Another lawmaker in Hong Kong joins the push for the special administrative region to add bitcoin to its fiscal reserves, saying it’s an inflation hedge, financial security tool and talent, and investment magnet.

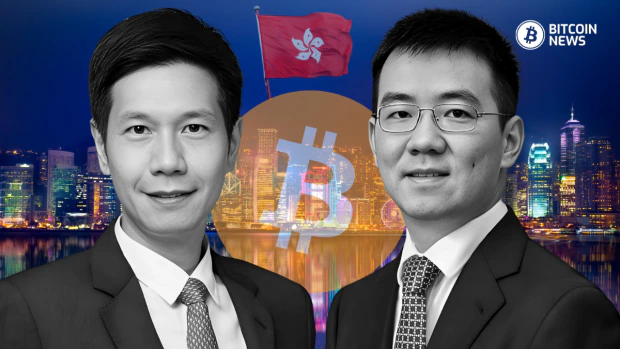

HK lawmaker Wu Jiexhuang now joins Johnny Ng, who has been pushing for bitcoin to be included in the city’s reserves. Their proposals point out the low transaction costs, inflation resistance and modernity of Bitcoin compared to traditional reserve assets like gold and silver.

Wu Jiexhuang, a HK Legco member, suggested using the “one country, two systems” concept to add bitcoin to the city’s reserves. Speaking to state-owned newspaper Wen Wei Po, Wu said holding bitcoin in national reserves would reduce market shocks and give HK a first-mover advantage.

Wu said adopting Bitcoin would make HK a leader in digital finance and increase financial stability. He recommended starting with small allocations to hedge against volatility and said strategic adoption would strengthen financial systems without unnecessary exposure.

Johnny Ng, another legislator and chairman of the Subcommittee on Issues Relating to the Development of Web3 and Virtual Assets, had previously said bitcoin reserves could also help HK’s fiscal deficit which is over 100 billion yuan ($13.7 billion).

Related: Hong Kong Legislator Advocates for Strategic Bitcoin Reserves

Ng suggested using bitcoin as part of the city’s foreign exchange reserves, saying its limited supply and increasing global acceptance makes it a good diversification asset.

Wu Blockchain commented on the developments, saying it will “stimulate the development of the cryptocurrency industry in Hong Kong, attract funds and talents, and bring more transaction stamp tax revenue.”

The lawmakers pointed to other countries and regions that are already adding bitcoin to their reserves.

Wu Jiexhuang mentioned El Salvador and Bhutan which have added bitcoin to their reserves, and the growing interest in Bitcoin among US states. He also mentioned US President-elect Donald Trump’s proposal to include bitcoin as a strategic reserve asset. Wu said:

“If major economic powers include Bitcoin in their strategic reserves, its value will stabilize, encouraging others to follow suit.”

Bitcoin is becoming a global phenomenon. For example Germany’s former finance minister Christian Lindner asked the European Central Bank to look into Bitcoin, and Japan’s opposition party raised the same question in parliament.

Despite the volatility concerns, it’s clear bitcoin is being seen as a reserve asset.

Hong Kongers are saying a bitcoin reserve is practical, with its low storage and transaction costs compared to gold. Wu says bitcoin will replace gold and silver as the top investment asset in reserves.

But skeptics are worried about the risks.

Bitcoin’s volatility, small market size ( $2 trillion vs $20 trillion of gold) and cybersecurity issues are among top concerns. Wu agrees and says governments should only allocate a small portion of their reserves to bitcoin to limit exposure.

Hong Kong authorities are working on a clear framework for Bitcoin. Financial Services and Treasury Bureau is looking to implement a “same business, same risks, same rules” approach to Bitcoin regulation.

Hong Kong is also facing competition from its neighbor, Singapore. In 2024, Singapore issued 13 digital-asset licenses to big players like OKX and BitGo. Hong Kong has only issued 7, some of which have withdrawn their applications due to the strict regulations.

While there are still volatility and regulatory issues, advocates say including bitcoin will secure Hong Kong’s financial future. With this initiative, Hong Kong can get ahead of the curve in the global financial market.