A study by Sam Callahan and Rapha Zagury analyzed returns from two different investment strategy types: Dollar-cost averaging (DCA) and lump-sum purchases. The results suggest that DCA could return up to 75% less.

Choosing Between DCA And Lump-sum

Clients interested in buying bitcoin face the decision of when to invest for maximum returns. Some prefer lump-sum investing, putting all their funds in at once for immediate investment. Others opt for dollar-cost averaging, spreading their investment over regular intervals to reduce the impact of volatility. Choosing the right entry point in bitcoin’s fluctuating market can be challenging.

Which investment strategy performs better for bitcoin investors: lump-sum or DCA? To find out, a simulation was run on bitcoin’s price history over the last six years. Various DCA strategies were compared at different time intervals with lump-sum investing. The DCA strategies included daily, weekly, and monthly intervals for buying.

DCA vs Lump-sum (2017-Today)

The performance of different strategies were analyzed over the last six years, comparing total accumulated bitcoin between DCA and lump-sum methods since January 2017. The results show that, on average, lump-sum purchasing outperformed DCA strategies during this period.

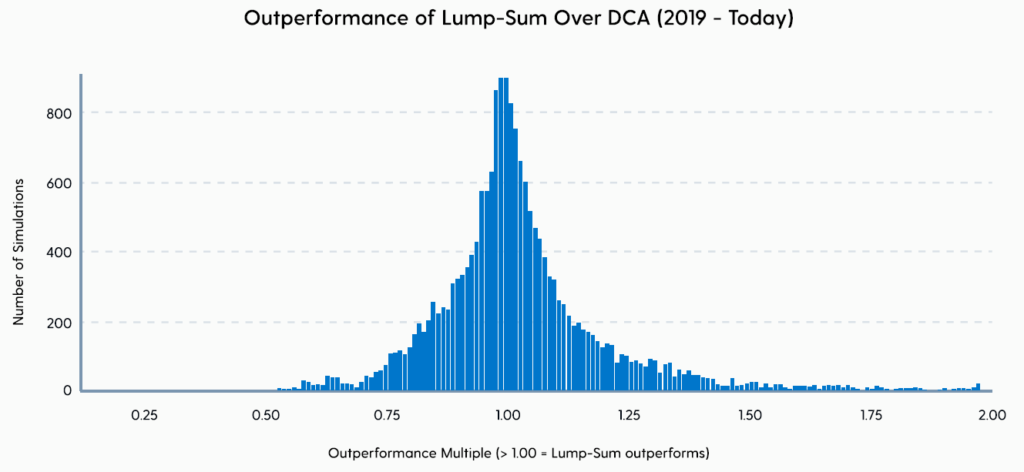

DCA vs Lump-sum (2019-Today)

Next, the performance of these strategies was examined over the last four years. Similarly, lump-sum investments tended to outperform DCA strategies during this period.

DCA vs Lump-sum (2021-Today)

In the last two years, DCA strategies outperformed lump-sum in certain instances, especially during bear markets, where investors could accumulate more bitcoin with lower prices. However, in general, lump-sum strategies tend to perform better, except when invested right before extended downward price trends.

