Leading Japanese e-commerce giant Mercari has opened the doors for increased Bitcoin adoption in the country by announcing that it will accept the digital asset starting in June while allowing users to buy its flea market app-listed products via BTC.

As per a report from Nikkei on January 5, Japanese Mercari marketplace has decided to facilitate Bitcoin transactions via its Tokyo-based digital asset exchange subsidiary, Melcoin.

Japanese Mercari Marketplace Vendors to Receive Payments in Fiat

The price of items on the e-commerce platform will be displayed in Japanese yen, along with an option to pay via BTC. Further, the vendors and sellers on Mercari will receive payments in the local fiat currency because e-commerce will convert the bitcoin to Japanese yen in real time.

Mercari stands out as Japan’s largest consumer-to-consumer e-commerce platform, boasting a user base of approximately 22 million users. Since its debut in 2013, the platform has rapidly become the country’s largest community-based e-commerce platform, with a remarkable usage rate of around 94%. Notably, the platform reported a substantial profit of 2.8 billion yen ($19.4 million) in the third quarter of 2023.

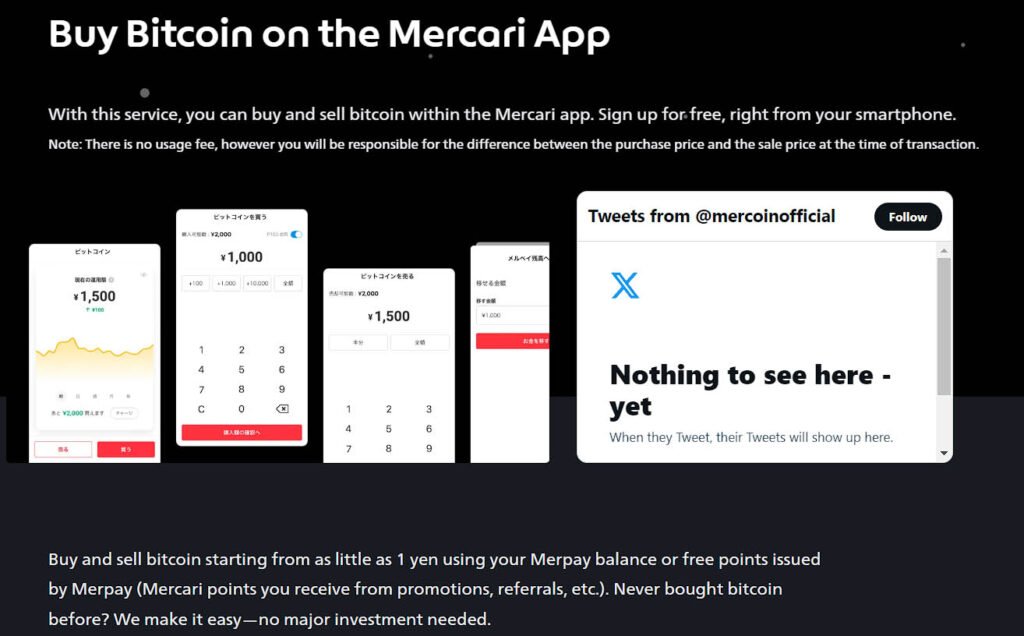

The report noted that allowing users to use Bitcoin would further boost the e-commerce platform’s user base. Mercari has invested substantially in the digital asset sector, recently launching its Mercari Bitcoin trading service.

The service allows users to trade BTC using the money made on the platform via sales. Users can swap their points for bitcoin and trade with the BTC received. Additionally, the firm’s loyalty program is also centered on digital assets, allowing users to trade their points for bitcoin.

Mercari is not the only e-commerce platform that has adopted Bitcoin for payments. Another platform called Rakuten introduced a loyalty program in late December that allowed users in Japan to exchange Rakuten Group’s loyalty points for bitcoin and other digital assets.

Notably, according to the most recent data from Bitcoin merchant mapping service BTC Map, the number of businesses—including bars, restaurants, shops, and services—that aim to accept bitcoin rose to 6,126 by the end of 2023. This is a significant increase from the 2,207 merchants listed at the beginning of the year.

Rise of Digital Asset Services in Japan

Messari researcher Mira Christanto stated on social media platform X that Japan has adopted a friendly approach to regulation of bitcoin services, allowing the country’s three-largest brokers by customer deposits—SBI, Rakuten, and Monex—to operate digital asset exchange platforms.

Christanto also noted that multiple asset managers in Japan are lobbying lawmakers to allow them to offer additional digital asset-related services and products like custody solutions and Exchange-Traded Funds.

He added:

“Large asset management funds are lobbying the government to allow custody and ETFs. If they get the green light, the banks are already waiting by the sidelines to get in on the action.”

As reported earlier by Bitcoinnews, Laser Digital, a division of the Japanese financial services Nomura, with assets worth more than $500 billion, debuted its Bitcoin Adoption Fund.

“The fund, which provides a seamless way for institutional investors to access the digital asset class, will be the first in a range of digital adoption investment solutions that Laser Digital Asset Management will bring to the market,” the announcement read.

Mercari’s decision to accept bitcoin represents a strategic move to not only enhance the user experience but also to contribute to the broader momentum of digital asset adoption in Japan. As the country continues to embrace digital-asset-friendly regulations, the integration of Bitcoin into mainstream commerce could massively gain traction.