Hong Kong has once again shown why it is one of the most Bitcoin-friendly countries in the world. Hong Kong Bitcoin adoption seems to be thriving as the Immigration Investment Scheme proposed by authorities in March might include Bitcoin. The program seeks to attract investment from 200 family offices settled overseas by the end of 2025.

Hong Kong Bitcoin Plans : BTC to be Included in Immigration Investment Scheme

Hong Kong lawmaker Qiu Dagan, who is a member of the Legislative Council from the science and technology innovation sector, has proposed the inclusion of Bitcoin in the Immigration Investment Scheme. Dagan noted that it is “theoretically possible” that Bitcoin could qualify as a foreign investment product.

It is crucial to note that Hong Kong sought to attract investments worth $3.84 million or more via its Immigration Investment Scheme, competing with other Bitcoin-friendly countries like United Arab Emirates and Singapore. Interestingly, the special administrative region (SAR) of China is also looking to debut Spot crypto Exchange-Traded Funds (ETFs), pending regulatory clearance.

The previous threshold for investments was $1.3 million, and it has been almost tripled. While real estate remains prohibited, investments in other assets like stocks, bonds, and potentially Bitcoin may qualify.

Lawmaker Chiu Ta-kan said that it might be possible for investors to purchase BTC on licensed exchanges operating in Hong Kong. Additionally, in doing so, digital currencies would be acknowledged as monetary investments for the program. Nevertheless, the authorities are still deciding the exact scope of qualifying investments.

Hong Kong’s Positive Attitude Towards Bitcoin

Under the Immigration Investment Scheme, investors can secure permanent residence in Hong Kong in seven years. The scheme seeks to attract more foreign capital and high-net-worth families. Furthermore, one of the big four consulting firms, PricewaterhouseCoopers (PwC), has received strong interest from its high-profile clients about the relaunched investment scheme. The firm believes that cooperating on tax incentives could attract even more applicants.

As earlier reported by BitcoinNews in June, the Hong Kong Monetary Authority (HKMA) is pressuring HSBC, Standard Chartered, and Bank of China to accept digital asset exchanges as their clients. The regulator has asked banking firms not to “create undue burden” on businesses that seek to open regional offices.

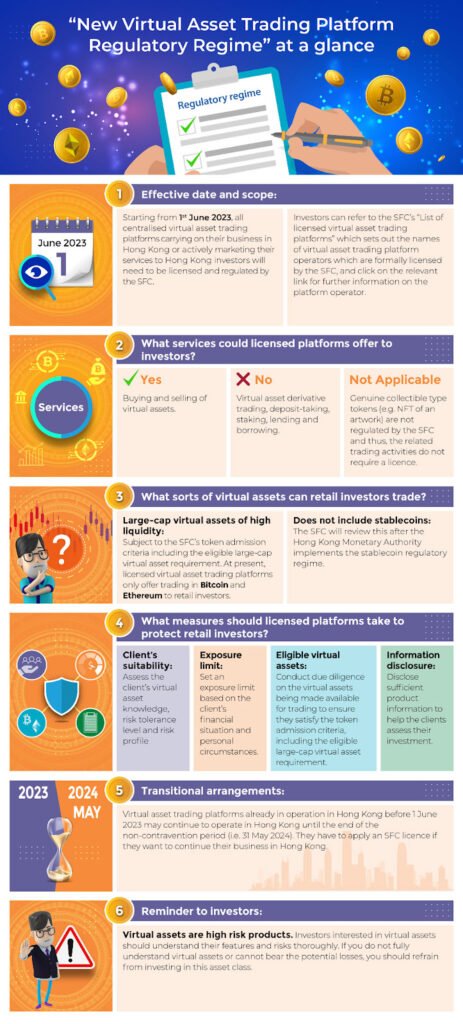

Earlier in October, a survey was conducted, revealing that only 47% of retail crypto investors in Hong Kong are aware of the Virtual Asset Trading Platform Regulatory Regime. The framework was introduced in June of this year to protect the interests of retail investors in digital assets in the region.

The report from the Investor and Financial Education Council (IFEC) of Hong Kong also noted that nearly 25% of Hong Kong adults ages 18–29 have invested in crypto within the past year, three times the demographic average.