KULR Technology Group, a recognized name in advanced energy management, just made a big splash with a $21 million bitcoin purchase. This is the start of the company’s bitcoin treasury program where up to 90% of its excess cash will be invested in bitcoin.

The publicly traded company, listed on the New York Stock Exchange (NYSE), bought 217.18 BTC at $96,556.53 per coin. KULR is betting on bitcoin as a long term store of value and inflation hedge despite the recent volatility.

Michael Mo, CEO of KULR, said the company’s move into Bitcoin fits into their overall vision for the future. He said in a statement:

“We envision that the future of a dynamic corporation is based on three pillars: super intelligence through AI, an automated workforce through robotics, and the future of money through BTC.”

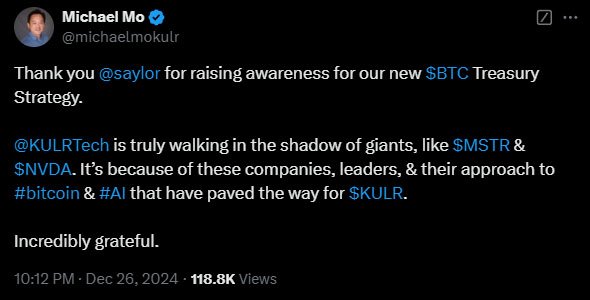

Mo’s love for Bitcoin was inspired by MicroStrategy Executive Chairman Michael Saylor who calls Bitcoin “digital energy”.

Mo said, “He [Michael Saylor] calls BTC digital energy, which really resonated with our mission because we are an energy management company for batteries and space applications are our core.”

Before KULR implemented its bitcoin strategy, the company surveyed its shareholders to see if they would support this new approach.

According to Mo, the answer was a big yes. “We received an overwhelming ‘Yes.’ Here we are, buying our first block of BTC and entering into the future of money,” he said.

The news of the bitcoin purchase sent KULR’s stock up 40% and closed at an all time high of $4.80, indicating investors’ approval.

Bitcoin’s appeal is in its decentralization and limited supply, which many investors see as an inflation hedge.

Despite the volatility – recently trading between $94,137 and $99,884 – analysts are bullish on bitcoin. Predictions range from $108,000 in the short term to $250,000 by 2030, as more institutions adopt the digital asset.

KULR’s move into bitcoin is part of a broader corporate trend. Companies like MicroStrategy, Semler Scientific and Metaplanet have already added bitcoin to their financial plans. MicroStrategy is a pioneer in this space and holds over 444,000 BTC and plans to add more.

KULR is not alone this month. Matador Technologies, a Canadian company, just added $4.5 million of bitcoin to their balance sheet.

Related: Canadian Matador Technologies Adds Bitcoin To Its Treasury

KULR, as per its announcement, uses Coinbase Prime for custody and self-custodial wallet services to protect its bitcoin. This is more proof that institutional grade solutions for bitcoin management are gaining traction.

KULR’s investment in bitcoin is more than just a financial move; it’s a statement of where corporates see the future. “We believe that BTC is the future of money,” Mo said. He sees a future where AI, robotics and digital currency come together to form a modern corporation.

KULR’s initial investment is big but this is just the start. The firm will be buying more bitcoin as part of its long term plan to stay ahead of the curve in a changing world.

Creation of bitcoin treasuries started with MicroStrategy back in 2020 and is gaining momentum. Not just corporations, some governments are also exploring the idea of having bitcoin as a reserve asset.

For example, US President elect Donald Trump has announced he will allocate funds to a national bitcoin reserve despite being criticized for it.