage of by being based in the Isle of Man. The consistently highlighted item was the small, stable, easy, and supportive nature of the Isle of Man’s regulations and business environment.

However, it now seems that the Isle of Man has lost its previous ‘fast follower’ stance, with little to no moves seen by Tynwald regarding adopting open standards such as MiCA.

Consequently, when many within the industry were asked about the excitement for bitcoin and the Island’s CVC environment, a consistent answer was that no such excitement exist.

“I’m not sure there is much excitement for bitcoin on Island. We need more education and use cases before consumers use it.”

Comments from a Payments Company

“I am not personally aware of this. If there is, this will be due to international press and general publicity about bitcoin”

Comments from a Fintech Company

Nevertheless, during the recent Digital Isle of Man conference in November, the author posed a question on the online question board. The query revolved around whether the legal status of bitcoin as a form of tender would be a subject of consideration.

Initially, the Chair for Finance Isle of Man responded with a seemingly definitive “no,” citing the absence of a central authority figure as a limiting factor. However, this stance was challenged by Kurt Roosen, Head of Innovation for Digital Isle of Man, who not only opposed the idea but also emphasized, “…those are the types of conversations we have to have going forward.”

Presenting a brief conclusion on this, the Isle of Man needs to react quickly to a developing global regulatory environment and institutional demand for Bitcoin, with Lightning Network featuring as a scalability solution to the increased on-chain network activity. This and more will be discussed in far more detail in the third article that looks at recommendations.

Potential Benefits and Challenges for the Isle of Man’s Economy

At this point, many may be wondering, why any of this matters. Why should the Isle of Man bother trying to utilize and leverage Bitcoin and the Lightning Network’s capabilities?

The answer lies in the foundations that make up the Isle of Man, which means leveraging its unique characteristics to combat its unique problem.

A small-scale retail economy with friendly regulations afforded by the Blockchain regulatory Sandbox, through registration with Digital Isle of Man’s Blockchain office, can form the perfect opportunity for firms in the developmental phase and beyond to test their Bitcoin, Lightning, and digital asset offerings.

However, before this benefit can be leveraged, the Island needs to significantly develop its knowledge base accordingly. Attracting and incentivizing highly regarded knowledgeable stakeholders in the space is key to mitigating existing worries surrounding a lack of talent and skills to fill key jobs, enabling growth for the economy.

By attracting and incentivizing these knowledge bases, the Isle of Man can create a positive feedback loop, where the knowledge base can attract other businesses and individuals to relocate to the Island and innovate.

In addition, the graduate environment in the Isle of Man is one often characterized by Islanders leaving for the bright lights of larger cities in the United Kingdom.

By providing world-leading and accredited education in related studies such as Financial Technology, the Island could provide the ideal ground for students from all over the world to safely enjoy their university years in the British Isle’s safest place.

This is also proposed by KPMG in their 10–15-year central government strategy proposal. However, being an Islander, a constant criticism relates to the Government’s lack of timeliness in projects.

If the development of KPMG’s proposal is slow in execution, it is likely that the Isle of Man will lose out in delivering the economic gains it seeks in years to come.

Conclusion

In summary, the Isle of Man needs to begin to lead the charge in some way. The Lightning and Bitcoin environment in the Isle of Man, despite having the correct infrastructure in place for a burgeoning industry, hasn’t felt the same enthusiasm and drive from the top down it had back in 2014 and 2015.

A half-in-half-out strategy rarely works, especially when considering the changes the Isle of Man intends to make going forward for its economic trajectory and growth. Consequently, the Isle of Man government should seek to capitalize on the renewed enthusiasm for digital assets globally, and expand the ‘Bitcoin Island’ narrative highlighted at the start of the articles.

FAQ

Why is the Isle of Man referred to as the Bitcoin Island?

The term Bitcoin Island was coined in 2014/2015 to describe the Isle of Man's efforts to embrace and promote Bitcoin and Lightning technologies. This article explores whether the island lives up to this title based on current market conditions.

What are some unique characteristics of the Isle of Man's economy conditions?

The Isle of Man is predominantly oriented as an offshore financial base with a focus on industries like E-Gaming and Insurance. It has a population of 84,000 residents and a significant percentage of economically inactive individuals.

How does the Isle of Man government aim to diversify its economy, and what are the identified growth industries?

The government aims to diversify the finance sector, develop the digital sector, explore medical cannabis development, and boost the tourism sector as identified in its 10-15 year economic strategy.

What is the current state of the Fintech sector in the Isle of Man?

The Isle of Man's start-up ecosystem, particularly in the Fintech sector, has experienced growth, with a focus on areas like CVC Blockchain. However, there are challenges such as regulatory complexities and barriers to innovation.

Who is Digital Isle of Man, and what is its role in supporting the technology sector?

Digital Isle of Man is one of the public agencies created under the Isle of Man’s Department for Enterprise. It focuses on supporting the technology sector and facilitating a partnership between the government and private entities.

How is Bitcoin and Lightning adoption portrayed in the Isle of Man?

While there is increased enthusiasm in 2023, the adoption of Bitcoin and Lightning faces challenges. Merchants report low transaction volumes, and consumers have limited awareness of the Lightning Network. Challenges include volatility concerns and poor wallet interfaces.

What are the regulatory conditions for Bitcoin and Lightning-focused businesses on the Isle of Man?

Bitcoin and Lightning-focused businesses on the Isle of Man benefit from 0% corporation tax and 0% capital gains tax. However, they must adhere to strong AML and CFT requirements under the Designated Business Act (Registration and Oversight) of 2015.

Which digital asset exchanges operate in the Isle of Man?

Bittylicious and CoinCorner are digital asset exchanges in the Isle of Man. CoinCorner, founded in 2014, distinguishes itself by focusing on simplicity and accessibility. It operates globally and has expanded into Dubai through a joint venture partnership.

d