In the ever-evolving world of finance, Bitcoin continues to reign supreme. But what’s driving its dominance? According to recent reports, it’s not just about being digital gold anymore; it’s about expanding its utility through Layer 2 solutions.

Bybit, a digital assets trading and research platform, recently released a report, analyzing the effects of layer 2 solutions on Bitcoin’s adoption. Bybit’s report states that Bitcoin Layer 2 solutions are expanding Bitcoin’s utility beyond its status as a reserve asset and digital gold.

Bitcoin’s constant place at the top of the digital assets charts has been nothing short of remarkable. Since late 2023, its market dominance has soared, surpassing the 50% mark by May 2024.

This surge can largely be attributed to the approval of Bitcoin Spot exchange-traded funds (ETFs) in the US, which has fueled increased trading volume and investor interest.

Importance of Layer 2 Solutions

As Bitcoin gains momentum, so too does the demand for solutions to enhance its scalability and functionality.

This is where Layer 2 comes into play. Layer 2 refers to networks closely linked with Bitcoin, designed to improve its scalability, reduce transaction costs, and introduce programmability. These networks operate separately but connect to Bitcoin mainchain through bridges or other solutions.

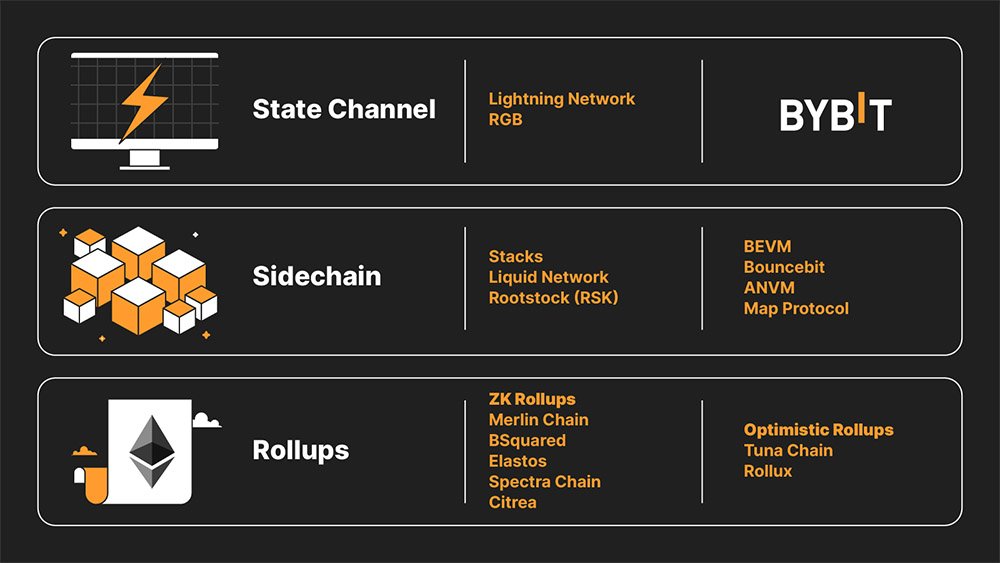

The report highlights that Bitcoin Layer 2 solutions come in various forms, each offering its unique benefits and challenges. It breaks them down into three main categories:

- State Channels: These offer faster transactions and reduced fees through separate channels between parties. However, they have limitations such as limited capacity and lack of smart contract capability.

- Sidechains: These are independent networks with their own consensus algorithms, bridging with the main network. While established players like Stacks and Rootstock lead the way, newcomers like AILayer are gaining traction with innovative features like AI integration.

- Rollups: These enhance transaction processing by batching transactions off-chain. Optimistic and zero-knowledge rollups are notable, with projects like Merlin Chain leading the way in ZK-rollups technology.

With Bitcoin’s outperformance and popularity driving the development of Layer 2 solutions, the landscape is poised for exponential growth. According to Bybit’s report, Bitcoin Layer 2 blockchains are set to boom as Bitcoin continues to outperform other major “cryptocurrencies” in 2024.

Bybit’s report highlights the increasing momentum of Layer 2 solutions, citing new innovations and heightened security measures.

This growth has catalyzed the development of Bitcoin Layer 2 solutions, designed to enhance scalability, reduce transaction costs, and introduce programmability to the Bitcoin network.

While Bitcoin Layer 2 solutions hold immense potential, they are not without challenges. Security vulnerabilities, interoperability issues, and counterparty risks pose significant hurdles. However, advancements in technology, such as ZK-rollups, offer opportunities for growth and innovation.

Bybit points out that despite these challenges, Layer 2 solutions are poised to become the dominant technology in the long term. Rollups, in particular, are seen as more advanced and efficient, offering better scalability and security compared to other solutions.

Bybit’s report noted:

“Rollups are seen as more advanced and are likely to dominate Bitcoin Layer 2 in the long term.

As Bitcoin continues to gain attention, the future of Layer 2 solutions looks promising. With a vibrant ecosystem of projects and increasing community interest, Bitcoin Layer 2 is expanding the utility of BTC beyond its status as digital gold.

Bybit’s report expressed that “All in all, Bitcoin’s Layer 2 solutions still have room to grow, and need to battle-test their applications because of their short operation history.”