The approval of Bitcoin Spot Exchange-Traded Funds (ETFs) by the Securities and Exchange Commission (SEC) marked a significant milestone. Fidelity Investments, with a user base of nearly 50 million in the U.S. alone, signaled a paradigm shift in the storage of digital assets within the framework of traditional finance.

Fidelity Bitcoin ETF And Self Custody Early On

The company’s journey into holding bitcoin began in 2014 when it established the Fidelity Digital Assets division to explore the potential of blockchain technology and digital assets.

Initially, Fidelity’s attention was more focused on research and understanding the underlying technology behind Bitcoin, however, as institutional interest in Bitcoin grew, Fidelity recognized the need for secure custody solutions to attract these investors.

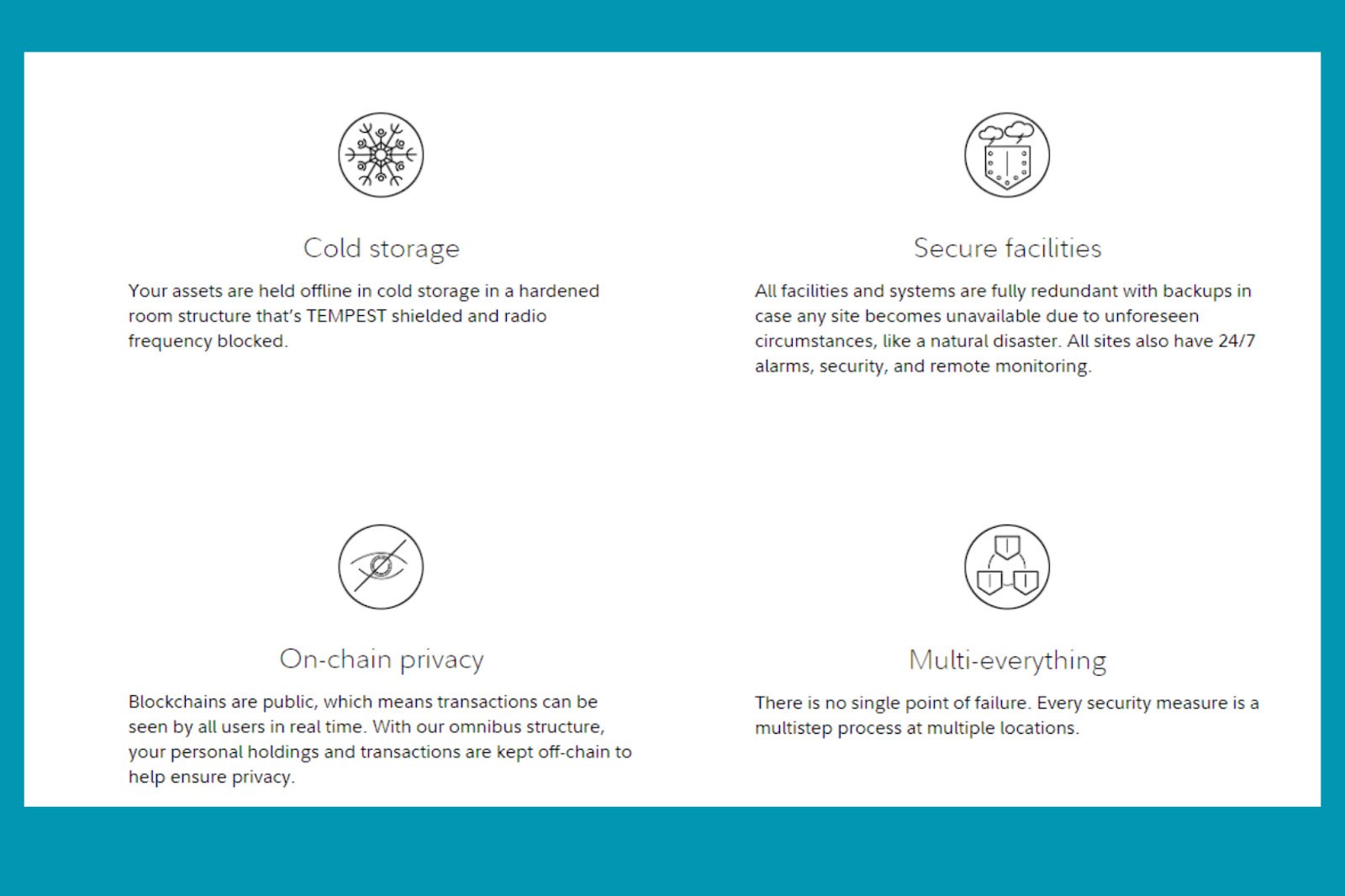

In 2018, Fidelity Digital Assets announced its plans to offer custody and trade execution services for Bitcoin, targeting institutional investors such as hedge funds, family offices, and market intermediaries. They implemented robust security measures, including cold storage solutions and multi-level authentication protocols, to safeguard clients’ digital assets.

In 2020, the company launched the Fidelity Bitcoin Index Fund, one of the precursors of the now-known Bitcoin ETFs, allowing accredited investors to gain exposure to Bitcoin through a regulated investment vehicle.

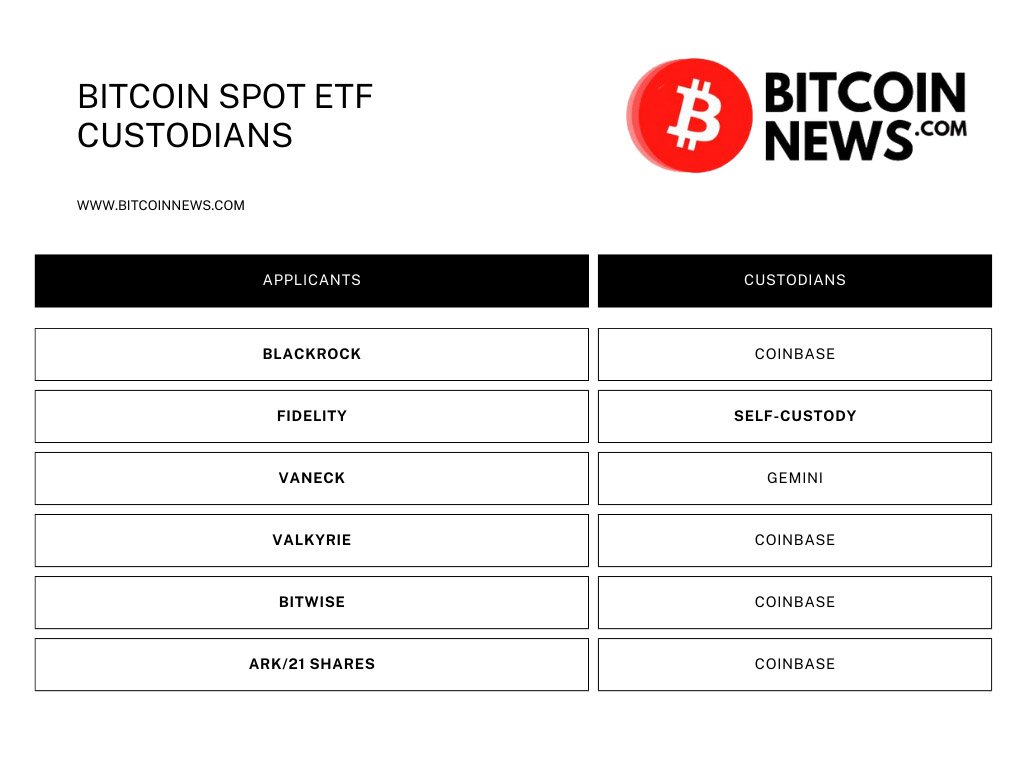

Unlike traditional ETFs where third-party custodians typically hold the keys to the underlying assets, Fidelity took a groundbreaking approach by holding the keys to its bitcoin directly.

