Intesa Sanpaolo, Italy’s biggest bank, has entered the Bitcoin space and made the headlines with the purchase of 11 bitcoin worth $1m. This is the first time a bank in Italy has done this and it’s got everyone talking about digital assets in traditional finance.

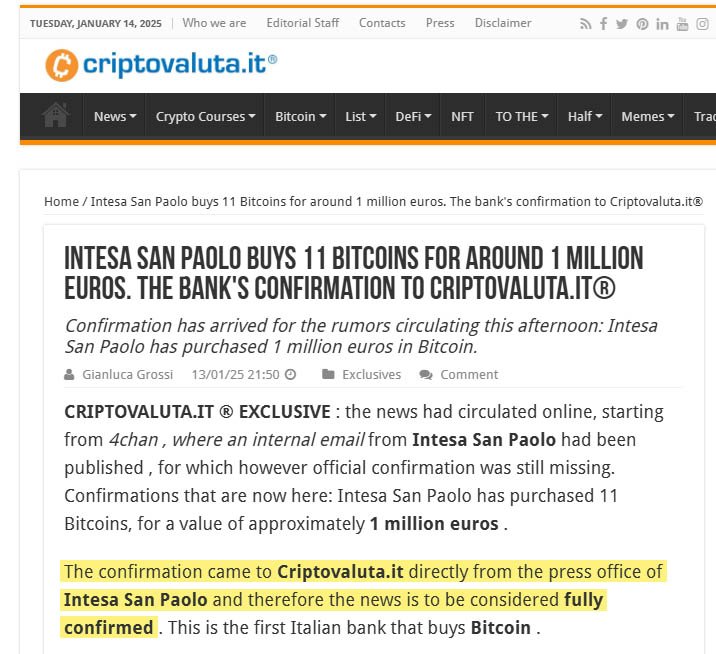

The news broke on January 13, 2025 when an internal email from Niccolò Bardoscia, Head of Digital Assets Trading & Investments, was leaked on 4chan online forum. Bardoscia reportedly confirmed the purchase in an internal email, writing:

“As of today, Intesa Sanpaolo owns 11 Bitcoins. Thank you all for the teamwork”.

The email was later confirmed by the bank’s press office which verified the acquisition but didn’t elaborate on the reasons or future plans.

This was done when bitcoin was trading at $92,800. This is a big moment for the bank and for the whole Italian financial system. CEO Carlo Messina said it’s a “test”, and that the bank doesn’t want to be a major player in the digital assets market.

Messina explained the bank’s cautious approach: “We tested how to handle any potential requests from clients, but there will anyway be very tight limits, and clients will need to prove they understand potential risks”.

He also advised non professional investors to be careful, saying households should not invest in bitcoin.

Despite being conservative, this fits with the bank’s overall digital assets strategy.

Intesa Sanpaolo set up a proprietary trading desk for digital assets in 2023 and started offering digital assets spot trading in 2024.

Although this is not exclusive to Bitcoin. The bank has also been involved in “blockchain technology”, underwriting a €25 million digital bond on the Polygon blockchain last year.

Intesa Sanpaolo enters the Bitcoin market at a time of changing regulations in Italy. In 2024 the Italian government reduced digital assets capital gains taxes from 42% to 26% after the backlash from the industry.

Related: Italy to Raise Bitcoin Tax to 42% Because “The Phenomenon is Spreading”

This, together with the growing institutional interest in digital assets, is creating a more favorable environment for adoption.

1.4 million Italians hold digital assets, with a total value of €2.2b. Intesa Sanpaolo’s investment will likely legitimize Bitcoin in the eyes of other banks and investors and encourage more adoption.

This is also a global trend. Institutional interest in Bitcoin is growing, with big players like MicroStrategy and Metaplanet buying more bitcoin.

In the US, the incoming Trump administration is expected to be Bitcoin-friendly, and everyone is waiting for an executive order to create a national bitcoin reserve.

While $1 million is a small amount compared to Intesa Sanpaolo’s $73 billion market cap, it’s a big statement. The bank is the first in Italy’s financial sector to make this move and it’s a signal that the times are changing for digital assets.

The bank which has 90,000+ employees and more than €25 billion in annual revenue wants to meet the needs of its high net worth clients.

“As a wealth management company that has the ambition to become like UBS, we have very sophisticated clients that may ask for this kind of investment,” Messina said.