Hong Kong Bitcoin adoption has seen a significant rise over the past decade. Bitcoin has transformed from a niche interest to a major player in the financial landscape, influencing both retail and institutional investors.

Bitcoin was introduced to the world in 2009 by an anonymous entity known as Satoshi Nakamoto. It started gaining traction in Hong Kong around 2013 when the city’s tech-savvy population and favorable regulatory environment began to notice its potential.

Early adopters were primarily tech enthusiasts and libertarians who valued its decentralized nature and potential for financial independence.

Hong Kong’s unique position as a bridge between the East and West has facilitated the growth of Bitcoin. The city’s advanced financial infrastructure, high internet penetration, and robust legal framework have created a conducive environment for Bitcoin to thrive.

Over the years, several exchanges and trading platforms have been established, providing residents with easy access to bitcoin.

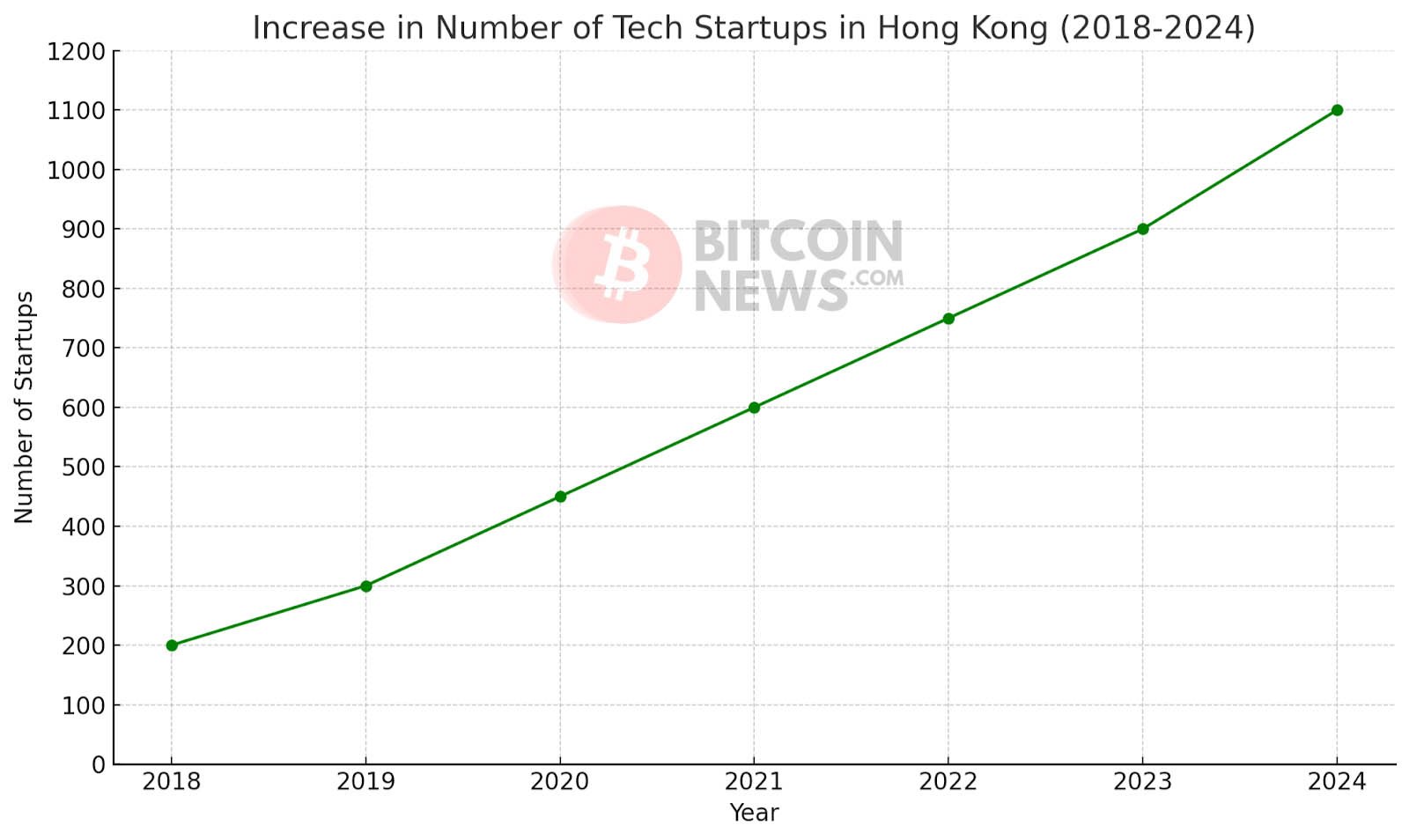

The city’s vibrant startup ecosystem has also contributed to Bitcoin’s growth. Numerous fintech startups have emerged, offering innovative solutions for buying, selling, and using bitcoin. These startups have played a crucial role in increasing public awareness and acceptance of Bitcoin.

