In defiance of the government’s ban on digital asset trading since 2021, Chinese investors are steadfastly embracing Bitcoin as a viable investment option. The persistent interest in Bitcoin among Chinese capital is highlighted in a recent Reuters report, shedding light on the clever strategies employed by investors to navigate the regulatory challenges and China Bitcoin ban.

Dylan Run, a finance executive based in Shanghai, exemplifies the resilience of Chinese investors. Concerned about the nation’s economic outlook and the sluggish domestic stock market, Run ventured into Bitcoin in early 2023.

The Reuters report details his astute approach. He impressively uses bank cards from rural banks and ensures each transaction remains below 50,000 yuan to avoid regulatory scrutiny. Run, viewing Bitcoin as a safe haven akin to gold, has now allocated nearly half of his investment portfolio to BTC, which has outperformed China’s sinking stock market.

Widespread Adoption of Unconventional Strategies

Run’s journey mirrors a broader movement among Chinese investors who actively seek unconventional pathways to access Bitcoin. Digital asset trading was officially banned in mainland China in 2021, and strict controls govern capital flows across borders.

Despite these constraints, Chinese investors persist in trading Bitcoin on offshore exchange platforms or through over-the-counter channels. The report also highlights how Chinese citizens leverage their $50,000 annual foreign exchange purchase quotas to fund BTC accounts in Hong Kong. It provides another instance:

“At Crypto HK, a popular crypto store in the Admiralty district, customers can buy bitcoin with a minimum HK$500 ($64) and are not required to provide any identity documents.”

Diversification Amid Economic Uncertainties

This trend is driven by a growing interest in diversification amid economic uncertainties in the country. One investor briefly expressed the sentiment, stating, “Given the economic climate in China, exploring alternative investments like cryptocurrencies has become a necessity.”

Bitcoin and other digital assets have emerged as a sanctuary for investors navigating China’s complex economic landscape. According to Reuters, this sentiment is shared not only by retail investors but also by Chinese financial institutions.

Facing challenges such as a sluggish stock market, weak demand for IPOs, and contraction in other businesses, Chinese financial institutions seek a compelling growth narrative for shareholders and boards.

China Bitcoin Ban: Offshore Exchanges Serving Hard

Bitcoin remains relatively accessible within mainland China, facilitated by offshore exchanges like OKX and Binance. These platforms offer guidance on converting yuan into stablecoins through fintech platforms like Ant Group’s Alipay and Tencent’s WeChat Pay.

Interestingly, an analysis by Chainalysis, a renowned digital asset data platform, echoes the same situation. According to the report, China’s global ranking in terms of peer-to-peer trade volume catapulted from 144th in 2022 to 13th in 2023.

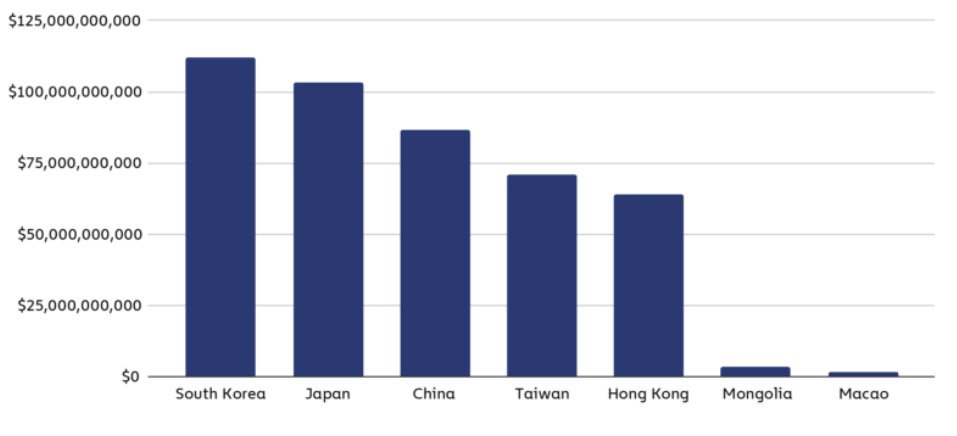

The Chinese digital asset market recorded an estimated $86.4 billion in transaction volume between July 2022 and June 2023, surpassing Hong Kong’s $64 billion in digital asset trading. Notably, the proportion of large retail transactions, ranging from $10,000 to $1 million, nearly doubled the global average of 3.6%.

These developments have sparked speculation that the Chinese government may be warming to bitcoin, with Hong Kong potentially serving as a testing ground for such efforts. As investors continue to navigate regulatory challenges, their resilience and innovative strategies underscore the enduring appeal of Bitcoin in the face of adversity within the Chinese market.