Fidelity’s Omnibus Storage Structure

Fidelity Investments launched its omnibus structure for bitcoin custody in 2018. This structure allows Fidelity to hold bitcoin on behalf of institutional clients without creating separate wallets for each client.

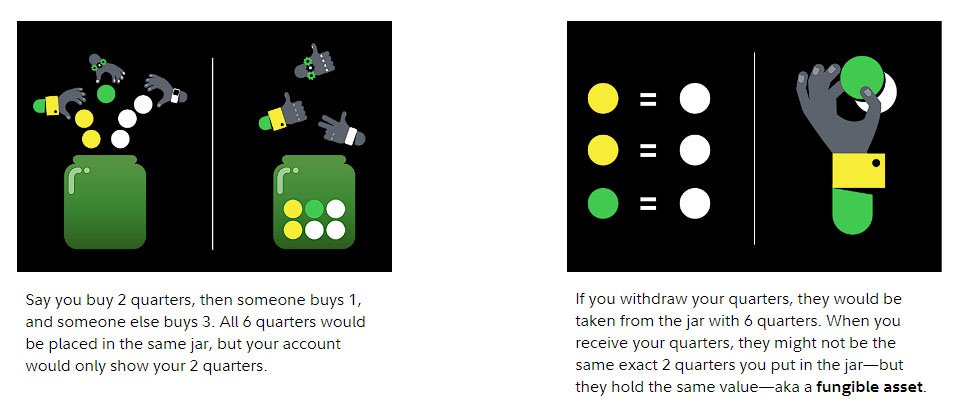

Here is an example given by the Fidelity Team:

“Simply put, an omnibus structure means all client assets are stored together but recorded individually. An omnibus structure allows Fidelity Digital Assets to pull assets from a single source vs. multiple accounts. For example, let’s use quarters to represent bitcoin. The idea of an omnibus structure is to have a communal jar of quarters vs. a separate jar for each person.”

– Source

This approach gives Fidelity an easier way to manage the funds than the otherwise individual hot wallets. Their method ensures that all the funds that are not actively traded are stored in cold storage, and only the traded funds are moved to a wallet connected to the internet and actively used for transactions.

Fidelity Signals Paradigm Shift in TradFi

The Bitcoin ethos shared all around the world is “Don’t Trust, Verify”, Fidelity’s decision to self-custody their funds is a testament to the understanding of Bitcoin.

By holding their keys, Fidelity can implement and control stringent security measures tailored to their needs and standards, such as geographical redundancy, offline storage, anti-radio frequency rooms, etc. Surely there are many other safety measures that are not shown to the public.

Third parties can introduce liabilities for the company’s funds. Security breaches, operational efficiency and regulatory compliance, among many others, can be problematic for the fund manager.

ETFs vs Real Bitcoin

“If you understand the risks and are deciding between buying bitcoin directly or a spot bitcoin ETP, the differences might be best summed up as functionality versus convenience. Buying bitcoin will give you access to the features Nakamoto envisioned”

– Fidelity Investments. “What is a spot bitcoin ETP? | Fidelity.” Fidelity Investments, 10 January 2024 – Source

Matthew Kratter from Bitcoin University YouTube Channel, explains the differences between a Bitcoin spot ETF and the bitcoin asset itself, also encouraging the viewer to explore the real bitcoin path instead of owning an IOU.

“Bitcoin makes everything better and ETFs are no exception. Bitcoin spot ETF will indeed help to preserve your purchasing power and protect you from the money printers of the central Bankers… The high inflation that we’ve been seeing and that the dollar really has seen since the founding of the Federal Reserve in 1913…So in Conclusion here I would say buy the Bitcoin ETF or one of the Bitcoin ETFs if you must, but I would wish something even better for you… ”

– Source

While holding ETFs IOUs seems convenient, the trade-offs between functionality, convenience, and privacy are always in play. The route to the real bitcoin path might seem scary at first glance for many users and institutions, but Fidelity’s Digital Assets branch is a testament of what can be achieved by companies and individuals alike.