In a strategic maneuver amidst Japan’s economic woes, Tokyo-listed firm Metaplanet Inc. has decided to adopt bitcoin as its primary treasury reserve asset, aiming to navigate through the country’s deepening economic crisis.

The move, announced through a press release and following statements, underscores Metaplanet’s response to the mounting debt burden and volatility of the Japanese yen.

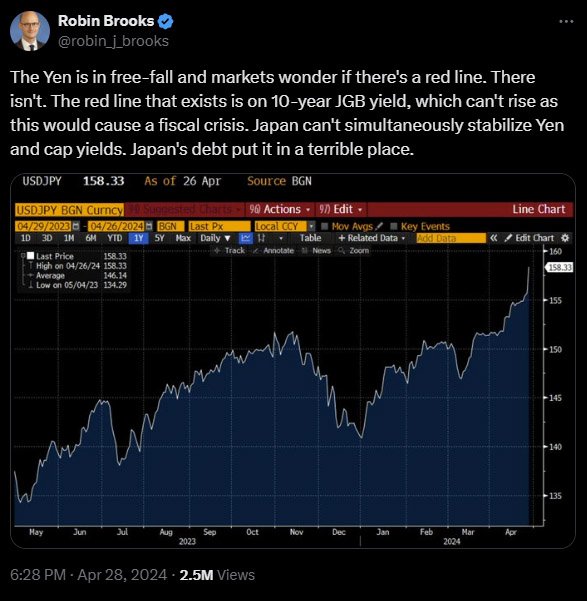

With the yen facing a sharp decline against major currencies and the government debt-to-GDP ratio hitting unprecedented levels, the decision to embrace Bitcoin signals a bold attempt to secure stability in uncertain times.

Metaplanet and Bitcoin Reserves

Previously, Metaplanet had focused on traditional investments and hospitality before pivoting to Bitcoin. Established in 1999, the company ran hotels, offered investment services, and provided investor relations consulting.

The firm’s CEO, Simon Gerovich, highlighted the rationale behind the firm’s strategic shift, noting that this is just the beginning, adding:

“Metaplanet has adopted bitcoin as its strategic reserve asset. This move is a direct response to sustained economic pressures in Japan, notably high government debt levels, prolonged periods of negative real interest rates, and the consequently weak yen.”

The firm cited two main reasons for this decision: first, to protect against the risks associated with Japan’s fiscal policies and the fluctuating value of the Yen, and second, to take advantage of the growing acceptance and use of Bitcoin worldwide.

Indeed, Japan’s economic landscape presents daunting challenges.

According to data from the International Monetary Fund (IMF), the country’s government debt-to-GDP ratio stands at a staggering 254.6%, the highest among developed nations. The yen, Japan’s fiat currency, has depreciated significantly, plummeting to a 34-year low against the U.S. dollar.

This decision to integrate bitcoin into its treasury operations comes as a response to these challenges. The company views Bitcoin as a “non-sovereign store of value,” offering stability and predictability amid the volatility of traditional fiat currencies.

“As the yen continues to weaken, Bitcoin offers a non-sovereign store of value that has, and may continue, to appreciate against traditional fiat currencies,” Metaplanet stated in the press release.

The move towards Bitcoin adoption aligns with a growing trend among institutions seeking alternatives to traditional financial instruments. The Japanese firm joins the list of companies worldwide that are diversifying their asset portfolios with bitcoin, viewing it as a hedge against economic uncertainty.

Metaplanet’s strategy involves prioritizing the accumulation of bitcoin over retaining yen, aiming to mitigate currency risks associated with Japan’s fiscal policies.

The firm’s treasury transformation reflects a “Bitcoin-first, Bitcoin-only” approach, sharply adjusting its operations to navigate Japan’s complex economic landscape.

Since April, Metaplanet has strategically acquired around 117.7 BTC, valued at approximately $7.19 million.

This acquisition strategy mirrors the approach taken by other notable firms, such as MicroStrategy, which have invested significant sums in Bitcoin as part of their treasury management strategies. Metaplanet is currently valued in the market at approximately 3.5 billion yen, equivalent to about $20 million.

The decision has garnered attention not only for its implications on Metaplanet’s financial outlook but also for its potential impact on the broader digital assets market.

Bitcoin’s price movements have been closely watched, with speculations of a potential price rally amidst global economic uncertainty.

Metaplanet’s announcement of purchasing bitcoin sparked social media buzz and drove up their stock price on the Tokyo Stock Exchange.

Trading under symbol 3350, shares surged from 20 JPY ($0.13) to over 35 JPY ($0.22). Interestingly, a few days ago, Metaplanet made headlines by naming Dylan LeClair, a well-known market researcher, as the new director of Bitcoin strategy.

As bitcoin’s price surged in the past months, reaching new highs, Metaplanet’s adoption of the digital asset further reinforces its status as a mainstream investment asset. The move could potentially signal a shift in how traditional financial institutions perceive and interact with Bitcoin.

Metaplanet’s bold move comes at a time when the Japanese yen continues to face challenges in the currency market. Despite government efforts to stabilize the currency through interest rate hikes and market interventions, the yen’s decline persists, fueled by widening interest rate differentials and a growing trade deficit.

Looking ahead, Metaplanet’s embrace of Bitcoin as a reserve asset sets a precedent for other firms navigating Japan’s economic turmoil.

As the global financial landscape evolves, the integration of bitcoin into traditional financial systems may become increasingly commonplace, offering new avenues for diversification and risk management.