Institutional investors are expected to make bold moves into the realm of Bitcoin Exchange-Traded Funds (ETFs), as forecasted by Bitwise CEO, Hunter Horsley, who anticipates substantial growth in holdings by wealth management firms by the end of 2024. Wealth management firms are financial advisory firms that provide a range of services to high-net-worth individuals (HNWIs) or affluent clients.

Growing Confidence in Bitcoin ETFs

In recent reports, Horsley has been vocal about the anticipated surge in Bitcoin ETF investments by wealth management firms. This forecast aligns with the broader market sentiment, indicating a growing confidence in Bitcoin as a viable investment option amidst evolving market dynamics.

Horsley’s prediction underscores the increasing demand for bitcoin, with Bitcoin ETFs expected to gain even more traction following the halving event. He states:

“By the end of 2024, people are going to be stunned by how many wealth management firms own a Bitcoin ETF. They’re smart, many extremely well informed, and increasingly share conviction on Bitcoin. Oh, and they’re long only.”

Market Dynamics and Institutional Interest

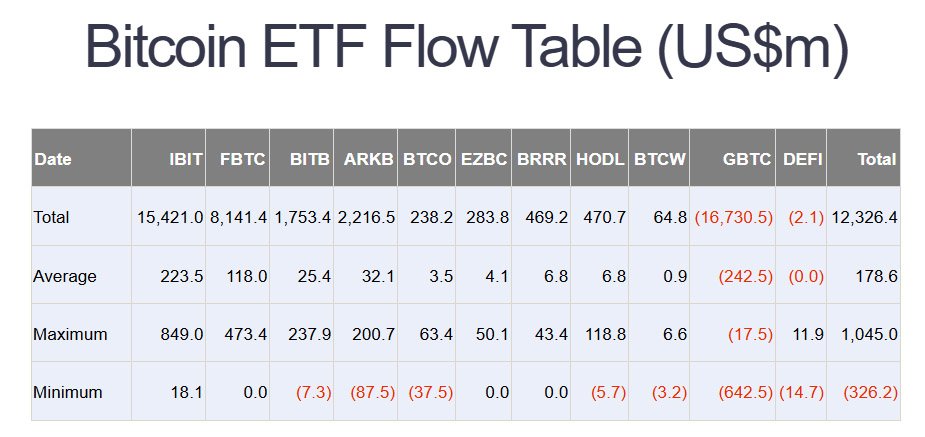

The rise of Bitcoin ETFs as preferred investment vehicles for institutional investors is evident in the rapid ascent of BlackRock’s iShares Bitcoin Trust (IBIT), which stands on the verge of surpassing Grayscale’s Bitcoin Trust (GBTC) as the largest bitcoin fund globally.

IBIT’s assets have surged to approximately $17.3 billion, positioning it just $2 billion shy of GBTC’s assets. This shift reflects a broader trend of institutional reallocation, with significant outflows observed from GBTC in recent months.

Fidelity and BlackRock have swiftly gained market shares since the launch of their respective Bitcoin ETFs, signaling a shift in investor sentiment and liquidity dynamics. Fidelity and BlackRock Bitcoin ETFs witnessed substantial net inflows, providing relief to the market’s liquidity issues.

Hunter Horsley: Stealthy but Material Adoption

Horsley believes that behind the scenes, Registered Investment Advisers (RIAs) and multifamily offices are quietly embracing Bitcoin ETFs, marking a significant milestone in the broader acceptance of the scarce digital asset within traditional financial institutions. Horsley describes this phenomenon as “stealthy but material,” indicating a growing recognition of Bitcoin’s potential as a legitimate asset class.

Major financial institutions are conducting extensive studies and incorporating bitcoin into their investment portfolios in response to market demand and the recently executed Bitcoin halving. This fundamental reevaluation of traditional investment strategies reflects a broader shift towards diversification and capitalizing on bitcoin’s potential upside.

Implications for the Market

The emerging dynamics are likely to reshape the Bitcoin market considerably as private bankers increasingly introduce themselves to Bitcoin via ETFs. With BlackRock’s IBIT poised to potentially surpass Grayscale’s GBTC, the stage is set for a new era of digital asset investment.

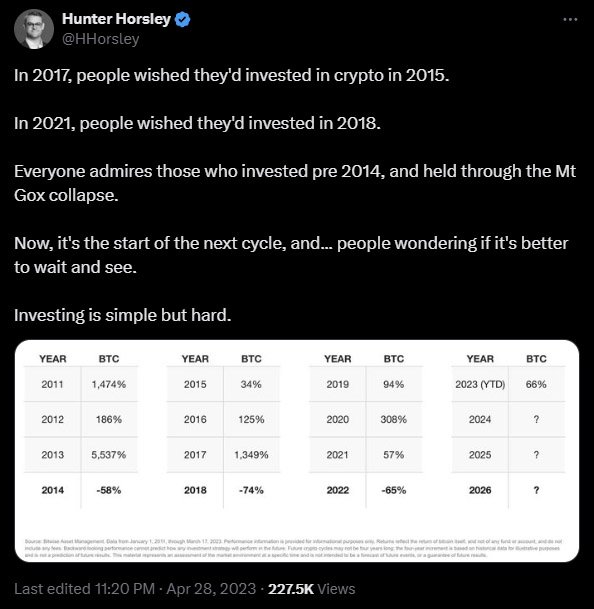

Horsley admires individuals who had a sharp eye for opportunity and were early investors in bitcoin. He included a chart displaying bitcoin returns during past halving events and expressed surprise at those who continue to adopt a “wait and see” approach.

Conclusion

The surge in Bitcoin ETF investments by wealth management firms signals a significant shift in institutional interest towards bitcoin. With Bitcoin ETFs gaining momentum and institutional heavyweights like BlackRock and Fidelity entering the fray, the landscape of digital asset investment is undergoing a transformation.

As the bitcoin market continues to evolve, Bitcoin ETFs are poised to play a pivotal role in driving institutional adoption and reshaping the financial landscape. Investors closely monitor the market with excitement as this trend unfolds, promising new opportunities and potentially stellar gains for bitcoin holders worldwide.