The Financial Accounting Standards Board (FASB) has finally issued new fair value accounting rules for Bitcoin and other eligible digital assets.

These go into effect December 15, 2024 and will simplify financial reporting for companies that hold digital assets, and increase transparency for investors. The updated standards are a big deal for corporate adoption of bitcoin.

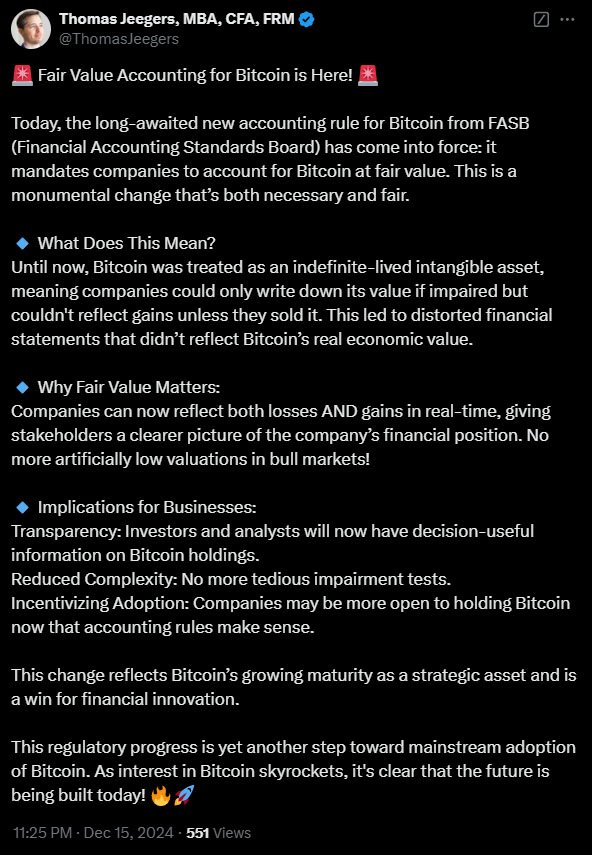

Before, companies treated bitcoin as an indefinite-lived intangible asset. This meant they would report losses if the value of those assets went down but couldn’t report gains unless they sold the assets.

This often resulted in outdated and incomplete financials. Under the new rules, companies will now have to measure eligible digital assets at fair value and update those values every reporting period.

Related: FASB’s Fair Value Accounting Shift and Bitcoin’s New Dawn

This means companies can now recognize gains and losses from market fluctuations and get a more accurate and real-time view of their financials.

According to FASB Chair Richard Jones, the new standard “will provide investors and other capital allocators with more relevant information that better reflects the underlying economics of certain crypto assets and an entity’s financial position.”

The new accounting standards may encourage more companies to hold bitcoin as a treasury reserve asset. Michael Saylor, co-founder and chairman of MicroStrategy, has been a big proponent of the updated rules.

Saylor said the change will simplify financial reporting and align Bitcoin’s value with its economic value. He called it a big win for bitcoin-holding corporations and said this will open the door for broader institutional adoption.

Being able to report bitcoin’s fair value will make holding the digital asset more attractive to big companies.

Bill Barhydt, CEO of Abra, said this means institutions in the S&P 500 can hold bitcoin without fear of permanent write-downs and it will accelerate its path to being a mainstream financial asset.

The FASB’s new rules only apply to fungible digital assets like bitcoin, that meet certain criteria.

Non-fungible tokens (NFTs), wrapped tokens and internally generated digital assets are excluded because of the challenges in measuring their fair value. As the FASB said, NFTs’ unique nature, inconsistent pricing and low liquidity make them not suitable for standardized fair value measurement.

“These updates apply only to fungible intangible digital assets because it is difficult to obtain market prices that meet FASB’s fair value criteria for nonfungible digital assets.”

The new standards will increase transparency in financial reporting. By reflecting real-time market prices for bitcoin and similar assets, companies will give investors a better view of their financials and risk.

Thomas Jeegers, financial analyst, says the rules will simplify accounting by eliminating impairment testing, making it easier for companies to manage bitcoin’s price volatility.

This will also increase investor confidence. Stakeholders will have a better view of a company’s cash flow and performance, so creditors, investors and regulators can make better decisions.

The FASB’s new rules came as bitcoin’s price surged. After the announcement bitcoin went above $105,000, driven by the regulation and speculation about broader institutional adoption.

Then President-elect Donald Trump’s comments about creating a Strategic Bitcoin Reserve—like the country’s oil reserves—added to the excitement.

Michael Saylor attributes the price increase to the FASB’s decision. He says this is one of three things that will drive bitcoin to $1 million, alongside approval of Bitcoin ETFs and introduction of more bank custody services.

The FASB’s new rules mark a big change for bitcoin accounting.

By bringing corporate reporting in line with the dynamic nature of digital assets, the rules bridge the gap between traditional financial markets and the emerging Bitcoin economy.

Companies like MicroStrategy and Tesla with large bitcoin reserves will benefit greatly from the simplified accounting.

How this new directive shapes future bitcoin investments remains to be seen. But one thing is for sure; the FASB’s fair value rules will change how companies and investors see Bitcoin.