Billionaire venture capitalist Chamath Palihapitiya has recently made a bold prediction regarding Bitcoin’s trajectory. He asserted that 2024 will mark the year when the digital asset achieves mainstream adoption.

In a January 7 interview, Palihapitiya attributed this impending shift to the potential approval of Spot Bitcoin Exchange-Traded Funds (ETFs), characterizing 2024 as a pivotal year for the market.

Chamath Palihapitiya: Bitcoin to Cross the Chasm

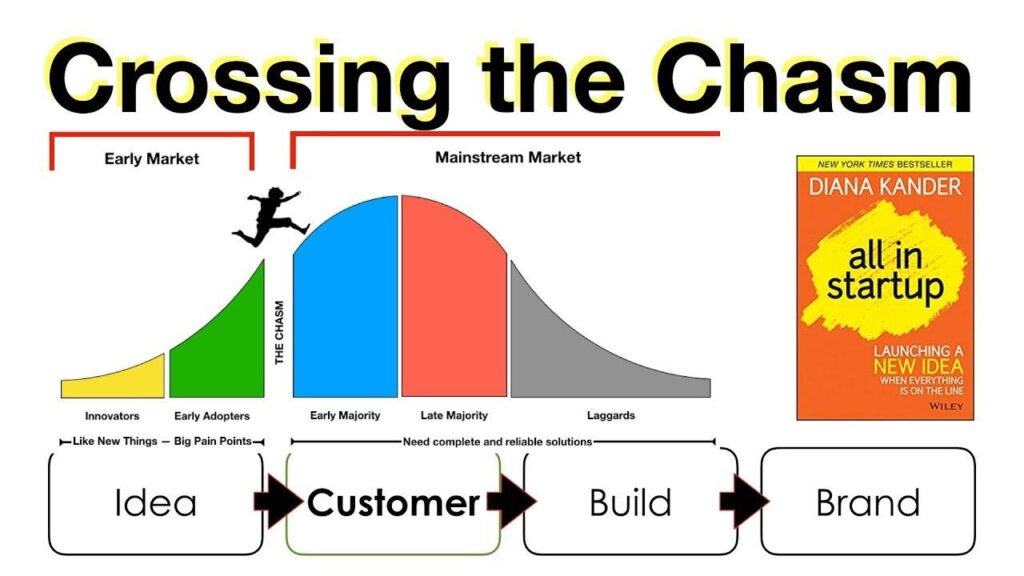

According to him, this is a crucial juncture for Bitcoin to “cross the chasm,” a concept from Geoffrey A. Moore’s technology adoption lifecycle. The concept of “crossing the chasm” originates from the technology adoption lifecycle and was popularized by Geoffrey A. Moore in his eponymous book.

It signifies the transition from early adopters to the early majority in the adoption curve, a critical phase for achieving widespread acceptance. This transition encounters a significant “chasm” or gap, typically occurring just above the 10% adoption mark, a formidable hurdle to overcome.

YouTuber Luke Mikic explains that this “chasm” symbolizes a substantial divide in adoption dynamics. Specifically, it signifies the difficulty in moving from visionary bitcoin enthusiasts, who constitute the early adopters, to the more conventional realms of mainstream business and consumer adoption.

Palihapitiya explained:

“This is the moment for Bitcoin to, to use that old term, cross the chasm and really see mainstream adoption where our parents and our grandparents understand what it is, can buy it, and then do buy it.”

The Sri Lankan-born Canadian and American investor’s optimism marks a stark departure from his previous statement in April 2023, when he proclaimed, “Crypto is dead in America.” Now, he envisions Bitcoin seamlessly integrating into traditional finance by the end of 2024, as the digital asset transcends its current status among visionary enthusiasts to resonate with a broader audience, including older generations.

Spot Bitcoin ETF Approval: A Key Factor

Crossing the chasm appears contingent on the approval of one or more Spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) within the week.

The potential approval of Spot Bitcoin ETFs in the United States is poised to result in massive adoption in the digital asset market. Analysts suggest that this approval, speculated to occur around January 10, could inject massive capital into the market.

However, if the regulator rejects the applications by major investment giants, there is a considerable likelihood that the BTC price could regress below the $40,000 threshold.

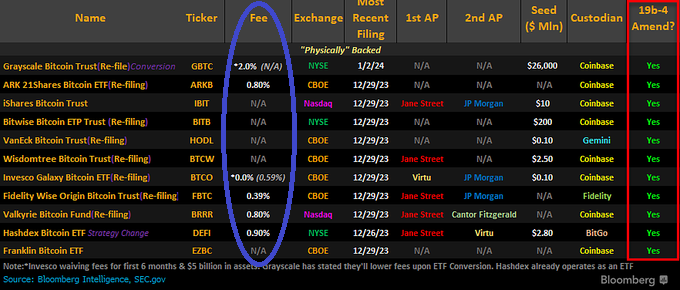

Interestingly, The ETF Store president Nate Geraci recently identified key factors to monitor in this landscape, emphasizing the importance of fee disclosures, particularly from major players like BlackRock and Grayscale.

Notably, VanEck adviser Gabor Gurbacs highlights the transformative potential of this development, foreseeing trillions of dollars flowing into the Bitcoin sector over the long term. Drawing parallels with gold’s market cap trajectory in 2004, Gurbacs envisions Bitcoin’s price following a similar blueprint, albeit at an accelerated pace upon ETF approval.

2024 Set to Witness Bitcoin Halving

Adding another layer of intrigue to the landscape, 2024 is also set to witness a Bitcoin halving event. This occurrence, which reduces the supply of new BTC entering circulation, historically leads to an increase in the BTC price.

The combination of mainstream adoption, catalyzed by potential ETF approval, and the impending halving event creates a compelling narrative for Bitcoin in 2024, attracting both institutional and retail investors alike.