In a groundbreaking move for American academia, Emory University, a prominent private research institution based in Atlanta, Georgia, has disclosed its substantial investment in bitcoin, marking it as the first U.S. university to do so.

This step reflects the growing institutional interest in digital assets and is seen as a significant moment for both the university and the Bitcoin sector.

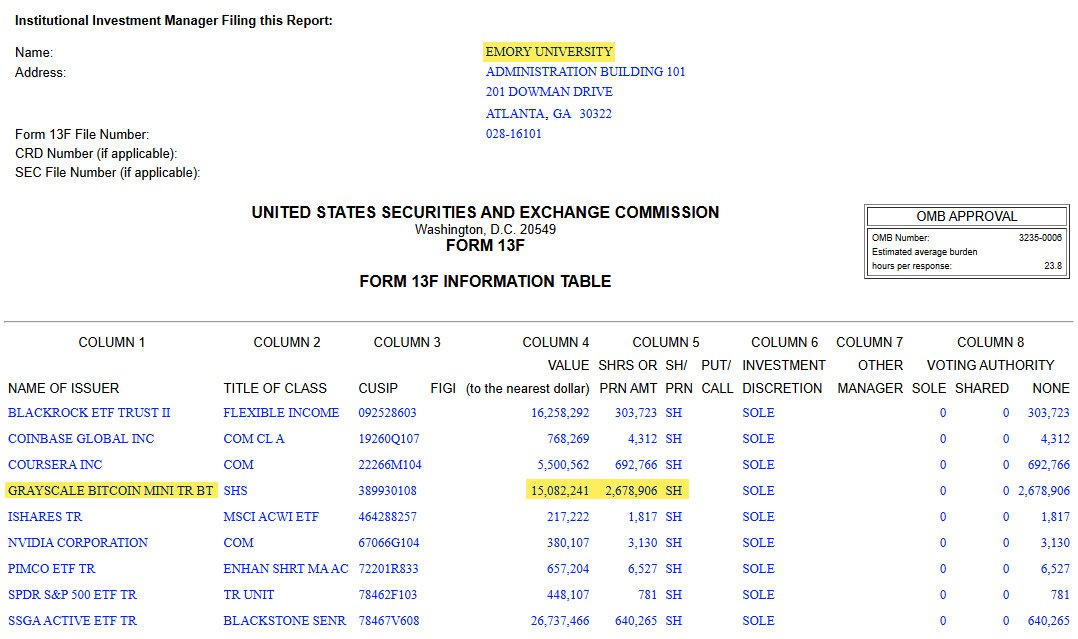

According to filings with the U.S. Securities and Exchange Commission (SEC), Emory University reported holding approximately $15.1 million worth of shares in the Grayscale Bitcoin Mini Trust, a vehicle that allows investors to gain exposure to bitcoin without directly holding the asset.

This investment makes Emory a pioneer among higher education institutions in the United States, with a bold venture into the digital asset market.

Emory University’s decision to purchase nearly 2.7 million shares of the Grayscale Bitcoin Mini Trust signals an important shift.

Similar to pension funds in Wisconsin and Jersey City which have ventured into bitcoin through ETFs, Emory’s investment is notable for directly exposing the university’s endowment to bitcoin’s price movements.

This move is relatively rare in academia, where traditional, conservative investment strategies have typically prevailed.

Related: Saylor Believes Bitcoin’s Inclusion in Pension Funds is Inevitable

This is the first time a university in the United States has ever owned exposure to bitcoin through the traditional public markets.

With a position valued at approximately $15 million, Emory’s investment is among the largest of any university and reflects a forward-looking approach within higher education circles.

In addition to its stake in bitcoin, Emory University also reported owning $768,269 worth of shares in Coinbase, one of the world’s largest digital asset exchanges, which acts as the custodian for Grayscale’s bitcoin assets.

This dual investment underscores Emory’s commitment to diversifying its endowment with an eye on emerging financial trends.

Launched in July, the Grayscale Bitcoin Mini Trust is a spin-off of the more established Grayscale Bitcoin Trust (GBTC).

Designed to provide investors with fractional exposure to bitcoin, the Mini Trust allows both institutional and retail investors to access the bitcoin market with lower fees and at a lower cost per share.

Emory’s stake in this trust means that the university can indirectly track bitcoin’s price, gaining passive exposure without the complexity of directly holding the asset.

By owning shares in the Grayscale Bitcoin Mini Trust, Emory University has chosen a straightforward and regulated way to enter the Bitcoin space. The trust’s fractional model makes bitcoin more accessible to a wider range of investors, including those in the academic sector.

The Mini Trust’s structure is also beneficial to universities like Emory, where long-term growth and low risk are key priorities.

With the Mini Trust’s low entry cost and simplified exposure to bitcoin, Emory’s investment is designed to balance risk while providing a foothold in the growing digital asset market.

Emory’s investment is a milestone for the academic sector, highlighting a shift in how universities view the potential of digital assets.

While other leading institutions like Harvard, Yale, and Stanford have explored blockchain technology and digital assets through research and tech funds, none have taken the step of investing directly in Bitcoin-related assets.

Emory’s investment is part of a wider trend in the financial world, where major institutional players, including asset management companies and hedge funds, are increasingly adding bitcoin to their portfolios.

Since the introduction of Bitcoin ETFs on major exchanges, interest in digital assets has accelerated among traditional investors.

This overlap between public markets and Bitcoin has made it easier for universities and other institutions to diversify their portfolios in line with modern financial trends.

As Emory’s investment showcases the potential for educational institutions to engage in digital finance, it also prompts broader discussions around the role of Bitcoin in academia.

In addition to participating in the financial markets, Emory’s stake in bitcoin and Coinbase is likely to encourage more educational discourse on blockchain technology and the future of digital currency.

According to reports, Emory’s involvement in Bitcoin aligns with its goals of diversifying its endowment portfolio and supporting innovative technologies. By keeping up with these trends, it aims to create a more technology-driven academic atmosphere.

In line with this strategy, Emory’s venture into the Bitcoin space could inspire other universities to reconsider their investment policies. This move may set a precedent for higher education institutions looking to balance traditional investments with emerging asset classes like Bitcoin.

Emory’s decision to invest comes at a time when interest in Bitcoin-related assets is surging.

On October 24, Bitcoin ETFs saw a significant inflow, with $188 million pouring into various funds. Notably, BlackRock’s iShares Bitcoin Trust recorded the highest inflow, with $165.5 million in new investments.

Emory’s foray into the Bitcoin Mini Trust mirrors this broader trend and positions the university as an early adopter among higher education institutions.

While other universities have focused their involvement in digital assets on research and academic initiatives, Emory’s investment has made it the first to directly commit part of its endowment to bitcoin.

This milestone reflects a growing institutional acceptance of Bitcoin as an asset class and highlights how universities can play a role in the digital finance landscape.

As universities across the U.S. observe Emory’s bold move, it remains to be seen if others will follow suit.

For now, Emory’s investment is a sign of the times, representing a turning point for both the institution and the higher education sector in recognizing the future potential of digital assets.