In the latest JPMorgan El Salvador report, the leading American financial services firm has revised its growth forecast for the country. The banking firm has commented on the “Bitcoinization” of the Central American country in recently published research, predicting substantial economic growth.

As per reports, in previous documents, JPMorgan predicted that El Salvador would witness year-over-year economic growth of 2.5%, but the number has been revised upward to an impressive 3.9% in the new report. It is important to note that El Salvador was the first country to adopt Bitcoin (BTC) as the legal tender in September 2021 under the leadership of Bitcoin-friendly President Nayib Bukele.

JPMorgan El Salvador Report: Economic Growth

Bukele took to social media platform X to share the new report from JPMorgan with the caption, “I will not say, ‘I told you so.’”

In the report, JPMorgan mentioned that El Salvador is “showing disinflation, positive behavior of fiscal accounts, and, more recently, growing signs of acceleration of the economy.” The financial institution noted that “domestic demand indicators are also healthy with service growth accelerating,” while adding:

“Data has consistently shown optimism over the past few months in El Salvador, featuring reduced inflation rates, positive trends in fiscal accounts, and more recently, indications of economic acceleration.”

Increase in Jobs and Investment in Public Infrastructure

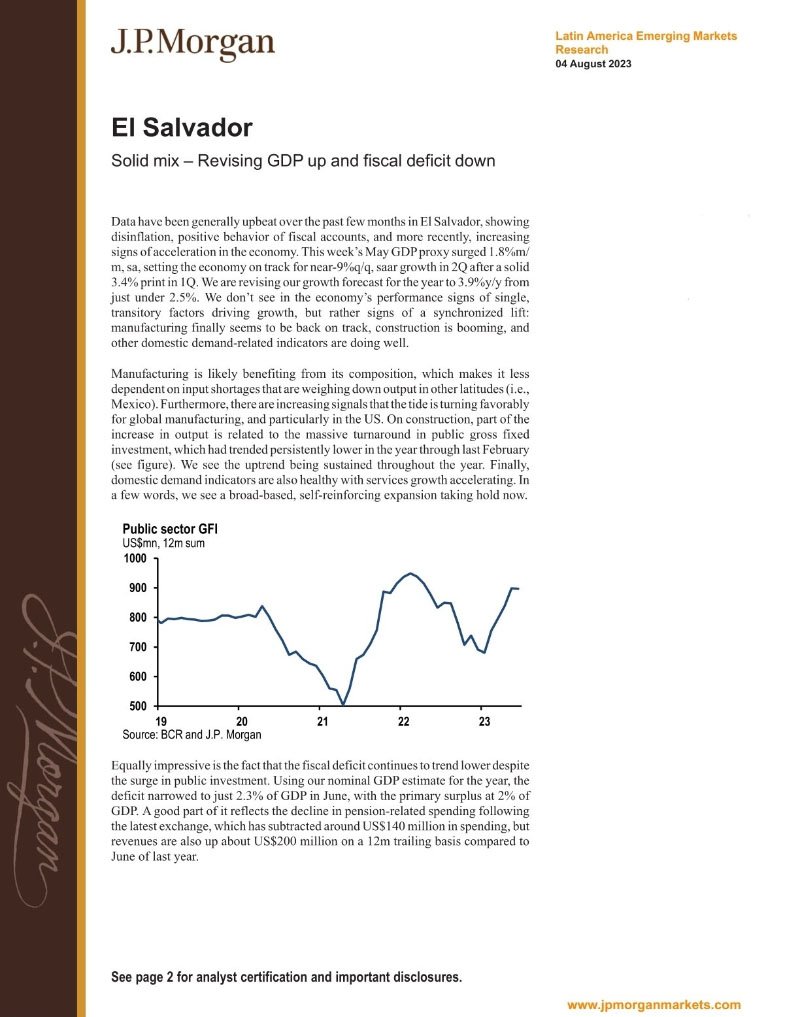

JPMorgan, a firm that has recently turned positive to the digital asset sector, also said that it is impressive that El Salvador’s “fiscal deficit continues on a downward trend despite the increase in public investment.” In the research, the banking giant noted that due to the increase in public investment, construction is also booming in the Central American country, and the government is investing heavily in infrastructure, which is creating jobs and stimulating the economy.

“We don’t observe one-off or transient factors driving growth in the economy; rather, we see signs of synchronized momentum: manufacturing appears to be picking up pace, construction is booming, and other indicators related to domestic demand are performing well,” said JPMorgan.

El Salvador and the IMF

El Salvador’s decision to integrate Bitcoin as legal tender created waves across the traditional financial world. The International Monetary Fund has, on multiple occasions, warned Bukele of repercussions. The financial agency of the United Nations stated that the use of Bitcoin requires transparency and attention.

“Given the legal risks, fiscal fragility, and largely speculative nature of crypto markets, the authorities should reconsider their plans to expand government exposures to bitcoin,” the IMF said in early February.

The IMF also added that the risks “have not materialized due to the limited bitcoin use so far,” while adding that Bitcoin’s use “could grow given its legal tender status and new legislative reforms to encourage the use of crypto assets, including tokenized bonds.”

On a separate note, last month, JPMorgan’s North America equity research team published a report titled “Bitcoin Mining: Expanding Coverage.” It stated that the concentration of hashrate among the 14 major Bitcoin mining companies contributes to 25% of the total global hashrate, warning of increasing centralization. The banking giant said that CleanSpark Inc., Riot Platforms Inc., Cipher Mining Inc., and Marathon Digital Holdings Inc. are the right companies to invest in with the approaching halving.

Related reading: