Bitcoin recently experienced a significant drop in transaction fees following a period of record highs. This drop comes after astronomical rises during the latest halving event, pushing transaction fees on a single block up to 37.6 BTC. This development has caught the attention of the Bitcoin community and raised questions about the future of Bitcoin’s transaction fees.

Bitcoin Transaction Fees: Record Highs and Subsequent Drop

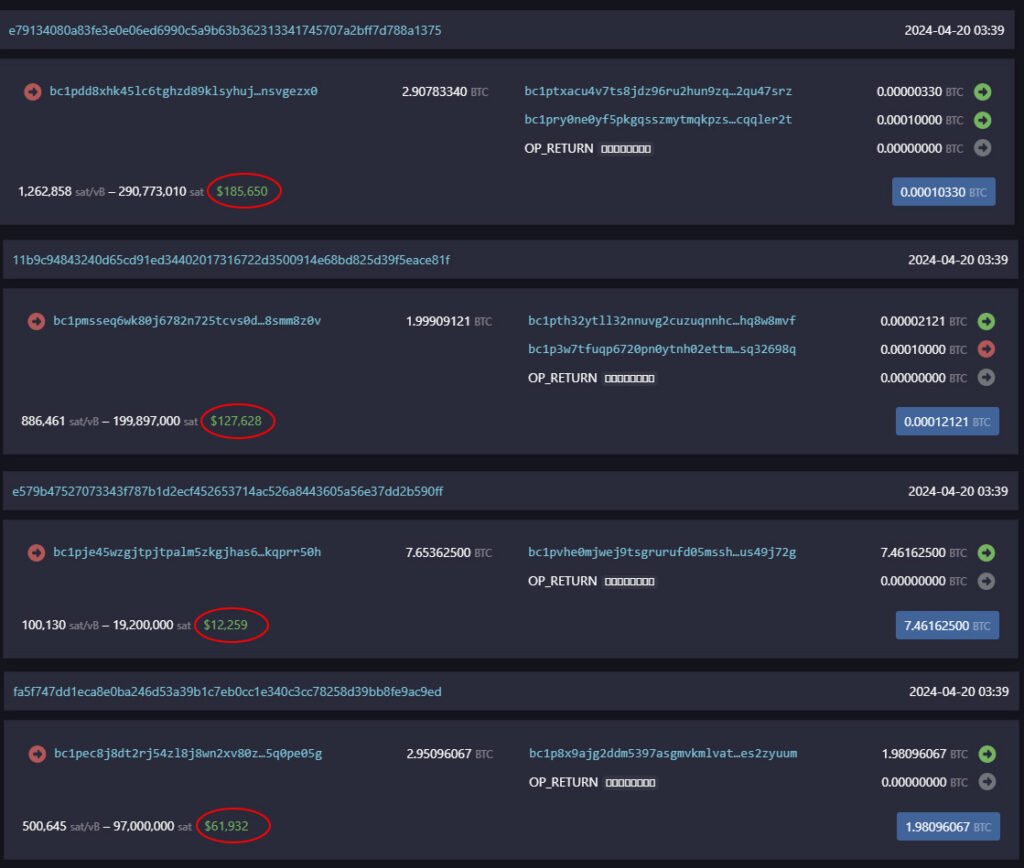

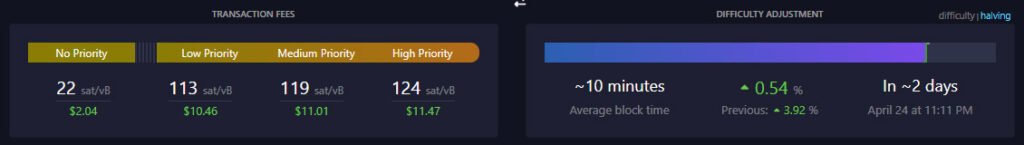

Just a few days ago, Bitcoin transaction fees soared to unprecedented levels, reaching an all-time peak of $128.45. This surge coincided with the Bitcoin halving event, leading to a frenzy of activity on the network. However, the excitement was short-lived as transaction fees swiftly declined, dropping to a much lower $10 per transaction.

Interestingly, a single user spent $500,000 in fees to ensure their transaction was included in the block that marked the halving event.

According to data from various sources, including YCharts and Mempool, the average fee for medium-priority transactions plummeted to $10-$20, marking a sharp decrease from the previous highs. This reduction in transaction fees has brought relief to Bitcoin users who were previously burdened by exorbitant fees.

Causes of the Surge

The surge in Bitcoin transaction fees can be attributed to several factors, one of which is the introduction of the Runes Protocol. Developed by Casey Rodarmor, Runes is a new token standard similar to Ethereum’s ERC-20 tokens. Its launch triggered a flurry of activity on the network as users rushed to create meme coins based on the protocol.

The introduction of Runes protocol was set to happen with the Bitcoin halving event, at block #840,000, which further fueled the surge in transaction fees. As a result, Bitcoin’s total daily transaction fees skyrocketed to $81 million, reflecting a notable trend in the network’s activity.

Impact on Miners and Network Scalability

While the surge in transaction fees initially seemed promising for miners, the subsequent drop has raised concerns about the sustainability of transaction fee revenue. Some experts had anticipated Runes to become a significant fee generator, but early signs suggest otherwise. The Runes launch sparked a fee surge, but its long-term revenue for miners is uncertain. Despite expectations, early indications show Runes may not be a major fee source. Runestone NFT floor prices plummeted around 50% in one day on April 21, per Magic Eden.

Additionally, the surge in transaction fees highlighted potential scalability challenges within the Bitcoin network. As transaction fees soared, the network became congested, causing delays and higher costs for users. However, the subsequent drop in fees indicates that the network may be able to adjust and find a balance in the long run.

Following the halving, not only has the Bitcoin transaction fee decreased, but the Hasprice index has also seen a notable decline. According to HashrateIndex, this metric “quantifies how much a miner can expect to earn from a specific quantity of hashrate,” and is denominated in USD/PH/day.

Data from HashrateIndex indicates a drop from $182.06 Petahash/day to $81.4 in just 24 hours. Consequently, Bitcoin miners are encountering revenue difficulties amid reduced incomes and heightened uncertainty.

Expert Insights

Grayscale, the manager of the world’s largest Bitcoin Trust, weighed in on the situation, predicting a path to a $10 trillion market cap for Bitcoin. According to Grayscale, if transaction fees stabilize at a higher rate than historically observed, future halvings’ impact on miner revenue will diminish. This suggests a potential future where transaction fees could become a significant source of income for miners.

Grayscale said:

“A preview of what’s to come in Bitcoin mining economics decades from now, as Bitcoin monetizes into a $10 trillion+ asset, demand for the network is orders of magnitude larger than today, and we’ve had a few more halvings.”

On the other hand, predictions of bitcoin’s future price vary wildly. Notably, JPMorgan predicts bitcoin could drop to $42,000 after halving due to overbought conditions. Bitwise contrasts, stating post-halving dips are common but followed by substantial gains. After 2012’s halving, Bitcoin rose 9% initially, then soared 8,839% in the subsequent year, suggesting potential long-term growth despite short-term fluctuations.

Criticism and Response

Bitcoin’s surge in transaction fees has not gone unnoticed by critics. Prominent Bitcoin critic Peter Schiff criticized the digital asset, calling it a failure due to the high transaction fees and longer processing times. Schiff’s concerns echo those of others who believe that Bitcoin may not be suitable as a digital currency due to its high transaction costs.

He said:

“The cost to complete a Bitcoin transaction is now $128 and it takes a half hour to process. This is another reason why Bitcoin can’t function as a digital currency. The cost to actually use Bitcoin as a currency is prohibitively high for almost all transactions. It’s a failure.”

In response to criticism, proponents of Bitcoin argue that the recent drop in transaction fees demonstrates the network’s resilience and ability to adapt to changing conditions. Despite the temporary surge in fees, Bitcoin continues to trade above the $66,000 mark, indicating stability in the market.

Conclusion

Bitcoin’s recent experience with record-high transaction fees followed by a sharp drop highlights the dynamic nature of the Bitcoin market. While the surge in fees might raise concerns about network scalability, the subsequent drop offers hope for a more balanced fee structure in the future. As Bitcoin continues to evolve, it will be interesting to see how transaction fees and network activity develop in the long term.