In a surprising turn of events, JPMorgan Chase, America’s largest bank, has been revealed to have investments in spot Bitcoin Exchange-Traded Funds (ETFs), despite the outspoken skepticism of its CEO, Jamie Dimon.

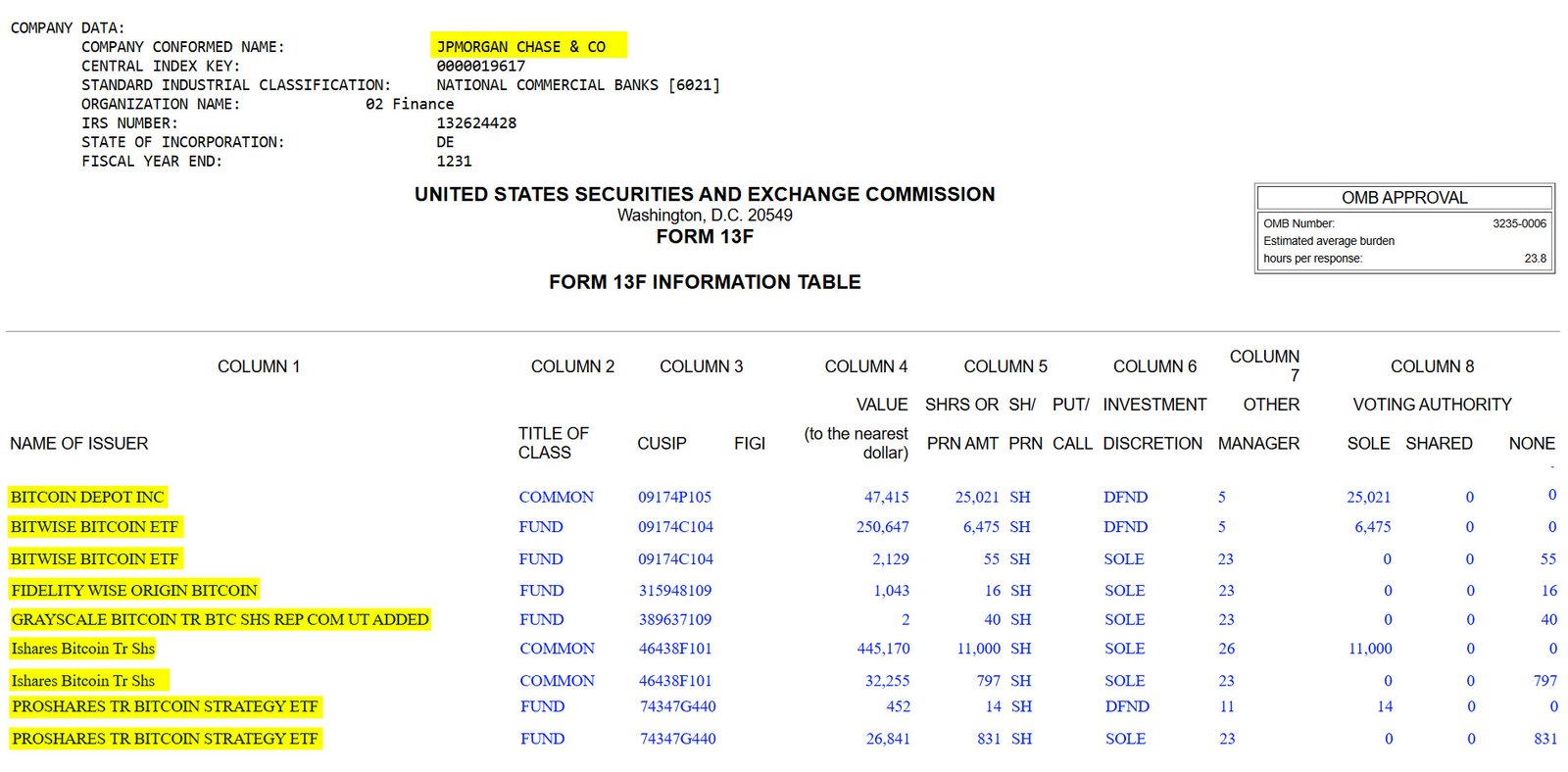

JP Morgan Bitcoin ETF investments, made public through filings with the United States Securities and Exchange Commission (SEC), sheds light on its exposure to various Bitcoin ETFs managed by industry giants like BlackRock, Fidelity, Grayscale, and others.

According to the filings, JPMorgan Chase has not invested significant amounts in the Bitcoin ETFs. Notably, apart from Bitcoin ETFs, the bank seems to hold around 25,000 shares of Bitcoin Depot, a bitcoin ATM manufacturer.

