Jersey City, New Jersey, is taking a significant step in the financial world by planning to invest a portion of its municipal pension fund in Bitcoin exchange-traded funds (ETFs).

This move marks a noteworthy development in the growing acceptance of the scarce digital asset among institutional investors.

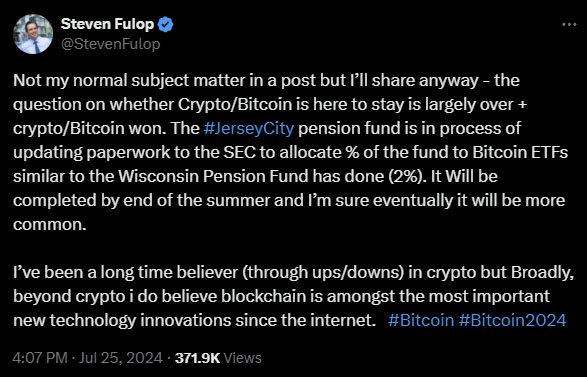

On July 25, Jersey City Mayor Steven Fulop announced that the city’s pension fund would allocate a percentage of its assets to Bitcoin ETFs. This decision follows a similar move by the Wisconsin Pension Fund earlier this year.

Fulop shared the news on social media, highlighting his long-standing belief in the potential of Bitcoin and blockchain technology.

Mayor Fulop, who has been in office since 2013, has always been a proponent of technological innovations. He took to X to share his excitement about the new investment strategy.

“Not my normal subject matter in a post but I’ll share anyway – The question on whether crypto/Bitcoin is here to stay is largely over + crypto/Bitcoin won,” Fulop tweeted.

He emphasized that blockchain technology is “amongst the most important new technology innovations since the internet.”

Fulop’s announcement comes as he is gearing up for a run for New Jersey governor in 2025. His support for Bitcoin could attract significant campaign donations from pro-Bitcoin companies and executives, adding another layer to his political strategy.

The Employees’ Retirement System of Jersey City is currently updating its paperwork with the U.S. Securities and Exchange Commission (SEC) to reflect this new investment.

While the exact percentage of the fund to be allocated to Bitcoin ETFs has not been specified, Fulop indicated it would be similar to the 2% allocation made by the Wisconsin Pension Fund earlier this year.

In mid-May, the State of Wisconsin Investment Board reported a $160 million investment in spot Bitcoin ETFs, including shares in BlackRock‘s iShares Bitcoin Trust and Grayscale Bitcoin Trust. This bold move by Wisconsin set a precedent that Jersey City is now following.

The decision by Jersey City is part of a broader trend of increasing institutional interest in Bitcoin.

In recent months, Bitcoin ETFs have attracted substantial inflows, signaling growing confidence among investors. For example, BlackRock’s IBIT recently saw significant inflows, surpassing Nasdaq’s QQQ in terms of year-to-date inflows.

Despite this growing interest, major financial institutions like Wells Fargo and JPMorgan Chase have shown limited engagement with Bitcoin ETFs, investing less than $1 million combined.

However, the moves by Wisconsin and Jersey City could encourage more public pension funds and other institutional investors to consider bitcoin as part of their portfolios.

Eric Balchunas, a senior ETF analyst at Bloomberg, commented on institutional investors’ adoption of Bitcoin ETFs. He stated:

“Normally you don’t get these big fish institutions in the 13Fs for a year or so (when the ETF gets more liquidity) but as we’ve seen these are no ordinary launches. Good sign, expect more, as institutions tend to move in herds.”

Mayor Fulop believes that integrating Bitcoin ETFs into Jersey City’s pension fund is not just a financial decision but also a step towards embracing the future of technology.

“I’ve been a long time believer (through ups/downs) in crypto but broadly, beyond crypto, I do believe blockchain is amongst the most important new technology innovations since the internet,” Fulop said.

This sentiment is echoed by other Bitcoin proponents, such as Michael Saylor, Chairman of MicroStrategy, who has consistently advocated for Bitcoin’s inclusion in U.S. pension fund portfolios.

Saylor believes that Bitcoin has the potential to become a standard component of diversified investment strategies.

While the exact amount Jersey City’s pension fund will invest in Bitcoin ETFs may not be substantial, the decision is symbolic. It represents a significant step towards the wider adoption of Bitcoin in traditional finance.

As more public pension funds and institutional investors explore bitcoin investments, the financial landscape is likely to evolve. Fulop’s move also reflects a growing acceptance of digital assets among policymakers and regulators.

The SEC’s approval of spot Bitcoin ETFs has opened the door for public pension funds to consider such investments, although Jersey City and Wisconsin are among the few public entities currently exploring this avenue.

As Jersey City moves forward with its plans, the focus will be on completing the necessary regulatory paperwork with the SEC. Fulop expects this process to be finalized by the end of the summer, paving the way for the pension fund to start investing in Bitcoin ETFs.

This development comes at a time when the Bitcoin market is experiencing significant fluctuations. Recently, bitcoin’s price has seen bearish momentum, with intra-day highs and lows fluctuating between $67,512 and $63,473.

At press time, bitcoin was trading at $67,400, showing a remarkable 6.35% increase in the past couple of days. Despite these fluctuations, the long-term outlook for Bitcoin remains positive, with many investors viewing the current dip as an opportunity to buy.