Michael Saylor, the chairman of MicroStrategy, has been vocal about the integration of bitcoin into pension funds, stating that it is not just speculative musings but is rapidly turning into reality, reshaping the investment strategies of major institutional players.

Saylor’s foresight into the future of bitcoin within pension funds’ portfolios has been echoed by various analysts and financial reports, signaling a shift in how these investment funds manage their allocations.

According to Saylor, bitcoin’s integration into pension fund portfolios is not just a possibility but an inevitability.

Saylor emphasized the potential benefits of incorporating the digital asset into traditional investment strategies, highlighting that Bitcoin is viewed as a safeguard against inflation and an investment opportunity with the potential for significant growth.

“There are thousands of pension funds in the United States that manage approximately $27 trillion in assets. They will all need Bitcoin,” Saylor emphasized, highlighting the widespread need for Bitcoin adoption among institutional investors.

Recent developments have lent credence to Saylor’s assertions.

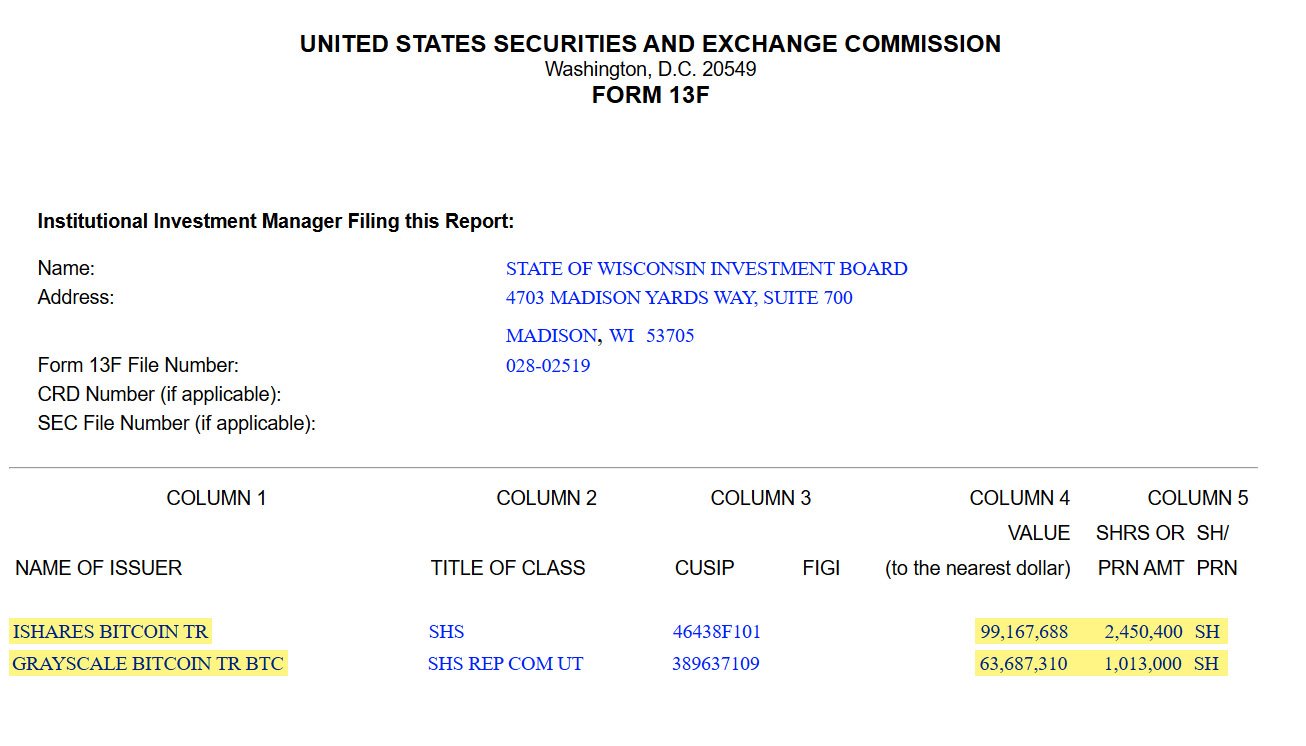

The State of Wisconsin Investment Board (SWIB), managing the state’s public pensions, disclosed a groundbreaking $162.8 million investment in Bitcoin ETF.

This investment includes 2,450,400 shares of BlackRock’s Bitcoin ETF (IBIT) worth over $99 million and 1,013,000 shares of Grayscale’s Bitcoin ETF (GBTC) worth $63.6 million.

This move is considered a pivotal moment in institutional adoption, potentially paving the way for other pension funds to follow suit.

Eric Balchunas, a senior ETF analyst at Bloomberg, sees SWIB’s investment as a game-changer. SWIB’s decision to invest holds notable weight, especially considering pension funds’ historical aversion to risk. This underscores a broader trend of rising institutional confidence in Bitcoin.

Balchunas said:

“Wow, a state pension bought $IBIT in first quarter. Normally you don’t get these big fish institutions in the 13Fs for a year or so […] Good sign, expect more, as institutions tend to move in herds.”

This sentiment echoes Robert Mitchnick of BlackRock, who revealed that large institutional investors, including pension funds, are conducting thorough due diligence before considering Bitcoin investments.

The momentum towards bitcoin integration is palpable, with several major firms already disclosing their holdings in Bitcoin ETFs.

Names like JPMorgan, Edmond de Rothschild (Suisse), Wells Fargo, and Susquehanna International Group (SIG) have joined the ranks, signaling a broader acceptance of digital assets within traditional investment portfolios.

Saylor attributes this shift to Bitcoin’s dual role as a hedge against inflation and a high-growth investment. With pension funds managing over $27 trillion in assets collectively, their potential impact of bitcoin integration cannot be overstated.

The appeal of Bitcoin extends beyond its potential for growth; it represents a strategic move towards embracing digital disruption and innovation. Saylor believes that pension funds risk being left behind if they ignore the transformative potential of Bitcoin in the digital age.

While the idea of pension funds embracing Bitcoin may have seemed ambitious in the past, recent developments paint a different picture. Involvement of American pension funds with bitcoin has only begun, with the first institutional steps materializing into substantial investments.