The Better DCA Strategy

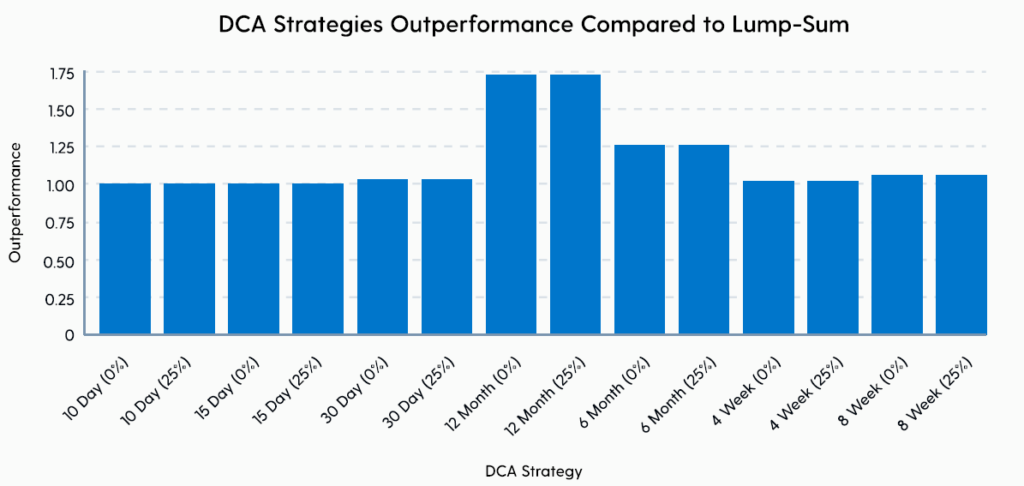

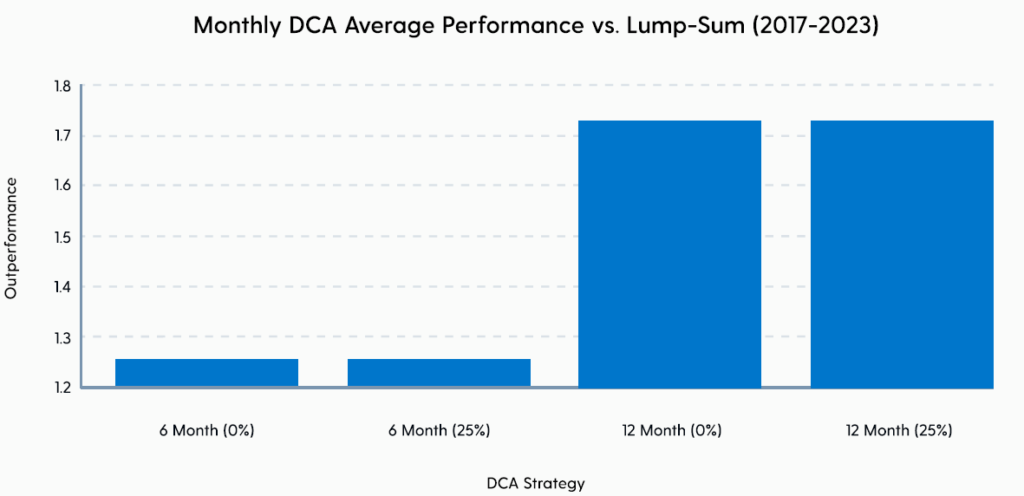

Deeper analysis reveals that longer DCA strategies performed worse than shorter ones, emphasizing the cost of waiting on the sidelines when investing in bitcoin. Monthly DCA strategies significantly underperformed other DCA approaches from 2017 to 2023. For example, the average 12-month DCA strategy accumulated around 75% less bitcoin than the average lump-sum strategy, and the average 6-month DCA strategy accumulated roughly 25% less.

Even when comparing daily DCA strategies, the shorter 10-day strategy performed better than the 15-day and 30-day options, though all slightly underperformed the average lump-sum strategy from 2017 to 2023.

Study shows average 4-week DCAs between 2017 and 2023 have outperformed 8-week DCAs. It also becomes evident that the average 6-month DCA strategy significantly outperformed the average 12-month DCA strategy, yet both strategies fell well behind the average lump-sum approach.

Results

The key lesson from this data is that the longer an investor waits to deploy their capital, the more they underperform compared to a lump-sum investment. The moral of the story is that, historically, getting capital in early when investing in bitcoin yields better results.

The results indicate that investors who chose lump-sum investing enjoyed higher returns than those using dollar-cost averaging. The reason behind this is upwards volatility. When bitcoin experiences upward movements, its growth can be explosive.