Three weeks after its much-anticipated launch, the Bitcoin Runes protocol, a novel addition to the Bitcoin blockchain, is experiencing a notable decline in activity.

Initially hailed as a groundbreaking innovation, Runes generated a staggering $135 million in transaction fees within its first week, setting records and sparking excitement among investors.

However, recent data indicates a significant slowdown in user engagement and transaction volumes, raising questions about the protocol’s future trajectory.

Rise of Bitcoin Runes

The Runes protocol made its debut on April 19, coinciding with Bitcoin’s latest halving event, and immediately made waves in the Bitcoin world.

Its launch triggered a frenzy of activity, with investors eagerly participating and driving up transaction fees for Bitcoin miners. According to reports, Runes-related transactions dominated the Bitcoin network, claiming the majority of transactions in the days following its launch.

However, the initial excitement surrounding Runes seems to have waned in the weeks that followed.

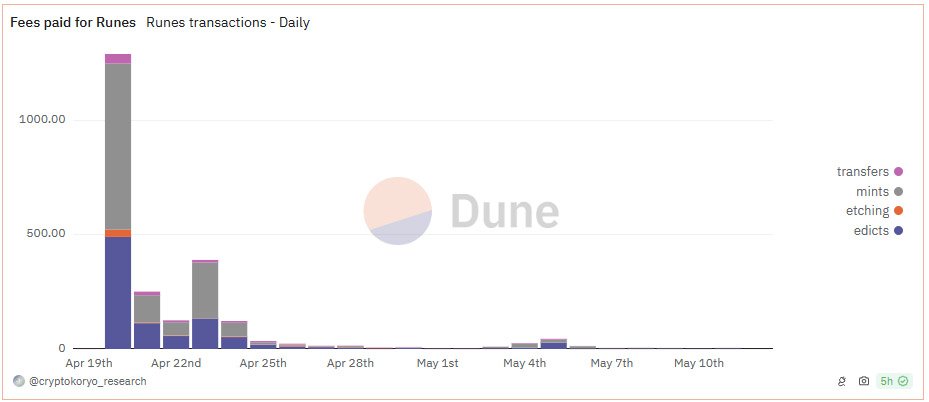

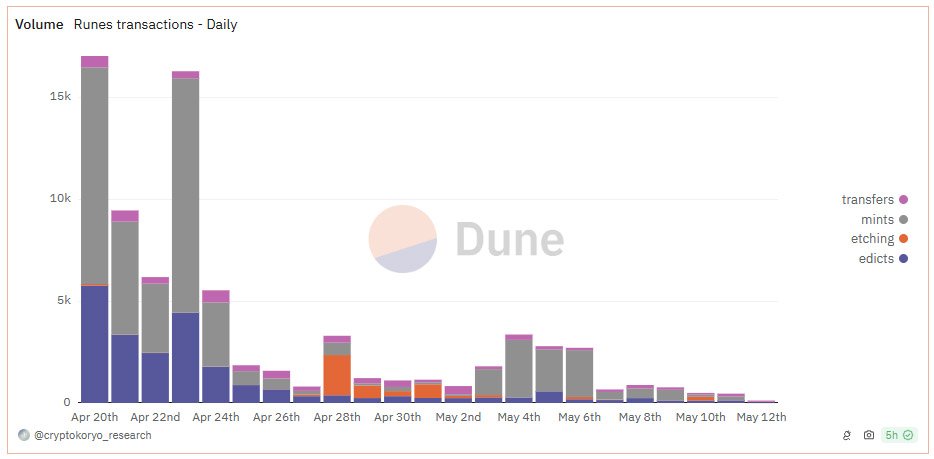

Data from various sources, including Dune analytics, indicates a steady decline in activity on the protocol. May 10th marked a particularly low point, with minimal new mints and wallet interactions recorded on the Runes protocol.

Analysts attribute Runes’ decline in activity to several factors. While the protocol initially enjoyed a surge in interest, fueled by the novelty of its technology and the potential for lucrative returns, it appears to have struggled to maintain momentum in the long term.

As with many platforms in the digital assets space, early adoption can be challenging, and Runes is no exception. Wu Blockchain, a prominent analyst, commented on the situation, stating:

“The Runes protocol generated $135 million in fees in its first week after the bitcoin halving, but activity has dropped dramatically since then, with May 10 being the lowest day for activity and only two times in the last twelve days generating over $1 million in fees.”

Casey Rodarmor, the developer behind Runes and also the creator of Bitcoin Ordinals, remains optimistic about the protocol’s future despite the recent downturn.

Speaking at an event in Hong Kong, Rodarmor hinted at future innovations and projects associated with Runes, showcasing the platform’s potential for further development and growth.

Despite the decline in activity, certain aspects of Runes’ market performance remain robust. Several Rune collections boast significant market capitalizations, indicating ongoing investor interest and support for the protocol.

Magic Eden data confirms the sustained value of these collections, providing a silver lining amidst the overall slowdown.

In the meantime, many question the inherent value of JPG images, whether etched on a blockchain or elsewhere. They believe that these “NFTs” didn’t have any value to begin with, as they are neither scarce, nor hard to create.

Critics of these protocols believe these are just passing fads, and eventually market will come to its senses and understand that they have no value. Those who minted or bought these products might face challenges in the future trying to getting their value out of them.

Recent reports show that this sentiment might not be very far from the truth. Many analyses have shown that around 95% of NFTs minted since 2020, have now lost their value and are worthless.

It’s important to note that Runes is not alone in facing challenges post-launch. Various sectors of the digital assets ecosystem have experienced similar slowdowns, including the ETF markets, suggesting broader market dynamics at play.

The decline in activity on the Runes protocol following its blockbuster launch underscores the challenges inherent in sustaining momentum in the fast-paced world of Bitcoin.

While the initial hype may have faded, the future of Runes remains uncertain but developers and traders are hopeful. With ongoing support from investors and continued innovation from its developers, Runes may yet carve out a significant niche in the evolving landscape of blockchain technology.

On the other hand, it might be just a short-lived success story followed by desertion. Only time will tell what the future holds for this “innovation”.