The bank’s holdings span across a range of ETFs, including BlackRock’s iShares Bitcoin Trust, ProShares Bitcoin Strategy ETF, Fidelity’s Wise Origin Bitcoin Fund, Grayscale Bitcoin Trust, and Bitwise Bitcoin ETF.

The total worth of these holdings is approximately $760,000, indicating an underwhelming entry into the world of Bitcoin investment.

JP Morgan Bitcoin Skepticism and Investment

This revelation comes amidst ongoing debates surrounding the adoption of Bitcoin by traditional financial institutions. While some see this as a positive step towards mainstream acceptance, others question the motives behind such investments, particularly in light of past criticisms from JPMorgan’s leadership.

Jamie Dimon, CEO of JPMorgan Chase, has been a vocal critic of Bitcoin, going as far as to label it a “fraud” in the past.

Despite this stance, the bank’s actions speak louder than words, as it quietly maneuvers into the Bitcoin market through ETF investments. Dimon’s public disdain for Bitcoin contrasts sharply with the bank’s behind-the-scenes activities, raising questions about the consistency of its messaging.

In response to inquiries about the bank’s investment decisions, Dimon has remained tight-lipped, indicating a reluctance to engage further on the topic.

Dimon labeled Bitcoin as a “pet rock” favored by lawbreakers and investors seeking quick profits and when pressed for comment by CNBC, Dimon tersely stated:

“I don’t care. So just please stop talking about this shit… This is the last time I’m ever going to state my opinion.”

Ryan Sean Adams, founder of Bankless, a digital asset media company, noted the event, adding:

“Turns out JP Morgan the largest US bank has been buying Bitcoin ETFs even while CEO Jamie Dimon’s been publicly hating on it. In December Dimon said in front of congress he would shut Bitcoin down if he were the government. They fud crypto in public and buy in private.”

The timing of JPMorgan’s entry into Bitcoin is noteworthy, coming after regulatory approval for Bitcoin ETFs. This approval has increased public interest in Bitcoin to an all-time high.

With Bitcoin ETFs gaining traction in the financial sector, major players like JPMorgan are increasingly being drawn into the fold, whether or not they publicly endorse the technology.

Analyzing the news, Bloomberg ETF Analyst James Seyffart mentioned:

“JPM, Susquehanna (which also owns these ETFs and was all over this site last week) and others are just market makers and/or AP’s. Their ownership isn’t necessarily indicative of anything other than this is how many shares they had on 3/31/24”

He also added that 13F filings only show long positions and don’t include information on shorts or derivatives, so they don’t provide a complete picture of these firms’ exposure.

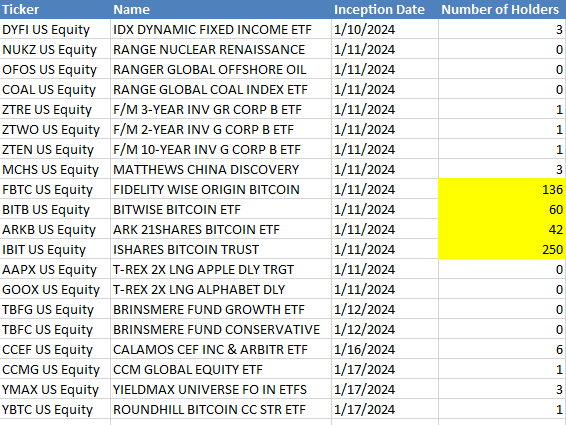

Eric Balchunas, another Senior ETF Analyst at Bloomberg, pointed out that many big banks are likely to report holdings in their capacity as market makers or authorized participants (APs), which is different from buying for direct exposure.

He also noted the significant number of holders each ETF has accumulated so far, with IBIT reaching 250 holders in the first quarter, which he finds remarkable.

He added:

“What is notable IMO is the sheer number of holders that each has so far.. $IBIT is up to 250. That’s bonkers for first quarter on mkt.”

The bank’s disclosure also highlights a broader trend among financial institutions, as more traditional players dip their toes into the world of Bitcoin.

Wells Fargo, America’s third-largest bank, also made a similar revelation about its Bitcoin ETF exposure, signaling a growing acceptance of digital assets within the banking industry.

Despite the skepticism from some quarters, the growing interest in Bitcoin ETFs underscores the increasing mainstream recognition of Bitcoin as a legitimate investment vehicle.

As regulatory barriers continue to be overcome and institutional investors flock to the market, the landscape of finance is undergoing a profound transformation.