El Salvador is embracing Bitcoin in unprecedented ways, from adopting it as legal tender to unveiling tools that enhance transparency in El Salvador bitcoin holdings. The nation’s Bitcoin journey is helping it reshape its financial landscape amid global scrutiny and domestic challenges.

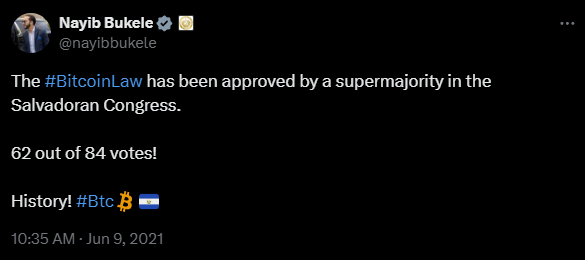

The country has made a significant mark by becoming the first country to adopt it as legal tender. This move was spearheaded by President Nayib Bukele and was approved by El Salvador’s Legislative Assembly in June 2021.

The Bitcoin Law, which went into effect on September 7, 2021, positions bitcoin alongside the U.S. dollar, which has been the nation’s official currency since 2001.

The Salvadoran government advocated for this law as a strategy to boost investment, economic growth, and to decrease the cost of remittances from Salvadorans living abroad, which account for about 20% of the GDP.

To support this initiative, El Salvador launched a national digital wallet called Chivo, meaning “cool” in local slang, enabling transactions in both bitcoin and U.S. dollars. The government encouraged the wallet’s use by offering a $30 bitcoin incentive for user registration.

The infrastructure to facilitate Bitcoin transactions, including the installation of Bitcoin ATMs, was also put in place. However, the economic impact of adopting Bitcoin has been mixed, with varied acceptance among businesses and investors due to its price fluctuations in dollar terms.

The international response was predominantly critical, with entities like the International Monetary Fund (IMF) and the World Bank expressing concerns about potential risks to economic stability and financial integrity.

The International Monetary Fund (IMF) has been particularly outspoken, emphasizing the potential issues like money laundering and financial instability that could arise from bitcoin’s use as legal tender.

IMF advises against the use of Bitcoin in this capacity due to its volatility and the associated risks to consumer protection. Similarly, the World Bank has declined to assist El Salvador with the implementation of bitcoin as legal tender, pointing out concerns related to environmental impact and transparency.

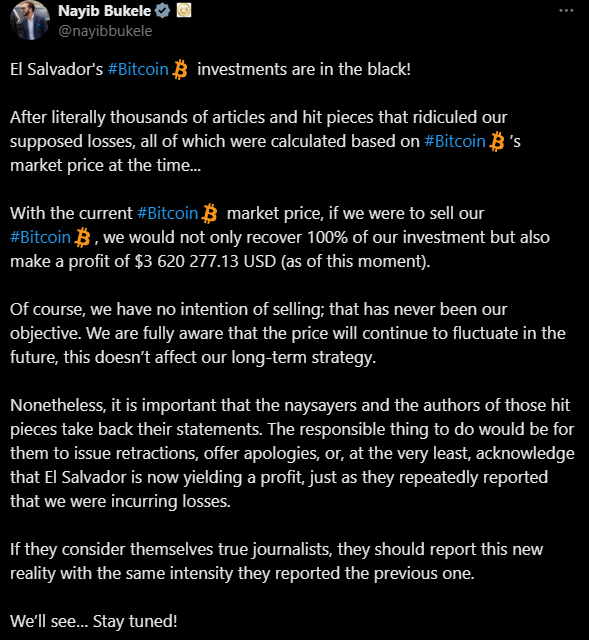

Despite these challenges, the Salvadoran government remains invested in Bitcoin-centered projects, including the ambitious plan for a “Bitcoin City” funded by Bitcoin bonds, intended to serve as a center for innovation.

This bold move by El Salvador continues to be a significant global experiment in integrating bitcoin into a national economy, with ongoing developments and implications yet to be fully realized.

Countries like the United States have also shown concern, particularly focusing on the potential for Bitcoin to be misused within the financial system for activities like money laundering and other illegal transactions.

Despite these international warnings, the Salvadoran government has pressed ahead with its Bitcoin initiatives, which has led to mixed reactions within the country. Some citizens are excited about the innovative potential, while others protest the lack of public consultation.

Globally, El Salvador’s move is regarded as a test case for the broader adoption of Bitcoin. This initiative is being closely observed, and its outcomes might influence future international policies and attitudes towards Bitcoin and its use in national economies.

As El Salvador continues to navigate these challenges, the global community remains keen on understanding the long-term implications of this groundbreaking economic approach.

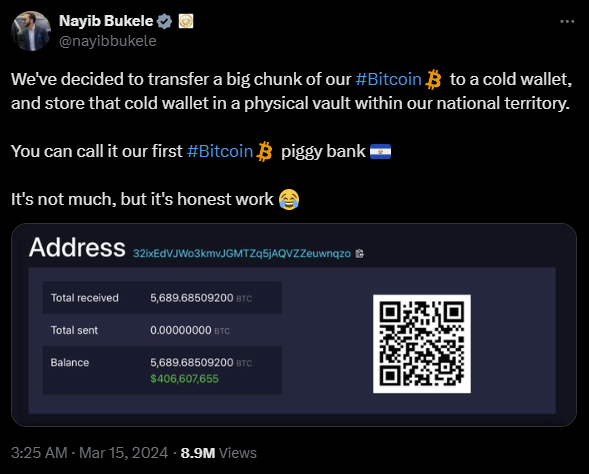

On March 14, 2024, Nayib Bukele, the current President of El Salvador, announced the contents of the nation’s Bitcoin cold wallet. As of the announcement, the wallet holds 5,749.76 bitcoin, currently valued at approximately $356 million.

Following President Bukele’s disclosure of El Salvador’s Bitcoin address, the account received a flurry of donations from supporters worldwide.

On May 13, 2024, President Nayib Bukele unveiled El Salvador’s Bitcoin Treasury Tracker. Hosted at bitcoin.gov.sv, this website functions as a modified version of mempool.space, specifically designed to monitor El Salvador’s bitcoin reserves in real-time.

It allows any user to track the country’s bitcoin holdings and transaction activities transparently.