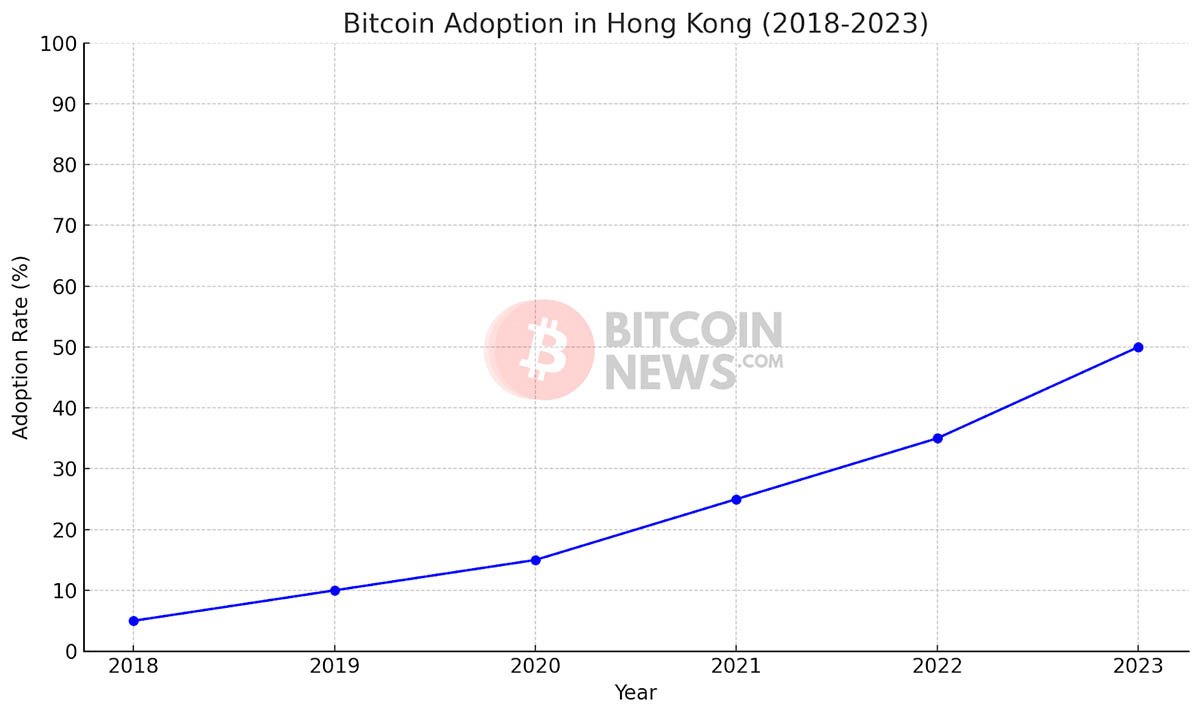

Here is the chart showing the adoption rate of Bitcoin in Hong Kong from 2018 to 2023. The data indicates a steady increase in adoption over these years, reflecting growing interest and use of Bitcoin in Hong Kong.

The regulatory environment in Hong Kong has been relatively supportive of Bitcoin. The Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC) have adopted a cautious but open-minded approach.

They have implemented measures to ensure that bitcoin trading and transactions are conducted in a safe and transparent manner, protecting investors while fostering innovation.

In recent years, the government has introduced regulations to prevent money laundering and ensure compliance with international financial standards. These regulations have helped build trust in the Bitcoin market and attracted institutional investors.

The SFC of Hong Kong has been proactive in supporting digital assets. The SFC stated:

“We are ready to allow retail investors to buy funds that are 100 percent invested in some digital assets.”

Institutional adoption of Bitcoin in Hong Kong has been a significant driver of its growth. Major financial institutions, including banks and investment firms, have started to recognize Bitcoin as a legitimate asset class.

They have begun offering Bitcoin-related products and services, such as custody solutions, trading desks, and investment funds.

The involvement of institutional players has brought increased liquidity and stability to the Bitcoin market. It has also helped legitimize Bitcoin in the eyes of traditional investors, further boosting its adoption.

Public perception of Bitcoin in Hong Kong has evolved significantly. Initially viewed with skepticism, Bitcoin is now seen as a viable investment and a means of financial diversification.

The increasing number of businesses accepting bitcoin as a payment method has also contributed to its mainstream acceptance.

Bitcoin ATMs have also become more common in the city, allowing residents to easily buy and sell the digital asset. These ATMs, along with educational initiatives and community events, have helped demystify Bitcoin and promote its use.

“Results of the April-May survey show cryptoexchange (61%) is selected most by respondents as the medium to hold VAs [Virtual Assets]. The most popular type of VAs that respondents are interested in holding is Bitcoin (73%), followed by NFTs (24%) and Ether (21%).”

– Source: HKUST

Related: Bitcoin Depot ATMs: Enhancing Bitcoin Access

Despite its growth, Bitcoin in Hong Kong faces several challenges. Regulatory uncertainty, market volatility, and security concerns remain significant hurdles.

However, the city’s resilient financial ecosystem and proactive regulatory approach provide a solid foundation for addressing these challenges.

The future of Bitcoin in Hong Kong looks promising. As more people become aware of its benefits and as the regulatory framework continues to evolve, Bitcoin is likely to become an integral part of Hong Kong’s financial landscape.

Its potential to revolutionize finance, promote financial inclusion, and drive economic growth makes it a key player in the city’s future.

Bitcoin has come a long way in Hong Kong, transforming from a fringe interest to a mainstream financial asset.

The city’s supportive regulatory environment, advanced financial infrastructure, and innovative spirit have been crucial in this journey. As Bitcoin continues to evolve, it holds the promise of further transforming Hong Kong’s financial landscape and reinforcing its status as a global financial hub.