Sandy Kaul, an analyst for Franklin Templeton, a global investment management organization, has recently made a bold prediction, stating that every national treasury will hold Bitcoin. She called Bitcoin a revolutionary tool for investor diversification and cross-border currency exchange.

Related reading: JAN3 Orange is Pilling Presidents

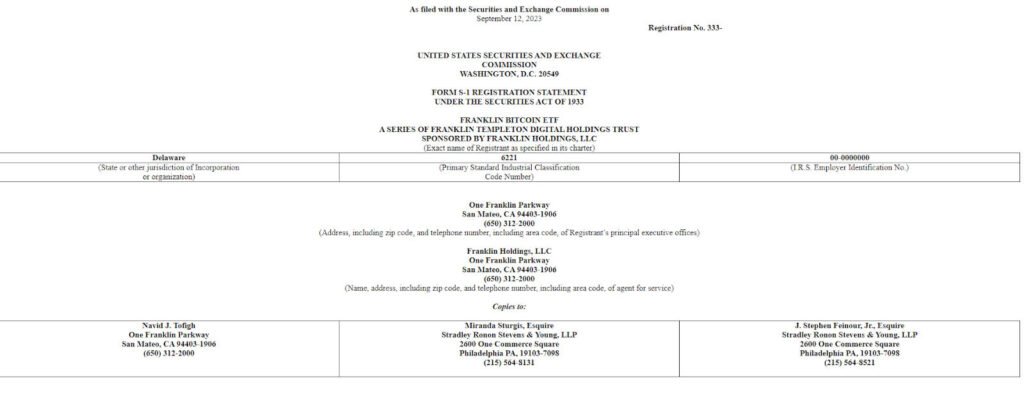

Franklin Templeton, which has close to $1.5 trillion in assets under management (AUM), is one of the applicants seeking the approval of the Securities and Exchange Commission (SEC) for its Spot Bitcoin ETF. Kaul, the Head of Digital Asset and Investor Advisory Services at the firm, had high praises for bitcoin in an interview on the Coin Stories podcast.

Bitcoin as a Tool for Less-Developed Nations

Kaul noted that bitcoin is already becoming a crucial tool for less-developed countries. Such countries aim to compete with larger economies like the United States on a “more equal playing field” by combining their buying power around the digital currency. Franklin Templeton’s executive stated:

“I think that you’ll see more of that. I also think that it’s going to become something that every Treasury needs to hold because portions of their business will just be facilitated more easily through Bitcoin payments.”

Kaul acknowledged that Central Bank Digital Currencies (CBDCs) might also make cross-border payments easier, but they will be subject to national exchange rate risks. As a result, she believes that every country will hold some amount of Bitcoin since it can be used as the “base unit of international trade.”

Moreover, the analyst predicted that Bitcoin will gradually be integrated into the traditional financial system, leading to increased adoption. However, the key question that Kaul pointed out is whether people will gravitate towards a global and government-independent solution in the near future.

“I just see it working its way increasingly into the traditional banking system as a foundational part of that system,” she said.

Franklin Templeton Aiming for Spot Bitcoin ETF

As mentioned earlier, Franklin Templeton is one of the contenders for Spot Bitcoin ETF approval in the U.S., along with BlackRock, Grayscale, 21Shares, ARK Invest, and VanEck. The asset management firm submitted its application in September with the SEC.

Kaul’s firm is looking to provide investors access to Bitcoin by wrapping it under an ETF. The executive called BTC one of the “best-performing asset classes” in the past decade while factoring in the market slump that was witnessed in 2022 following the collapse of digital asset exchange FTX.

In the coming five to ten years, Kaul sees the effect of the digital asset sector seeping into the traditional finance industry. She stated:

“The money that I have in my account and the investments I make in my portfolio are going to act like loyalty programs and unlock all sorts of benefits for me.”

Kaul’s bold prediction, foreseeing every national treasury holding Bitcoin, underscores the transformative potential of the digital asset in the global financial landscape.