On July 19, 2024, the world experienced a significant cyber outage that disrupted numerous sectors, including airlines, banks, media companies, and other essential services.

This chaos was sparked by a faulty software update from CrowdStrike, a prominent cybersecurity firm, which primarily affected Microsoft’s Windows operating systems.

The result was a digital meltdown that grounded flights, halted banking transactions, and caused widespread media blackouts. The travel industry was particularly hard-hit. Major U.S. airlines like American Airlines, Delta, and United had to ground flights.

Airports around the world, from Singapore to Amsterdam, faced disarray as electronic systems went down, forcing manual check-ins. In Germany, Eurowings even stopped flights entirely for several hours.

Banks across the globe also struggled. Financial institutions from Australia to Germany faced significant operational challenges, with customers unable to execute transactions and traders labeling the situation “the mother of all global market outages.”

Media outlets, such as Sky News in the UK, went off air due to the disruptions.

George Kurtz, CEO of CrowdStrike, clarified that the outage was not a cyberattack but a consequence of a botched software update, which led to the infamous “Blue Screen of Death (BSOD)” on many devices.

Microsoft acknowledged the issue and swiftly worked on a fix, but experts warned that a full recovery might take until early next week.

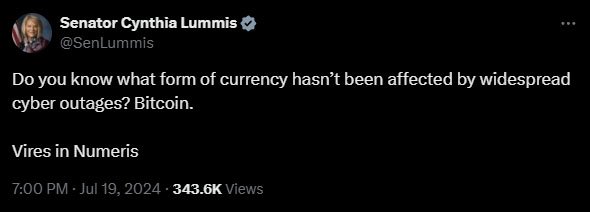

In the midst of this digital chaos, Bitcoin remained unaffected. Senator Cynthia Lummis of Wyoming, a vocal advocate for digital currencies, took to social media to highlight Bitcoin’s resilience.

She posted on X, praising Bitcoin’s resilience.

“Vires in Numeris,” a Latin phrase meaning “strength in numbers,” is often used to describe Bitcoin’s robust infrastructure. Lummis’s use of this phrase underscores her belief in the power of decentralized technologies.

She has criticized the current administration for not enacting sound digital-asset legislations and has even suggested that Bitcoin integration could help maintain the U.S. dollar’s dominance.

Lummis’s praise for Bitcoin was echoed across the community. Many users retweeted her statement, emphasizing the advantages of Bitcoin as a decentralized currency.

Unlike traditional financial systems that rely on centralized infrastructures, Bitcoin operates on a decentralized network, making it less susceptible to such widespread failures.

Senator Lummis has been a consistent supporter of Bitcoin. She is known for her efforts to introduce the bipartisan “Responsible Financial Innovation Act” aimed at regulating the digital asset sector.

Her advocacy for Bitcoin stems from its decentralized nature, which she believes offers greater stability and security compared to traditional financial systems.

The global cyber outage didn’t just underline the vulnerabilities of centralized systems; it also seemed to give a boost to the Bitcoin market. As traditional systems grappled with the fallout, bitcoin’s price climbed above $66,000 for the first time since March.

The total digital assets market saw a 3% increase, reaching $2.5 trillion for the first time that month. This market uptick highlighted the growing interest and trust in decentralized digital assets during times of crisis.

Mark Cuban, a well-known entrepreneur and supporter of Bitcoin, commented on its potential as a global reserve asset. He noted that the ongoing geopolitical unrest and the recent cyber outage could align the stars for bitcoin’s price acceleration. He said:

“Combine that with global uncertainty as to the geopolitical role of the USA, and the impact on the US dollar as a reserve currency, and you can’t align the stars any better for BTC price acceleration.”

The recent events have sparked a broader discussion on the benefits of decentralized technologies. Bitcoin’s ability to remain unaffected by the cyber outage demonstrated its resilience and reliability.

Taras Kulyk, founder and CEO of Sunnyside Digital, pointed out that Bitcoin’s decentralized network, which primarily uses Linux-based frameworks, was immune to the disruptions caused by the Microsoft outage.

“If you look at the Bitcoin hash rate chart, [Bitcoin] was completely unaffected […] It’s hilarious because banks globally have been shutting down because of this server issue, and yet, Bitcoin keeps hashing, and I hate to use the term, but, ‘tick tock, next block.’”

This incident has emphasized the need for stronger risk management strategies to prevent similar disasters in the future.

Analysts have noted that even a small technical glitch can lead to widespread chaos, highlighting the fragility of our interconnected systems. As such, the stability of decentralized networks like Bitcoin becomes even more appealing.

Senator Lummis’s consistent advocacy for Bitcoin signals its growing acceptance and potential integration into mainstream financial systems.

As a member of the Senate Banking Committee, her support lends significant weight to the argument for digital currencies. Her recent statement serves as a powerful reminder of Bitcoin’s unique strengths in an increasingly digital world.