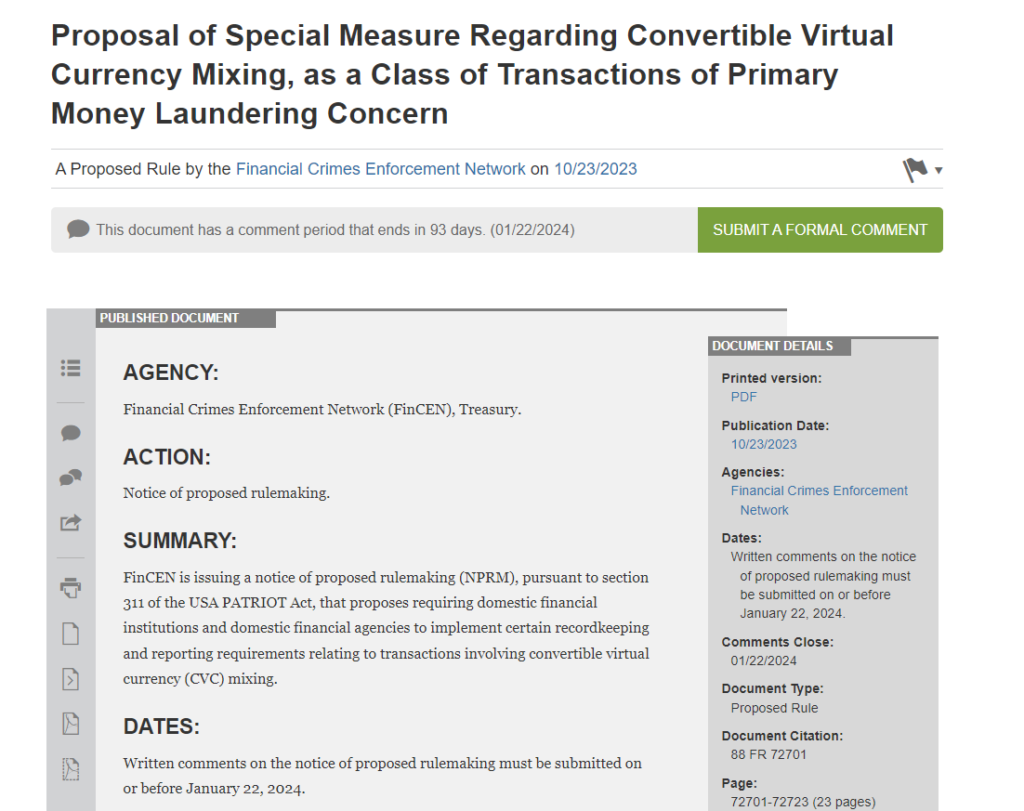

The Financial Crimes Enforcement Network (FinCEN) seeks to introduce strict policies on bitcoin mixers, citing money laundering and terrorist financing concerns. With this move, the United States agency is aiming to increase the transparency of mixers to prevent illicit usage by groups like the Palestinian militant group Hamas.

FinCEN’s Announcement

As per a press release, if the rules are finalized and imposed on bitcoin mixers, financial firms will be required to report information regarding the transactions that they suspect utilize these decentralized platforms. Deputy Secretary of the Treasury, Wally Adeyemo, stated:

“Today’s action underscores Treasury’s commitment to combating the exploitation of Convertible Virtual Currency [CVC] mixing by a broad range of illicit actors, including state-affiliated cyber actors, cyber criminals, and terrorist groups.”

Notably, bitcoin mixers are used to conceal the original source of a BTC transaction, resulting in increased privacy. Authorities around the globe have condemned the usage of these tools, as they are often used to launder money by hiding the identity of the owner of the digital assets that are transferred into mixers.

Related reading: KYC Is The Illicit Activity

About FinCEN

FinCEN is a department of the United States Treasury that collects and analyzes information about financial transactions to “combat money laundering and terrorist financing”. It has communicated increasing concerns to US officials regarding the usage of bitcoin mixers by organizations that are deemed “terrorist groups” by the government in lieu of the recent attack on Israel by the Hamas group.

“This is FinCEN’s first ever use of the Section 311 authority to target a class of transactions of primary money laundering concern, and, just as with our efforts in the traditional financial system, Treasury will work to identify and root out the illicit use and abuse of the CVC ecosystem,” said FinCEN Director Andrea Gacki.

Related reading: Bitcoin Could Free Us From KYC AML Processes

Related reading: Chainalysis: No Scientific Evidence The Surveillance Software Works, According to Head of Investigation

Gacki also noted:

“Convertible Virtual Currency (CVC) mixing offers a critical service that allows players in the ransomware ecosystem, rogue state actors, and other criminals to fund their unlawful activities and obfuscate the flow of ill-gotten gains.”

FinCEN’s Concerns and Actions

As per a previous report by Reuters, the Hamas group raises money via charities from friendly nations, passing cash through Gaza tunnels, or using Bitcoin to bypass international sanctions. As a result, the use of digital assets in “terror financing” has become a serious concern for FinCEN.

In 2020, FinCEN penalized Larry Dean Harmon, the founder, administrator, and primary operator of Bitcoin mixers Helix and Coin Ninja, marking its first recorded case against mixers. The agency fined Harmon a whopping $60 million.

Related reading: